Hurricane Dorian Caribbean & Bahamas industry loss up to $3bn: AIR

By Steve Evans From Artemis

Hurricane Dorian is estimated to have caused an insurance industry loss in a range from $1.5 billion to as much as $3 billion from its impacts to the Caribbean islands, according to AIR Worldwide.

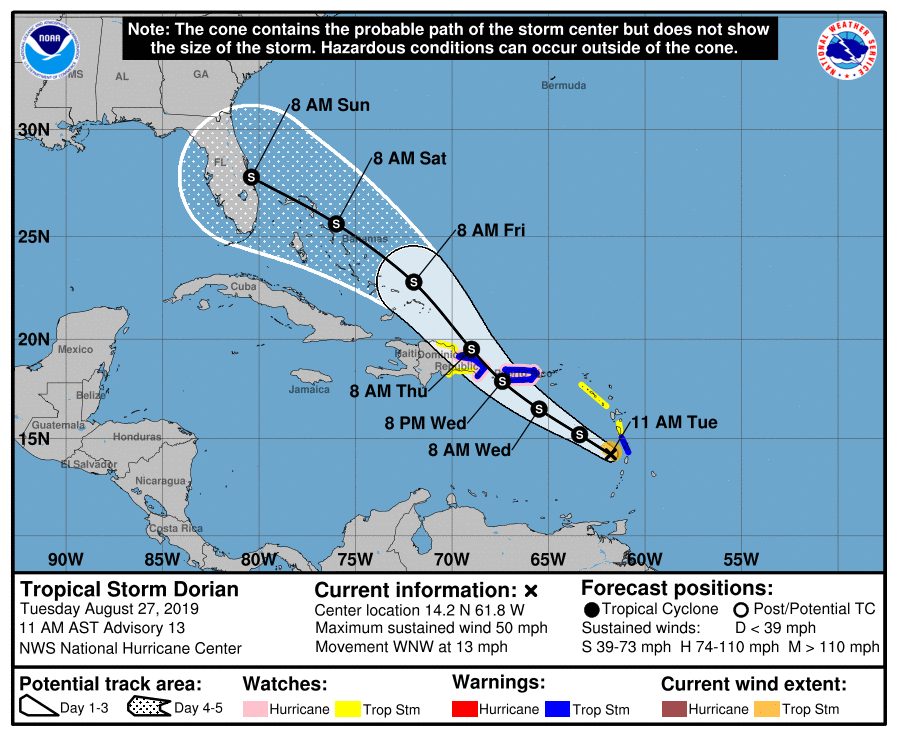

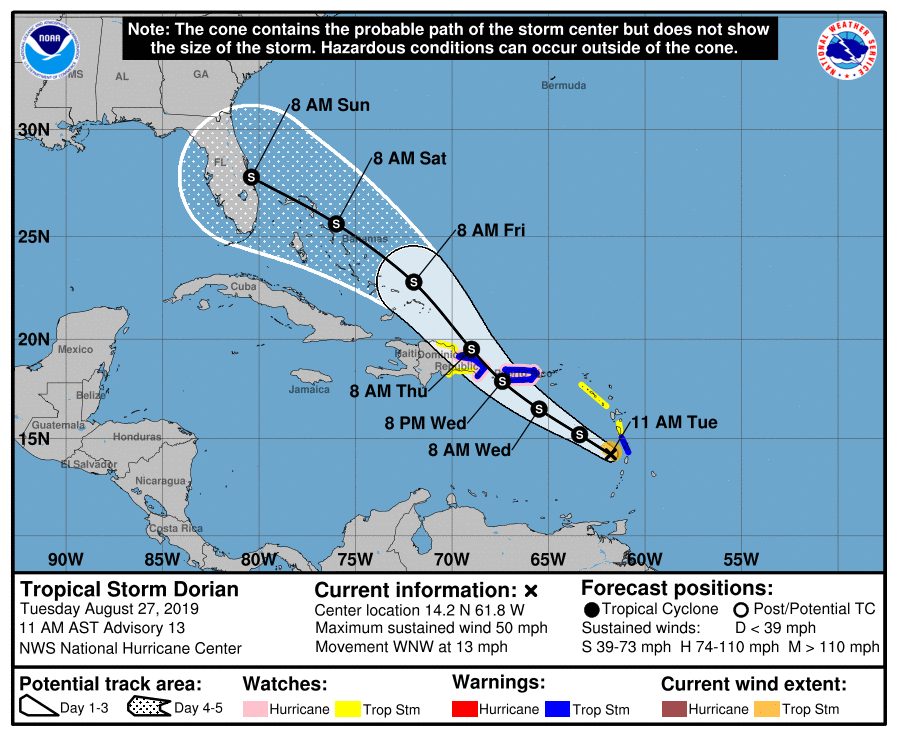

Hurricane Dorian impacted a range of Caribbean islands on its passage towards the Bahamas and United States.

Having slammed the Bahamas with record winds and prolonged impacts, the damage caused to property was most severe there.

But catastrophe risk modelling firm AIR Worldwide estimates that the impacts to insurance and reinsurance interests, which will include any leakage of claims to insurance-linked securities (ILS) funds and vehicles, at $1.5 billion to $3 billion.

As we previously reported, the Bahamas received a direct hit from hurricane Dorian and islands have been devastated, with massive property damage reported and a significant local insurance market loss likely, that global reinsurance capital is likely to assist with.

Insurance and reinsurance market losses of up to $1.3 billion had previously been experienced from strong hurricanes that hit Abaco and Grand Bahama islands, hence it always seemed likely hurricane Dorian could eclipse that total given the devastation experienced.

The Caribbean impacts from hurricane Dorian therefore appear set to near or beat records for the Bahamas islands.

While impacts for other Caribbean islands it affected on the way were lower, as hurricane Dorian strengthened rapidly after it passed them and headed for the Bahamas.

Hurricane Dorian is now beginning to move clear of North Carolina, with the worst of its United States impact now likely almost passed.

Further insurance and perhaps reinsurance market losses are possible from its brush with the U.S. coastline, across Florida, Georgia, South and North Carolina, but these are unlikely to be particularly significant (perhaps as much as low single-digit billions though, sources suggest at this time).

As ever, being a modelled estimate of industry insured losses, the total does not include all potentially damaged and insured assets, so the true extent of industry losses could be a little higher once all claims are in.

AIR explained its insured loss estimates for the Caribbean and Bahamas include:

- Damage to onshore residential, commercial, and industrial properties and their contents, as well as automobiles

- Time element coverage (additional living expenses for residential properties and business interruption for commercial properties that experience physical loss from both direct and indirect sources)

- Storm surge (implicitly accounted for in the wind damage functions)

But do not include:

- Loss to offshore properties, pleasure boats, and marine craft (losses for boats inside a building may be estimated if their replacement value is included as contents)

- Losses to infrastructure

- Losses from hazardous waste cleanup, vandalism, or civil commotion whether directly or indirectly caused by the event

- Demand surge

- Losses resulting from the compromise of existing defenses (e.g., levees)

- Losses to uninsured properties

- Other non-modeled losses, including loss adjustment expenses

For more on this story go to: https://www.artemis.bm/news/hurricane-dorian-caribbean-bahamas-industry-loss-up-to-3bn-air/