Experts answer 16 questions about Credit Score & Credit Report

Image Credits: Freepik

Are you struggling with managing your finances and enjoying all the perks of having a credit card? Because right when you thought you got the gist of the credit life, you met with endless payments to clear.

Did you know secured credit card Canada or other similar top Visa cards in your area can help? Yes! They can teach you how to spend effectively and efficiently without pushing you to change your lifestyle.

But is owning the best credit card enough? Surely, not!

You can really mess things up in your personal and business life if you don’t know how to use them for a better credit score and excellent credit report. So, let us take you out on a roller coaster ride of credit knowledge to make you the expert in the credit and business world.

Credit Score: Easy-To-Understand Overview

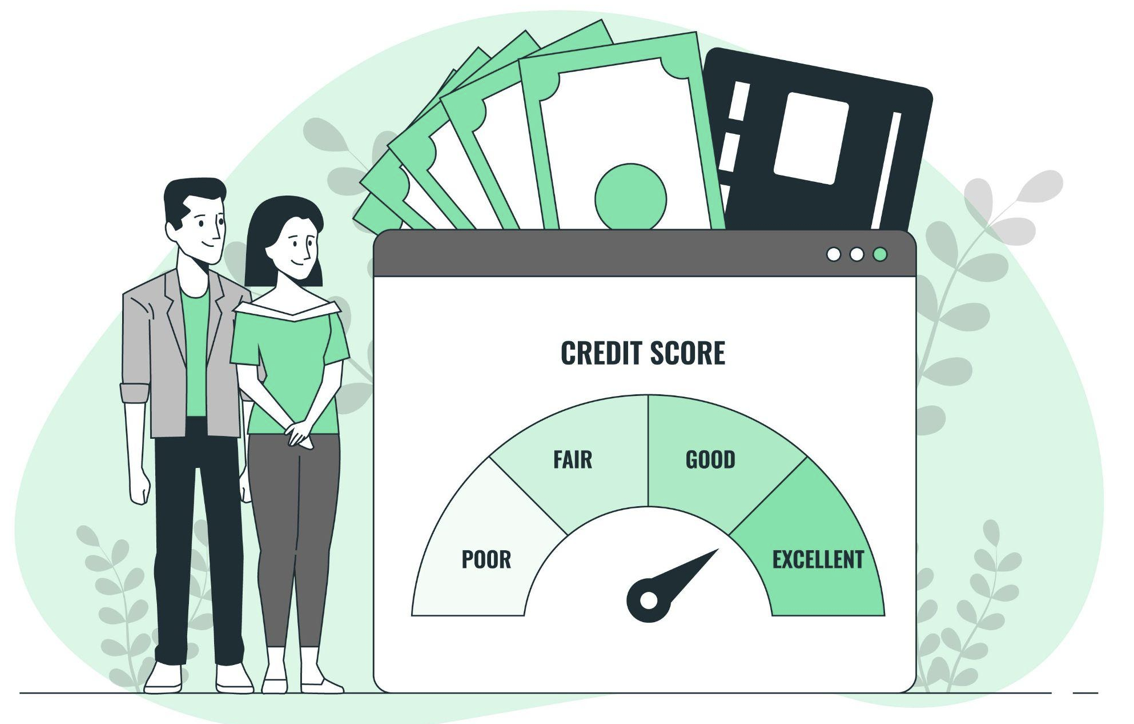

Image Credits: Freepik

A credit score is a mere number that can decide your loan application status, approval rate, premium value, and financial stability. According to Equifax, the range of your credit score defines your creditworthiness.

So, how is it related to your business and personal life?

- For a business, a bad credit score will ruin the chances of attracting more investors and expanding the revenue and company goals

- At a personal level; it can make it difficult for you to have access to all benefits of credit card usage

Credit scores generally range between 300-850. Here’s how they’re categorized:

| Level | Range |

| Poor | 300-579 |

| Average | 580-669 |

| Good | 670-739 |

| Great | 740-799 |

| Excellent | 800-850 |

Credit Report: How It Works?

A credit report is a detailed credit summary of the user. The credit bureaus gather data from different sources to generate the statement every 12 months. However, this data is updated every month or two, depending on how often the companies keep the bureaus updated.

Transunion Canada (one of the top 3 credit reporting agencies) indicated in their article that consumer credit reports don’t include any personal or business account information (if not related to debt issue), income, and cash or cheque payments.

So, why is a credit report important for your business or personal life?

- For a business, it portrays liability, stability, and trustworthiness. A credit report with a good credit history shows the investors that your business is worthy of their investment and partnership

- For an individual, it certifies you as a responsible credit card user that knows how to pay his debt and bills while managing the finances perfectly. It can land you low-interest rate rental apartments, insurance, or personal loans

Credit Report Vs. Credit History

However, credit history and credit report are not the same. In fact, they have a minor dividing line that separates the two.

Your credit report is a resume of your credit history, including credit inquiries, credit score, etc. In comparison, the credit history has detailed information of all your account dealings, transactions, balances, and similar things.