Cayman Government offers significant concessions to Caymanian home buyers

Grand Cayman, Saturday, 23 September 2023 – Premier Hon. Wayne Panton presented a proposal to Parliament on Friday, 22 September that further revises the existing concessions for prospective Caymanian homeowners. The Government’s expansive proposal would make it easier for more Caymanian families to be able to own their own homes.

Premier Panton, who also serves as Minister for Finance & Economic Development, noted that the proposal calls for increasing the value of existing thresholds, restricting the concession to the purchase of raw land or residential property, and the brand-new introduction of a new concessionary tier for Caymanians purchasing their second property.

The Premier’s announcement in Parliament is welcome news for many Caymanians who dream of owning a home in the Cayman Islands. With real estate prices continuing to rise in all districts of the Islands, the Premier’s proposals will place the possibility of home ownership back within the realm of possibility for many Caymanians.

Premier Panton noted that “Prices for a modest three-bedroom home in the Eastern districts have been steadily rising for years. Even if you’re lucky enough to find a home in the $485 – 500 thousand price range, at 20% you’d still need a $97K down-payment to access a mortgage? Can you imagine how hard it is to find that amount of money as a single mother with three children, or as a young couple or even as a single person? And even if you manage to get the money together for a down-payment, who will help find even more money to pay the thousands and thousands of dollars you’ll need for the Stamp Duty? Who will help? We will. Under my leadership, this Government will.”

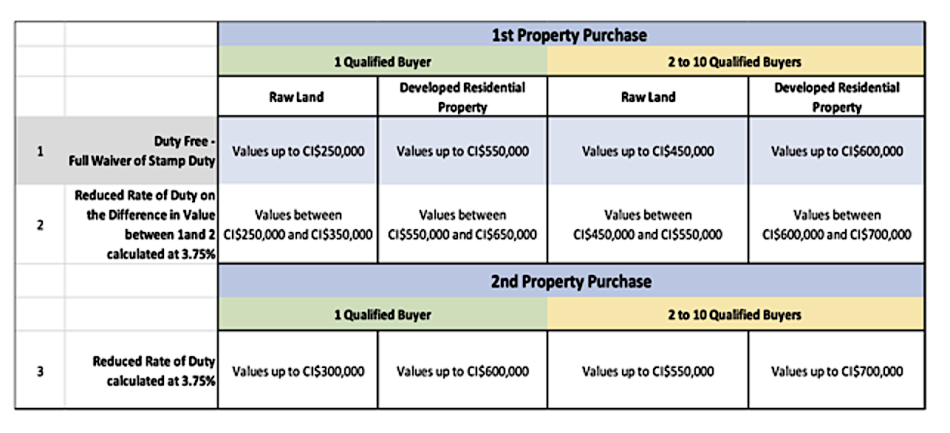

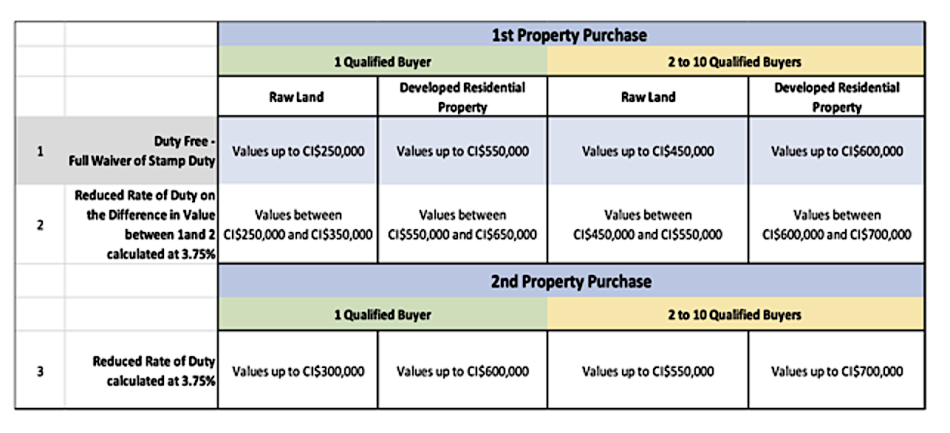

The expanded concessions raise the property values for full stamp duty exemptions for first time Caymanian property buyers, as well as providing a reduced rate of stamp duty for properties valued above the fully exempt thresholds.

Additionally, the new concessions package offers a new benefit for Caymanians purchasing a second property.

For a Caymanian purchasing their first parcel of raw land, there will be no stamp duty assessed on values up to CI$250,000. Where the property value is above $250,000 but less than $350,000, stamp duty will be assessed at 3.75% on the difference above $250,000 only.

For a Caymanian purchasing their first home or developed residential property, there will be no stamp duty assessed on values up to CI$550,000. Where the property value is above $550,000 but less than $650,000, stamp duty will be assessed at 3.75% on the difference above $550,000 only.

For a group of two to 10 Caymanians purchasing their first parcel of raw land together, there will be no stamp duty assessed on values up to CI$450,000. Where the property value is above $450,000 but less than $550,000, stamp duty will be assessed at 3.75% on the difference above $450,000 only.

For a group of two to 10 Caymanians purchasing their first home or developed residential property together, there will be no stamp duty assessed on values up to CI$600,000. Where the property value is above $600,000 but less than $700,000, stamp duty will be assessed at 3.75% on the difference above $600,000 only.

The changes also formalise an avenue for Caymanians purchasing their second property to qualify for a discounted stamp duty rate.

For a Caymanian purchasing a second parcel of raw land, stamp duty will be assessed at 3.75% on values up to $300,000.

For a Caymanian purchasing their second home or developed residential property, stamp duty will be assessed at 3.75% on values up to $600,000.

For a group of two to 10 Caymanians purchasing a second parcel of raw land together, stamp duty will be assessed at 3.75% on values up to $550,000.

For a group of two to 10 Caymanians purchasing a second home or developed residential property together, stamp duty will be assessed at 3.75% on values up to $700,000.

The changes and additions to the Caymanian property buyers stamp duty concessions are outlined in the following table:

Premier Panton said, “To be sure, these concessions will increase the number of Caymanians who are able to afford their first (or second) homes and make it easier for hard-working Caymanian citizens and families to be able to purchase property.”

The enhanced stamp duty benefits will be offered to Caymanians immediately, with the Premier acting in his capacity as Minister of Finance and Commissioner of Stamp Duty to exercise the powers under section 20(6)(a) of the Stamp Duty Act (2019 Revision) to grant the concessions.

The process for the legislative amendments is a thorough but lengthy one but when completed will ensure that these valuable benefits are available for all Caymanians purchasing their first or second properties without being subject to the discretion of anyone.

Premier Panton said, “Today, we are taking another step toward fulfilling Outcome #3 of our Strategic Policy Statement where we commit this government to finding solutions that improve the well-being of our people and help them reach their fullest potential. Today, we demonstrate our commitment to enabling wealth generation among Caymanians by making it easier for them to own a home.”