Cayman: Government 2022 revenues top $1 billion, bringing $47.7 million surplus

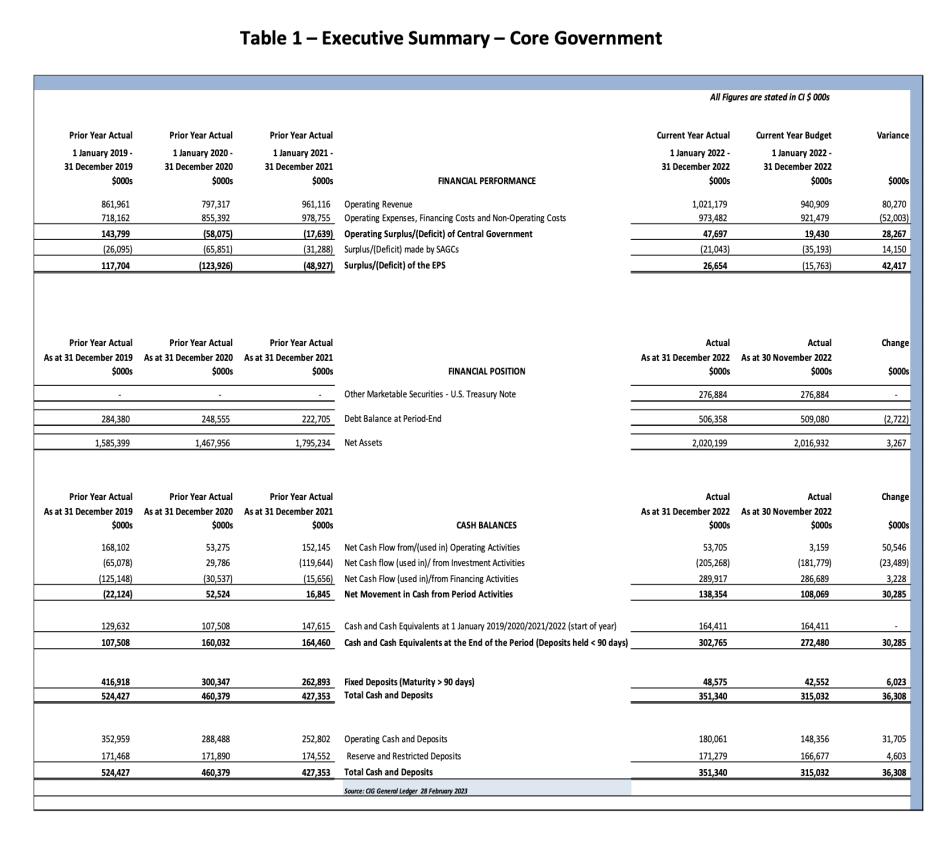

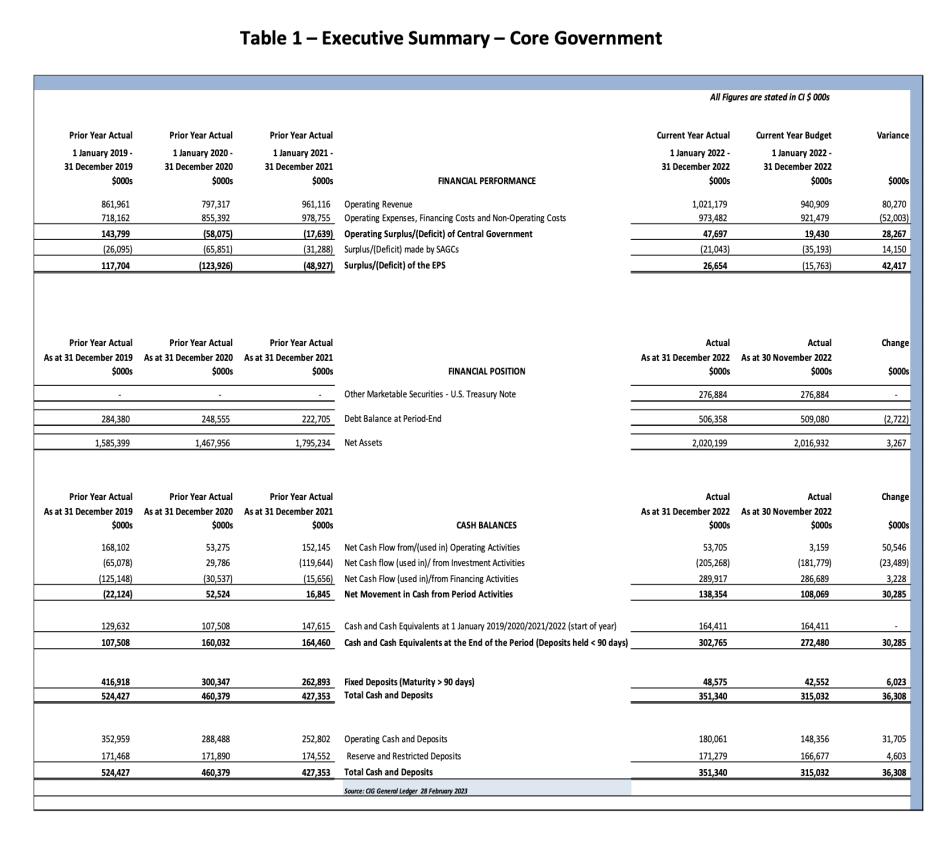

Grand Cayman, 12 April 2023 – The Cayman Islands Government ended 2022 with a $47.7 million Operating Surplus for Central Government, which is $28.3 million more than was projected and the result of revenues reaching $1.02 billion.

The Cayman Islands Government’s unaudited financial results and position for the year 1 January 2022 to 31 December 2022 were presented to Cabinet on 7 March 2023, with better-than-expected results observed almost across the board.

Most notably, the 2022 results show an Operating Surplus for the Entire Public Sector (EPS), rather than the initially projected Operating Deficit for the EPS.

Total Operating Revenues of Core Government were $1.02 billion while Operating Expenses, Financing Costs and Non-Operating Costs, were $973.5 million; Statutory Authorities and Government Companies (SAGCs) reported an Operating Deficit of $21.0 million.

Surplus: Central Government – Better than Projected by CI$28.3 million

At the end of December 2022, there was a CI$47.7 million Operating Surplus for Central Government, which is CI$28.3 million more than the initially projected Operating Surplus of CI$19.4 million.

Surplus: Entire Public Sector – CI$42.4 million Better than Budget

Although a deficit was forecasted at an EPS level, 2022 ended with a surplus of $26.6 million, or $42.4 million more than the projected Operating Deficit of $15.8 million.

Revenues: Surpassed Projections by CI$80.3 million

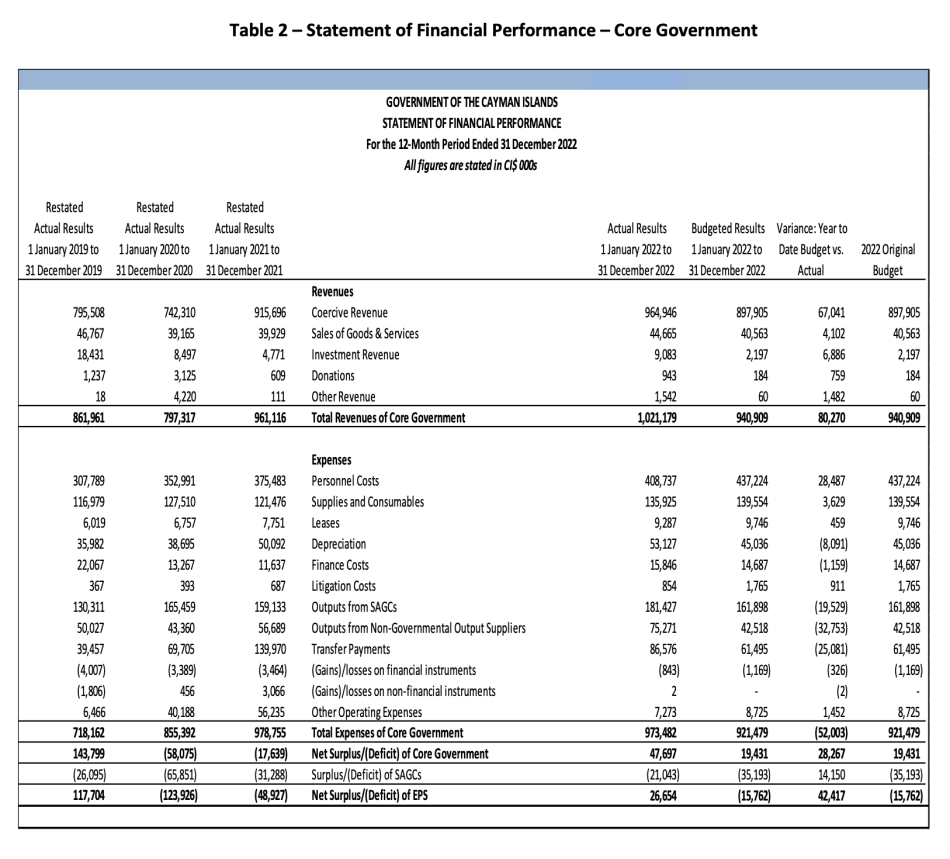

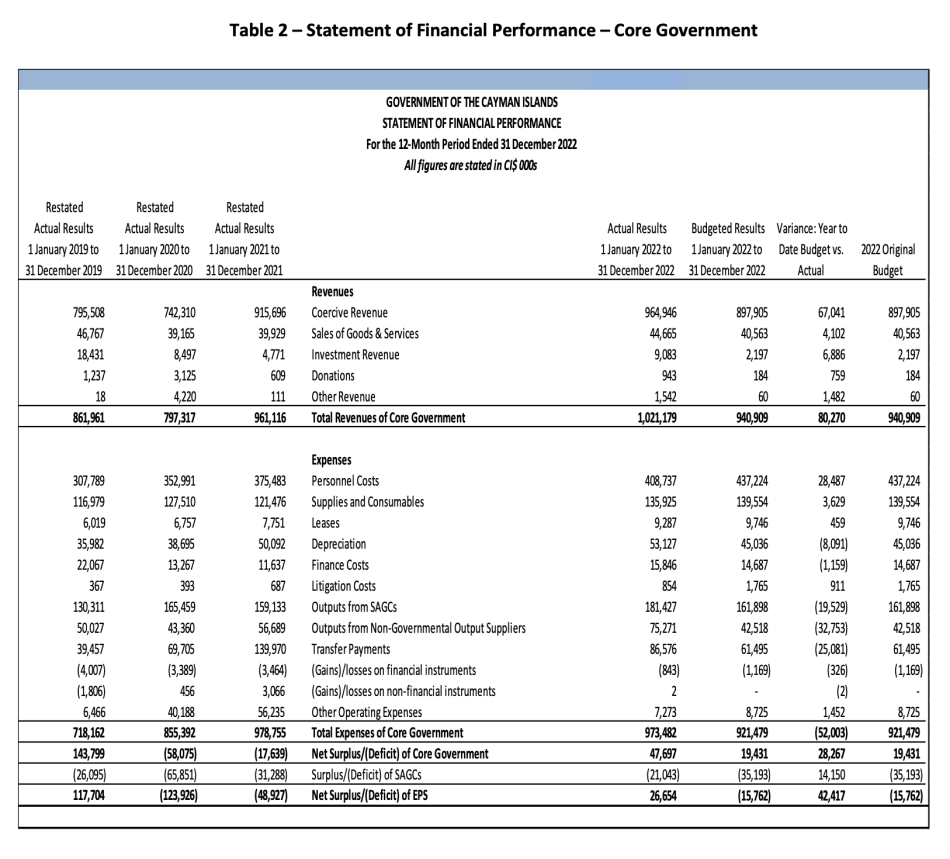

Total Operating Revenues of Core Government for the twelve-month period ended 31 December 2022 were CI$1.02 billion, which was CI$80.3 million more than the full year projection of $940.9 million. This was mainly due to a favourable variance in Coercive Revenue.

Coercive Revenue of $964.9 million, representing 95% of total Revenue earned, was $67.0 million more than the initial 2022 projection and $49.3 million more than actual revenue collected in 2021.

Continuing the trend observed throughout the year, financial services fees plus work permit and property related revenues contributed most to the higher-than-anticipated revenues collected.

The most significant positive total year variances were recorded for the following categories:

- Financial Services Fees collected by the Cayman Islands Monetary Authority (CIMA) for Government were CI$6.2 million higher than anticipated, which was mainly due to an increase in the volume of registered funds with Mutual Fund Administrators Licence Fees CI$4.6 million higher than expected and Private Funds Fees CI$4.3 million more than projected. These increases were offset by Securities and Investment Business Licence Fees being CI$1.6 million less than budget expectations. When compared to actual results for the same period in the prior year, the 2022 Financial Services fees collected by CIMA are approximately CI$8.8 million more, equating to a 5.9% increase;

- Work Permit Revenues were CI$21.3 million higher than projected, representing increasing demand for workers as the economy moved beyond phase five of the border reopening and a stronger economic performance than expected (notably in the Real Estate and Construction industry). Compared to actual results for 2021, these 2022 fees are CI$14.5 million (or 14.9%), more; and

- Property Related Revenues were CI$22.1 million higher than anticipated, as there continues to be a higher-than-expected volume of property transactions coupled with high property values. Compared to actual results from 2021, the 2022 revenues are CI$12.0 million (or 10.7%), less.

However, not all revenue categories brought in higher-than expected amounts:

- Import Duty Revenues, owing to the continued impact of COVID-19 on the world economy, Import Duties fell CI$16.2 million short of expectations. However, when compared to the prior year, the 2022 Import Duty Revenues of CI$226.2 million are CI$20.1 million higher due to the relaxation of COVID-19 restrictions and the re-opening of the Cayman Islands borders.

Expenses: Higher than Initial Budget, Impacted by Health Care costs

Operating Expenses for the year ended 31 December 2022 were $973.5 million; this amount was $52.0 million more than the initially projected full year budget of $921.5 million. Compared to the prior year actuals, total expenses in 2022 were $5.3 million less.

The variance between actual and budgeted expenses is largely due to overages related to health care expenses, including of $30.7 million for tertiary health care costs; $2.9 million for the actual costs of health insurance for civil service pensioners; and a $14.8 million adverse variance with respect to the Health Services Authority due to the cost of supplies and other items to combat COVID-19 of $10.3 million as well as actual costs for the Care of Indigents exceeding the budget for this category by $9.0 million.

To ensure sufficient funds were available to the Ministry of Health and Wellness, Parliament approved, via section 12 of the Public Management and Finance Act (2020 Revision), an additional $15.8 million in funding.

Transfer Payments of $86.6 million were $25.1 million more than the initial 2022 budget. This variance is mainly due to the ex-gratia tourism stipend, which was $16.4 million over budget and the electrical assistance programme which cost $7.9 million and was not originally in the 2022 budget allocations.

To ensure sufficient funds were available, Parliament approved supplementary funding of $16.5 million for the tourism stipend. The electricity assistance programme was a new supplementary expenditure introduced in July 2022 with approved funding of $8.5 million.

The overages in these areas were somewhat offset by underspending in other areas including Personnel Costs being $28.5 million less than budget and Supplies and Consumables, excluding Leases, coming in at $3.6 million less than the full year budget.

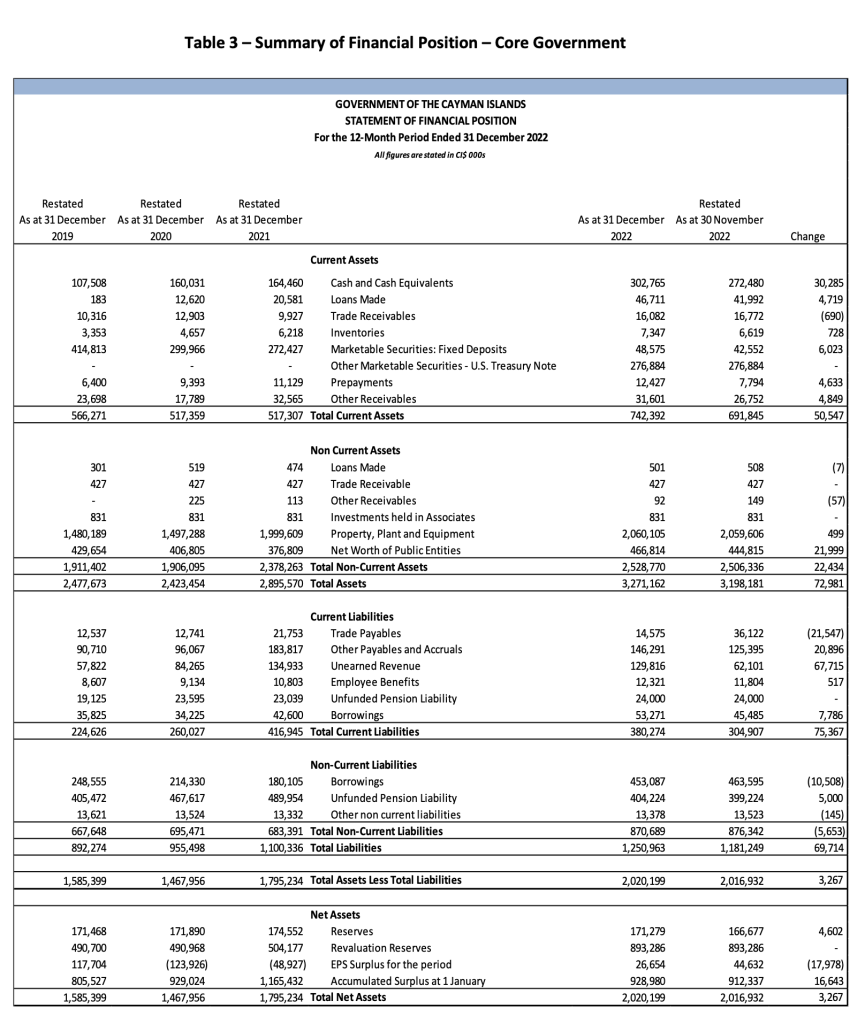

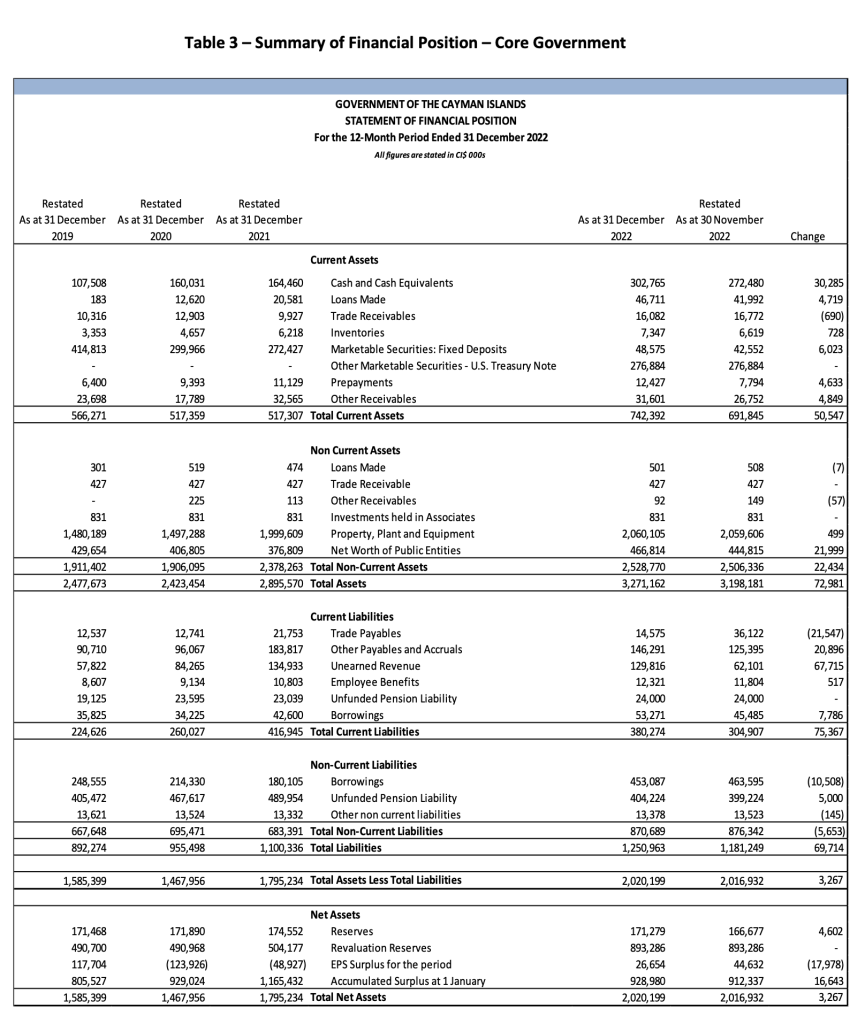

Net Assets & Cash Position

At 31 December 2022, Net Assets of the Government were $2.0 billion. Bank account balances, including fixed deposits totalled $351.3 million; $171.3 million of which were held as Reserve and Restricted deposits, and $180.0 million as Operating Bank Account balances.

US Government Treasury Notes, which will mature in June 2023 were held at 31 December 2022 at their purchase price of US$333.6 million or CI$276.9 million.

Four-Year Financial Performance Comparison

The Table below provides a comparison of the full year financial performance with the prior three years.

| 2019 | 2020 | 2021 | 2022 | |

| Revenues | 861,961,000 | 797,317,000 | 961,116,000 | 1,021,179,000 |

| Operating Expenses, Financing Costs and Non-Operating Costs | 718,162,000 | 855,392,000 | 978,755,000 | 973,482,000 |

| Operating Surplus/(Deficit)of Central Government | 143,799,000 | (58,075,000) | (17,639,000) | 47,697,000 |

| Surplus/(Deficit) made by Statutory Authorities and Government Companies | (26,095,000) | (65,851,000) | (31,288,000) | (21,043,000) |

| Surplus of the Entire Public Sector | 117,704,000 | (123,926,000) | (48,927,000) | 26,654,000 |

| Total Bank Account balances | 524,427,000 | 460,379,000 | 427,353,000 | 351,340,000 |

Four-Year Revenue Comparison

The Table below provides a breakdown of the main categories of coercive revenues with a comparison to prior years.

| 2019 | 2020 | 2021 | 2022 | |

| Import Duty Revenues | 193,075,000 | 173,361,000 | 206,042,000 | 226,152,000 |

| General Registry Fees | 173,253,000 | 169,868,000 | 181,918,000 | 195,476,000 |

| Government Fees collected by CIMA | 95,608,000 | 95,896,000 | 149,673,000 | 158,484,000 |

| Work Permit Revenues | 94,490,000 | 82,406,000 | 96,836,000 | 111,300,000 |

| Property-related Revenues | 73,339,000 | 72,967,000 | 111,951,000 | 99,919,000 |

| Tourism-related Revenues | 47,521,000 | 13,555,000 | 1,005,000 | 24,189,000 |

| Other Coercive Revenues | 118,222,000 | 134,257,000 | 168,271,000 | 149,426,000 |

Premier and Minister for Finance & Economic Development Hon. G. Wayne Panton observed, “I am very pleased to have ended 2022 with a $26.6 million public sector surplus rather than the projected $15.8 million deficit. The 2022 Revenues for Central Government were $80.3 million better than Budget and an improvement of $159.2 million or approximately 18.5 per cent more than pre-COVID 2019. This is the culmination of the overall trend for 2022 of better-than-expected revenues each month, and particularly demonstrates ongoing confidence in our Financial Services sector and the post-COVID recovery of our economy.”

He continued, “We recognise, however, that there continue to be challenges to overcome – especially with regard to the ever-increasing cost of living, rising interest rates and fluctuating global economic trends. The silver lining in all of this is that our higher than expected revenues and surpluses for 2022 will help us to maintain a positive financial position in the face of both local and international financial pressures. The results also clearly demonstrate that the Cayman Islands remains an attractive jurisdiction for inward investment, as well as maintaining local economic growth. The Government’s aim for 2023 and 2024 is to build on this solid foundation as we also seek to relieve some of the economic stresses on Caymanian families.”