Singapore beats Hong Kong for first time in 2019 FDI ranking

By Jacopo Dettoni From fDi Intelligence

Social unrest has taken its toll on the investment appeal of Hong Kong.

Social unrest in Hong Kong has redrawn the investment map of south-east Asia as Singapore emerges as the financial centre of choice of foreign investors in 2019.

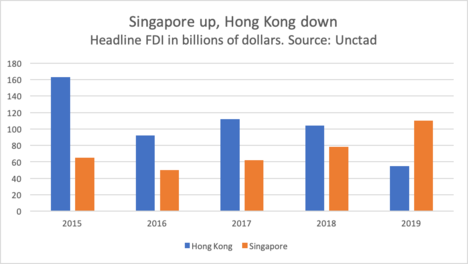

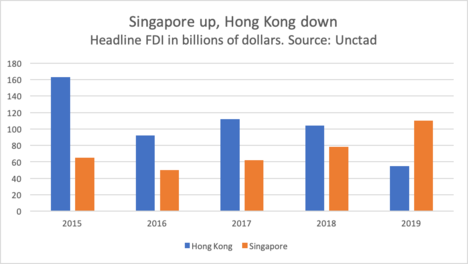

Singapore attracted $110bn in headline FDI last year, up by 41% from a year earlier, according to preliminary annual figures from Unctad.

The country beat Hong Kong for the first time in the ranking of the world’s most attractive investment destinations as FDI into Hong Kong almost halved to $55bn in 2019 “as divestments continued through the year”, Unctad’s latest Global Investment Trend Monitor says.

Hong Kong has been facing widespread protests since March 2019 as the limits of its current relationship with mainland China, framed under the ‘one country, two systems’ model come to light, prompting younger people to take to the streets to air their concerns over the city’s independence and rule of law.

Social unrest accelerated a shift of capital from Hong Kong to Singapore. The latter has been capitalising on the tremendous growth of Asean countries for years, strengthening its position as the region’s alternative financial centre to Hong Kong. Political uncertainty is now giving investors an additional reason to back Singapore instead.

“This shift was already happening before the protests started; perhaps they only have tilted the balance in favour of the move,” Carlos Casanova, an economist for the Asia-Pacific region at credit insurance firm Coface, told fDi in December. “It doesn’t mean Hong Kong is no longer going to be a financial centre for mainland China. In fact, Hong Kong continues to be a very important financial centre for the mainland because China has a closed capital account. [As long as] China has a closed capital account, Hong Kong will remain China’s gateway to the world.”

Hong Kong remains a necessary centre of offshore finance for investors from mainland China willing to access the global financial market, because they still face tight capital restrictions in the domestic market, which prevents companies, banks and individuals from freely moving money in or out of the country except in accordance with strict rules. The city state remains the biggest hub for offshore renminbi business.

For more on this story go to; https://www.fdiintelligence.com/Locations/Singapore-beats-Hong-Kong-for-first-time-in-2019-FDI-ranking?utm_campaign=Feb%201st%20newsletter&utm_source=emailCampaign&utm_medium=email&utm_content=