IMF / 2021 Preliminary Assessment of the Euro Area Economy

The euro area is recovering rapidly since the second quarter of 2021 after falling by about 6½ percent in 2020, the IMF Monday, (December 6 2021) in Brussels, Belgium.

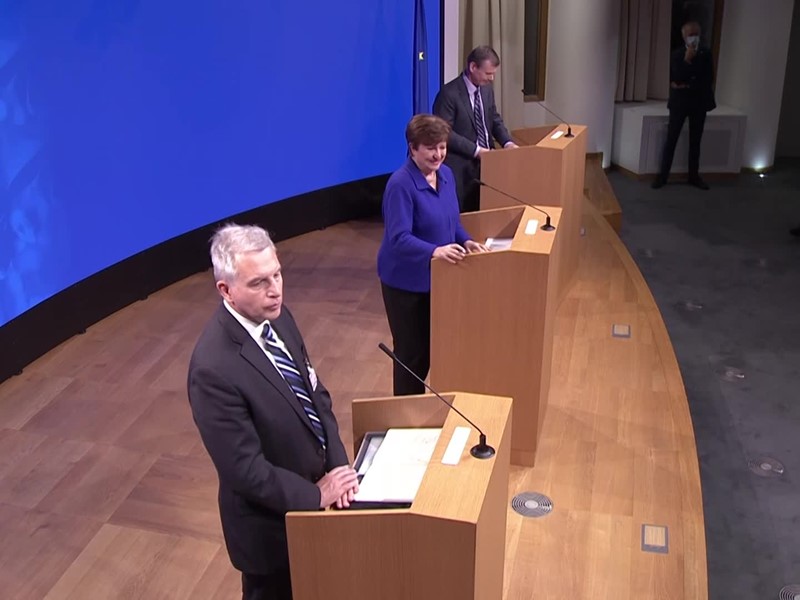

“The euro area economy is recovering rapidly thanks to high vaccination levels, continued forceful policy support and increased consumer and business adaptation to the pandemic. Following a sharp contraction six and a half percent in 2020, Euro Area output has re-bounced strongly and is expected to exceed its pre-crisis level in the fourth quarter of 2021” said Kristalina Georgieva, IMF’s Managing Director, at a news conference.

Recent inflation readings have been higher than forecasted, but the IMF sees pressure on prices easing and returning to trend in 2022.

“Underlying inflation in the area, in the Euro Area, is projected to remain weak despite the recent price increases. Higher inflation in 2021 has been largely driven by base effects from last year’s low oil prices, which were amplified by dwindling reserves of natural gas and transitory factors such as the German V.A.T. exploration. We project inflation to decline through 2022 as these factors dissipate and to remain below the ECB’s two percent target in the medium term,” added Georgieva.

Although the euro area is recovering rapidly, uncertainty surrounding that forecast remains high and is largely tied to the evolution and legacies of the pandemic.

Georgieva advised that the fiscal framework should be reformed to make it more efficient at preventing debt distress, while allowing adequate room for macroeconomic stabilization. She also emphasized that the key monetary policy challenge is to maintain clear and effective communication in the face of extraordinary uncertainty.

“EU fiscal rules should be reformed to reflect the post-pandemic reality. The application of the current fiscal rules would require unrealistically large and counter-productive adjustments by some high debt countries. Turning to monetary policy, the key challenge here is to maintain clear and effective communication in the face of extraordinary uncertainty. As underlying inflation dynamics are expected to remain weak over the medium term, the ECB should look through transitory inflation pressures and maintain an accommodative monetary policy stance, and it will need to clarify soon how this could be achieved given the upcoming expiration of the pandemic emergency purchase program and the third round of the targeted longer term refinancing operations.” Said Georgieva.

Georgieva concluded her remarks by stressing on the crucial role of European leadership on global issues like climate, global minimum income tax, and vaccinating the world against COVID-19.

“European leadership on global issues, it remains critical. In addition to leading on climate, it is important to continue engagement with major trading partners to address underlying sources of global trade tensions and the finalization of the proposed global corporate minimum income tax and importantly, as one of the leading exporters of COVID-19 vaccines and a donor to COVAX, the EU should continue its efforts to press for vaccinating the world and to increasing global vaccine production, including diversifying it in parts of the world that have been lacking any capacity like Africa.” said Georgieva.

To watch the full press briefing, click here.