Cayman Minister speaks on current state of the economy and the Government’s finances

2020 Economic Forum

State of the Government Finances

by the Honourable Roy McTaggart, JP

Friday, 14 August 2020

Virtual Event

Welcome

Mr. Woody Foster, President of the Cayman Islands Chamber of Commerce, Members of Council, Ladies and Gentlemen, Good Morning! It is my pleasure to be here with you this morning to provide an update on the current state of our economy and the Government’s finances.

Just one year ago, I delivered a similar speech at the 2019 Economic Forum – which was held at the Kimpton Seafire Resort and Spa. I spoke of how the Cayman Islands was then enjoying an exceptionally robust period of economic activity with solid, sustained growth across all sectors.

I spoke of low and falling unemployment; low to moderate inflation; along with strong and stable Government finances – which had enabled us to invest in infrastructure and improve public services while generating operational surpluses and decreasing public sector debt.

This as a result of a strategy, over two successive governments, of living within our means, growing surpluses and reserves, and paying down on debt. As at 30 June 2013 the Islands’ General Reserves stood at $44.5 million and Operating cash balances were $21.2 million. At 30 June 2020 these had improved significantly with General Reserves of $104 million and Operating cash balances of $382.7 million. The Debt balance at 30 June 2013 was $573.9 million and this has decreased substantially to $266.5 million at 30 June 2020.

Not only were we as a Government supporting business and economic growth because of this strategy but we were also putting our Islands in a better place to survive the next economic down turn.

At the Forum, we freely interacted and networked in camaraderie over coffee breaks and lunch.

What a difference a year makes!

Like the rest of the world, Cayman is facing the same impacts of COVID-19 – impacts that we never imagined we would ever experience in our lifetimes.

My message today is not all doom and gloom. Yes, we are currently facing severe economic and financial hardships that will require all of us to dig deep in order to persevere and survive. But because of the fiscal strategy employed over the past two terms, good reserves and decreased debt, we are facing the economic impact of this pandemic in as strong a fiscal position as I could have expected. This level of economic strength has allowed us the leverage needed to make certain decisions to better respond to the virus so as to protect life and health, and then later as we started our phased programme of recovery.

So we have started from a place of strength. This is not just Roy McTaggart saying this but noted economist Marla Dukharan is quoted by the Compass as saying in April of this year that:

“Only the countries that have built financial buffers stand ready to spend money to kickstart the economy during the downturn, particularly at a time when government revenues are falling.

“In the Caribbean, the Cayman Islands stands alone in this regard, as most of the others will end up at least partially financing their COVID-19 response with debt,”

Whilst we may likely in time need to access a line of credit to cover shortfalls in revenue, we are not yet there. But I want to assure you that the Government is doing all that it can to assist all citizens, residents and businesses in need.

I am confident that with the same perseverance and resilience we have shown many times in the past, this too shall pass and we will weather through.

I need to pause here for a moment and address a post from an online media site yesterday with a headline entitled COVID-19 Recession could lead to tax. The story was a result of an interview I did on Tuesday with CIGTV. I consider the headline to be unnecessarily alarmist and encourage everyone who is interested to view the 5 minute clip on the CIGTV Youtube channel and hear for themselves what I said. For those who might not get a chance to listen for themselves, here is the bottom line:

I did not say Government was considering direct taxation, I said that if the situation got worse AND if we ran out of options, we would have to make some tough decisions….which could include a really tough decision, like contemplating taxation.

My reference to the word taxation in my interview referred to the existing indirect tax regime – not direct taxation.

We entered COVID-19 in the enviable position of having substantial cash reserves to help our people. Because of the Pandemic and Global Recession, our revenues are a fraction of what they were this time last year. Through our responsible fiscal management, we have reserves. Through our research and partnerships, we are (evaluating several other options) which we can consider to minimise the negative impacts on our economy and this Government does not foresee the need to introduce new taxes, and certainly not direct taxation.

Ladies and Gentlemen let me assure you that the Government is not contemplating any change to its well established fiscal strategy of:

- No new taxes;

- Paying down debt; and

- Managing expenditure to produce significant budget surpluses.

This strategy has successfully served us well and enabled the Cayman Islands to sustainably grow our economy and meet the ever-increasing demands for public services and improved infrastructure.

The Cayman Islands Government has an indirect tax regime that is well established and supports robust levels of economic activity and the Government does not see the need to make any changes to this regime. To be clear, the Government is not contemplating any direct taxation.

The current realities of the COVID-19 Pandemic mean that Governments across the world are severely challenged to meet the fiscal burdens caused by decreasing revenues; contracting economies; and increasing demand for public services.

For us here in the Cayman Islands we are doing everything possible to ensure that our country and economy can rise above this crisis. We are committed to living within our means as we meet the needs of our people.

Pre-COVID-19 Economic Performance

Colleagues, it would be an understatement to say we have had a turbulent year so far.

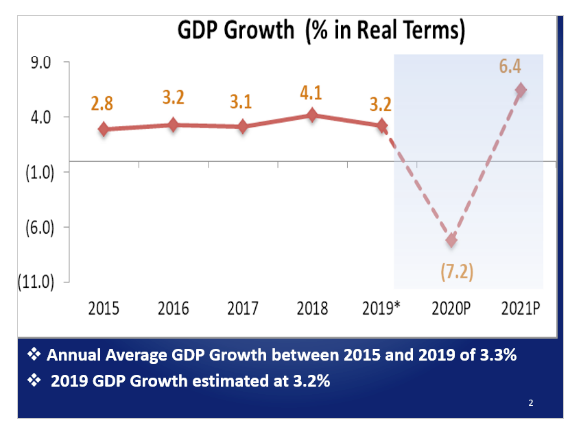

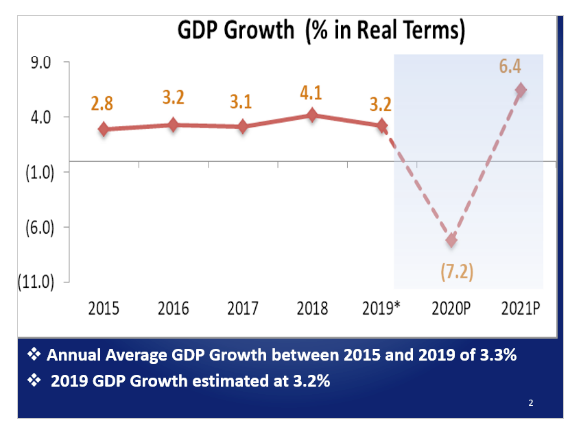

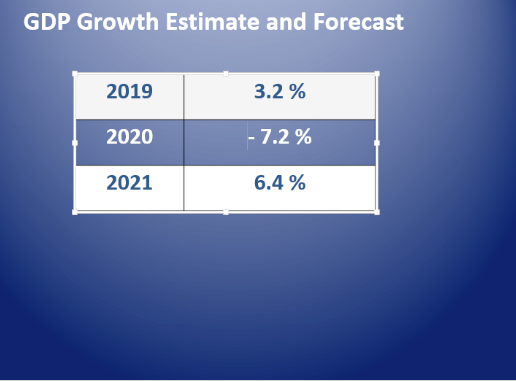

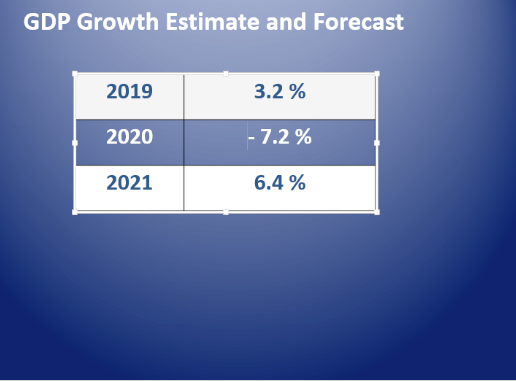

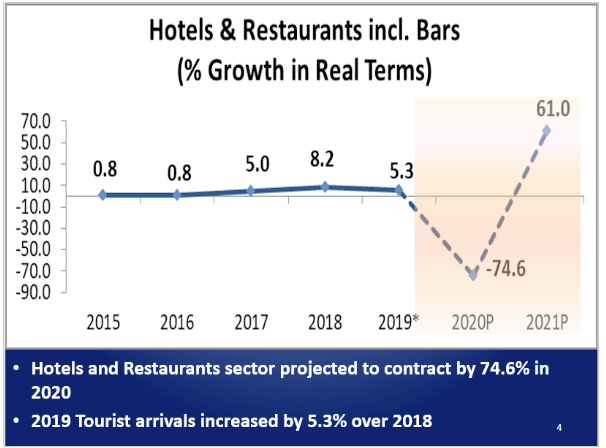

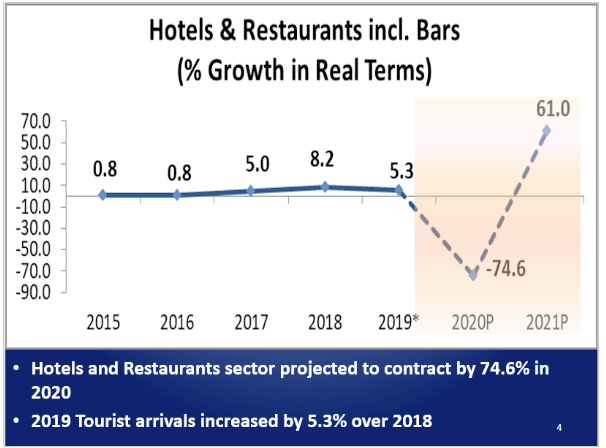

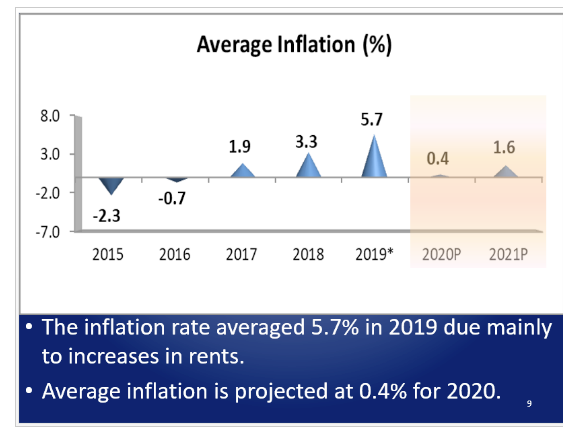

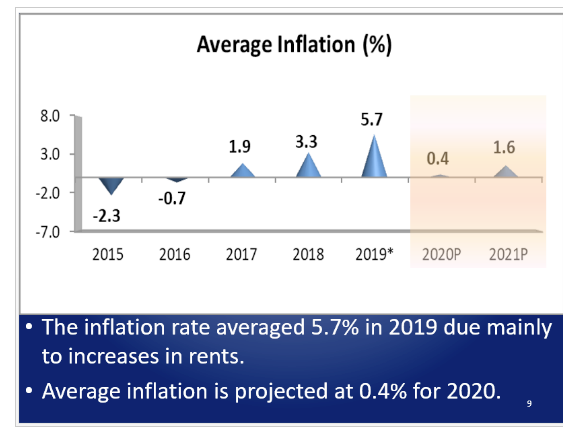

Seven months ago, I would have presented to you a thriving economy growing at an average annual rate of 3.3% between 2015 and 2019. Economic growth in 2019 was estimated at 3.2%, led by construction growth of 5.8%, and hotels and restaurants by 5.3%. Inflation averaged 5.7%, and the unemployment rate was 3.5%.

The trend of robust economic growth was led by strong performances in the core service areas of our economy, namely; financial and insurance services, business services and tourism. These were further reinforced by substantial growth in construction, trade and other population supporting sectors.

Economic projections for 2020 and 2021

This performance continued until March when the “sudden stop” ushered in a new paradigm, with the projections for 2020 forcing us to contend with a new reality.

The Cayman Islands’ economy is expected to contract by 7.2% in 2020 before recovering partially by 6.4% in 2021. The contraction in output for 2020 is precipitated by reductions in economic output associated with recent restrictions and low demand for some of our services in the coming months. International demand for our services will be impacted by the continuing closure of our borders and expected contractions in the US and other advanced economies.

The growth estimates are in the context of measures implemented by the Government to contain the spread of the virus, increase disposable income and boost activity.

Without these measures, the projections presented today would be bleaker, and we need not look far across the sea to appreciate what could have been.

In its June 2020 update, the IMF projected the US economy to contract by 8.0% for the year. It is worthwhile to note that this was before the US recorded its highest annualised quarterly contraction on record of 32.9% for the June 2020 quarter, and before the recent spike in COVD-19 infections and public utterances of new lockdown measures.

These developments have the potential to stifle our recovery further if the trend persists and the US enters another extended lockdown period.

The measures and actions implemented by Government at the start of, and during, the crisis, with the support of the business community, have left us with a solid foundation on which to chart our future. The collaboration by Government and the private sector to develop world-class infrastructure and regulatory framework prior to the crisis has allowed our financial and business services sector to remain on a sound footing throughout the crisis and reduced the potential fallout.

Additionally, the actions taken by this Administration to contain the spread of the virus and support the basic needs of our people has left us in an arguably COVID free environment with no significant healthcare dislocation and relatively stable socio-economic conditions.

As a Government, we are prepared to go even further to support our local economic infrastructure, and I hope this Forum will be a platform to develop new ideas and collaboration for “Rebuilding a stronger and more diverse economy.”

Growth by Industry

The contraction in 2020 is expected to span across a lot of key sectors.

Despite a relatively robust performance in the first two months of the year (which now seems like a decade ago) the hotels and restaurant sector is expected to bear the brunt of the crisis, reflecting a contraction of 74.6%. This reflects a reduction in the sector’s capacity, resulting from the closing of our borders and the fallout in our major tourist markets. The reopening and subsequent rebuilding of this segment of our economy is a very crucial component of our recovery, and I look forward to the discussions on this topic in the panel discussion later.

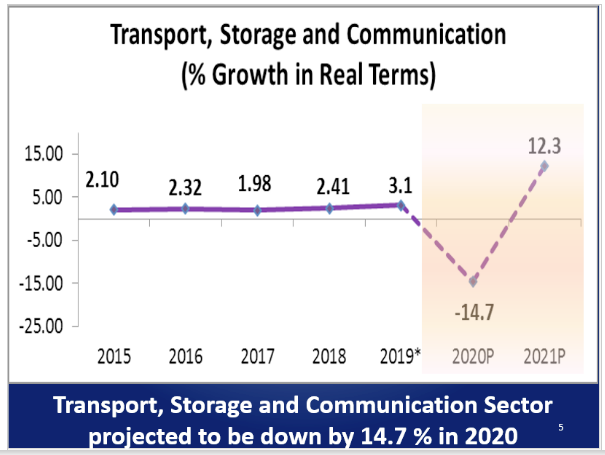

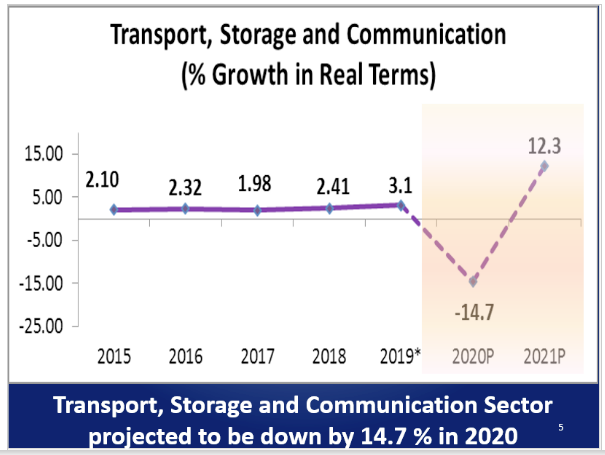

The transport, storage and communication sector is projected to contract by 14.7%, as the decline in transport outweighs a moderate growth in communication. The sector is projected to suffer the second-largest decline for the year.

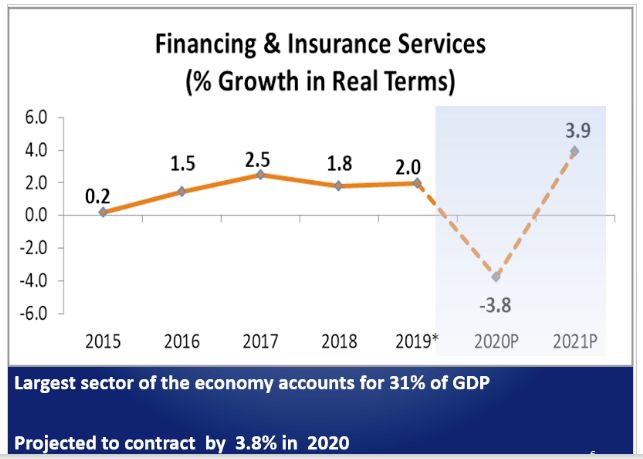

The financing and insurance sector is projected to decline by 3.8% for the year. The sector showed its resilience in the short term as the industry was able to get employees to work relatively well remotely. Additionally, with the sector’s high leverage of online platforms, it was able to offer most services virtually.

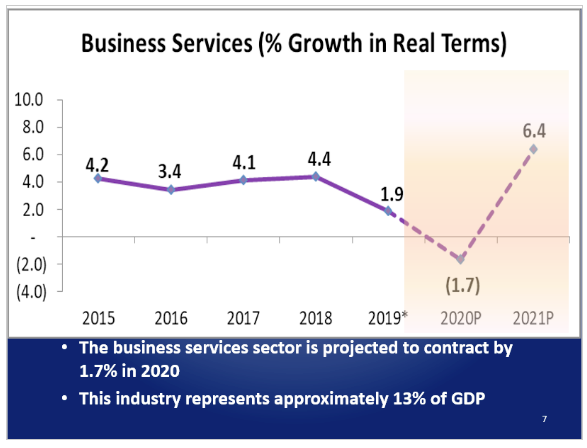

The business services sector, which is comprised mainly of legal and accounting services, was also relatively unimpeded by restrictions but is expected to be impacted by the general fallout in domestic and international demand in the latter part of the year. Consequently, the sector is anticipated to fall by 1.7% for the year.

Notably, there is a considerable downside risk to the forecast in both the legal and accounting components of this sector. Economic activities could be impacted by uncertainties in international financial markets going forward.

If this risk develops, the Government stands ready to partner with the business community to enact the necessary legislative changes to maintain a vibrant financial and business services industry.

Notwithstanding the contractions in most economic sectors, additional spending by the Government on health and other essential services is expected to boost economic activity in health and social services and other Government services. Additionally, with more individuals working remotely and resumed office activities, consumption of electricity and water is expected to remain robust for the year.

Employment

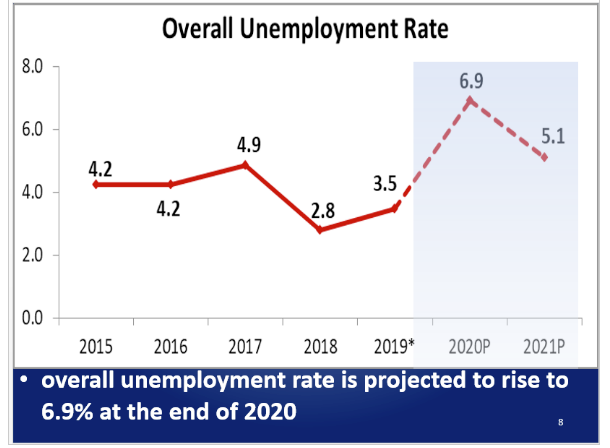

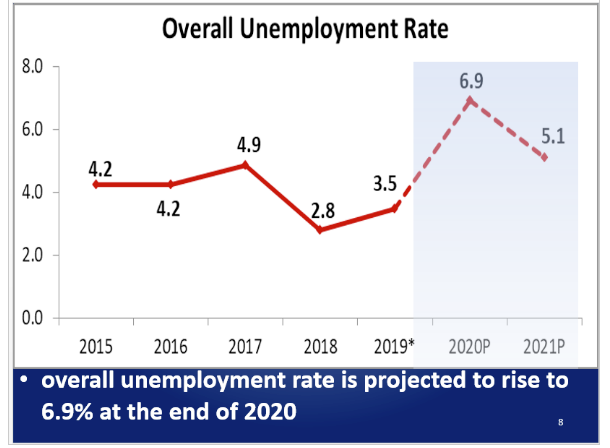

The unemployment rate in 2020 is forecasted at 6.9% of the labour force, due to a fall-off in demand from the labour-intensive tourism sector among others. Additionally, the closure and consolidation of some industries is expected to contribute to higher unemployment levels. The demand for labour is expected to track the GDP growth forecasts with a decline in employment opportunities expected in the industries primarily affected. Over the medium-term, new employment is expected from the recovery of labour-intensive industries such as tourism. The unemployment rate in 2021 is projected at 5.1%.

Sustaining the local economy, in the short-term will require spending by our local population. The success of the country to eliminate Covid 19 has enabled a good recovery of the domestic economy and this is helping greatly. Thousands of persons have left our Islands since March and admittedly the loss of the spend from these individuals will have a negative impact on the economy. But as businesses are re-emerging from the shutdown, and start to rebuild, the Government is insisting that the re-employment of Caymanians must come first.

This will help move unemployed Caymanians back into jobs and facilitate the circulation of funds locally. We hope that the local business community will also see the value in this and support our Administration’s effort to ensure the employment of our citizens and residents.

Inflation

The contraction in demand locally and internationally has reduced pressures on both imported and local inflation. Consequently, the consumer price index (CPI) inflation rate is forecasted at 0.4% in 2020, lower than the high of 5.7% observed in 2019. Falling international commodity prices are expected to support stability in the consumer basket and relieve most inflationary concerns from policy decisions in the near term. Inflation in 2021 is projected at 1.6%.

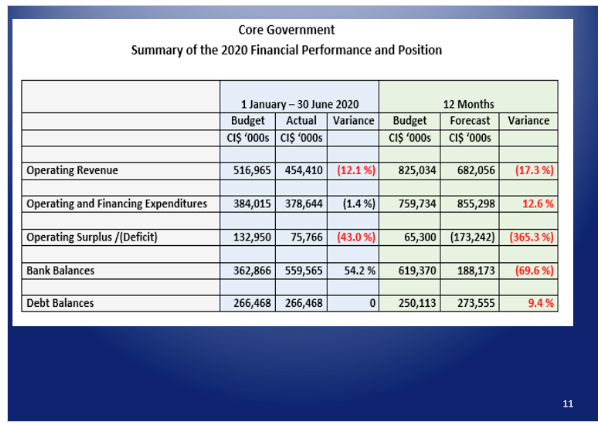

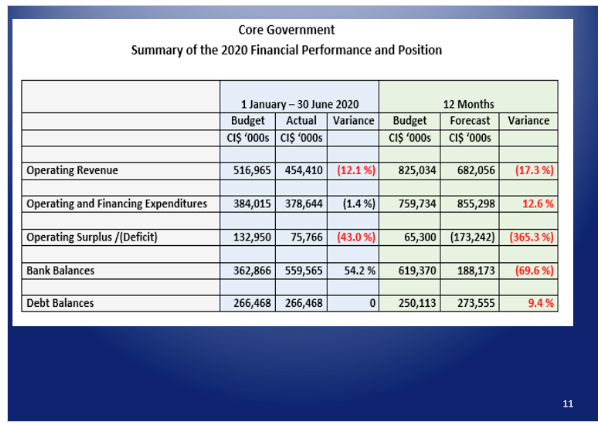

Financial Performance and Position of the Government

The impact of COVID-19, along with the Government’s response to ensure the health and safety of the people of the Cayman Islands and to stimulate the local economy, has had a significant impact on the Government’s financial performance and position.

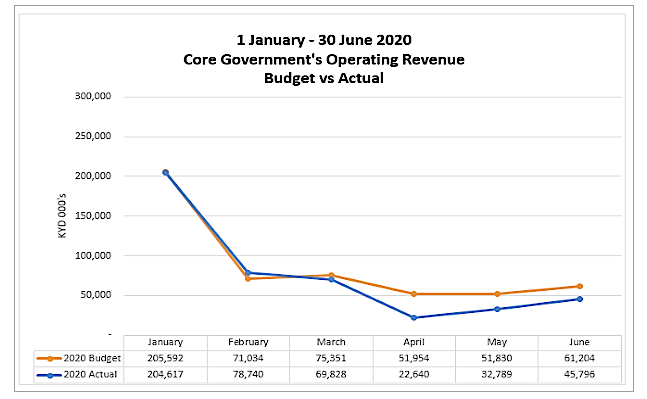

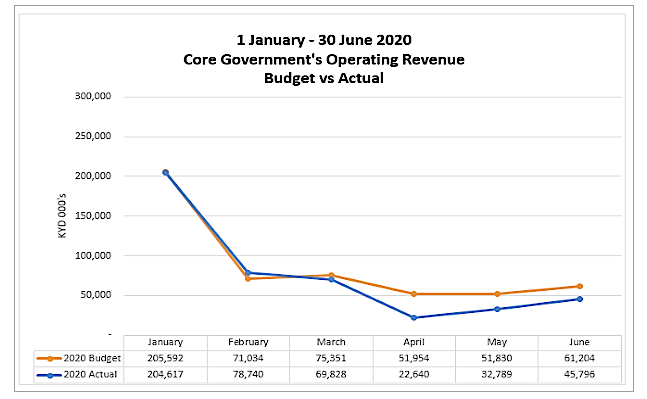

Operating Revenue

By the end of the first quarter of 2020, Core Government’s Operating Revenues were performing marginally better than the year to date budget, by 0.3%. The Government saw positive variances in Building and Permit Fees, Partnership Fees and Stamp Duty on Land Transfers. – which, when combined, were $7.0 million more than the 1st Quarter’s budget.

However, there were significant negative variances in revenue primarily due to:

- Other Exempt Company Fees – which were $3.4 million lower than budget;

- Security Investment Business Licences – which were $1.7 million lower than budget; and

- as expected, Tourist Accommodation Charges – which were $4.8 million lower than budget.

Three months later, by the end of the second quarter of 2020, Operating Revenues had deteriorated by $62.6 million or 12% lower than the year to date budget.

Although Partnership Fees and Stamp Duty on Land Transfers continued to perform better than budget, by a combined $8.3 million, the impact of COVID-19 on the economy and on Operating Revenues began reflect in:

- Tourist Accommodation Charges – which were down by $14.8 million;

- Work Permit Fees – down by $18.5 million;

- Mutual Fund Administrators Fees – down by $7.2 million;

- Other Import Duty – down by $13.5 million;

- Annual Permanent Resident Work Permit Fees – down by $3.5 million; and

- Gasoline and Diesel Duty – which was down by $3.8 million.

When compared to the same six-month period in 2019, Core Government’s Operating Revenues are lower by $76.7 million.

The Government forecasts that by the end of 2020, Operating Revenues will be at $682.1 million – which is $142.9 million or 17.3% lower than budget.

Operating and Financing Expenditures

For the six-month period ended 30 June 2020, Core Government’s Operating and Financing Expenses were $5.4 million or 1.4% lower than the year-to-date budget of $384.0 million.

This favourable variance was mainly due to savings in Personnel Costs, Supplies and Consumables, and Transfer Payments. The Government forecasts that by the end of 2020, Operating and Financing Expenses will be $855.3 million – which is $95.6 million or 12.6% higher than budget!

A significant portion of the $95.6 million increase in expenses can be attributed to the series of economic stimulus measures and costs that the Government has implemented and plans to implement to help mitigate economic hardship on vulnerable people and to support the economy. These measures and costs include:

- Supporting a wide-range of healthcare activities and other COVID-related costs including:

- the purchase of test kits;

- the cost of testing;

- personal protective equipment, medical supplies and equipment including equipping Jasmine (formerly Hospice Care) with a generator so that the premises could be used to treat Covid patients if necessary;

- the cost of quarantine facilities and social distancing;

- repatriation flights;

- cleaning products, including hand sanitizers;

- public awareness campaigns;

- costs associated with moving Core Government staff to remote working, such as costs of laptops, phones and other IT equipment;

- rental of equipment and vehicles; and

- fuel.

- Funding for vulnerable individuals and families which include:

- A one-off payment of $425 to the disabled, seamen, veterans and persons already receiving personal financial assistance from the Government;

- A one-off stipend of $600 paid to taxi drivers affected by the fall-off of cruise ship visitors;

- A one-time grant of $600 to Caymanian tourism workers affected by the shut-down;

- Additional monthly support of $1,000 for 3 months for tourism workers;

- Providing $1.0 million to assist farmers to buy feed and other supplies;

- Providing $2.0 million to expatriate work permit holders in the form of food vouchers; and

- Paying the health insurance premiums for April to June 2020 for individuals who had been furloughed.

- Supporting education expenditure and activities in the form of:

- online distance learning, including cost of learning packs and the online learning platform;

- free school meals;

- grants to pre-schools; and

- outsourced services for schools, including security, cleaning and school buses.

- Supporting public sector personnel costs in the form of:

- overtime payments to Core Government staff, such as Police Officers and Customs and Border Control Officers while maintaining security and compliance with curfews and, overtime payments to healthcare staff; and

- additional costs incurred for essential Core Government staff, such as meals and refreshments; and honorarium payments for staff.

- Amending the Pensions Law toallowpersons to withdraw up to 100 percent of their pension funds not exceeding $10,000, and 25 percent of funds above $10,000. In addition, pension payments were suspended from 1st April to 30th September 2020, for employees and employers;

- Supporting businesses by:

- creatinga$5.0 million low-cost loan facility to be provided through the Cayman Islands Development Bank, to businesses that are 100 % Caymanian owned;

- providing $9.0 million in grants to small and micro businesses; and

- providing funding of $500,000 for technical assistance and $200,000 for training for Caymanian-owned businesses.

- Waiving tourism accommodation taxes and trade and business licence fees in the short-term; and

- Enhancing the capacity oftheNeeds Assessment Unit and the Planning Department to deal with the increased demand for services.

Operating Surplus

The combination of the deterioration in Operating Revenues and the increase in Operating and Financing Expenses has resulted in a year to date Operating Surplus of $75.7 million – which is $57.2 million or 43% less than the budgeted year to date Operating Surplus.

The Government forecasts an Operating Deficit of $173.2 million by the end of 2020 – which is $238.5 million or 365.3% lower than the budgeted Operating Surplus of $65.3 million.

Bank Balances

Due to accumulated surpluses, so far the Government has been able to finance the COVID-19 related costs and stimulus measures from cash reserves.

At the end of June 2020, total closing bank account balances, including fixed deposits, stood at $559.6 million – which is $196.7 million or 54.2 % higher than the year to date Budget.

This major positive variance is attributable to higher opening cash balances for 2020 than budgeted by $86.1 million, lower year to date capital outlays than budgeted by $74.0 million and higher than budgeted year to date operating cash inflows of $37.5 million.

To avoid the depletion of all of our cash reserves and to assist with meeting our financial obligations over the next 2 years, the Government made to decision to seek a loan of CI$500 million or US$609.7 million.

The Ministry of Finance has received one syndicated bid from five local banks to its Request for Proposal.

In compliance with procurement legislation, the Ministry of Finance’s Entity Procurement Committee will evaluate the bid and the external Public Procurement Committee will also assess the bid. By late August or early September, the Government will be able to announce whether the bid, along with the terms of the loan, will be accepted. Therefore, at present, the offered facility has not yet been used by Government.

If the bid is accepted, the Government does not intend to immediately draw down on the entire amount of the loan. The Government intends to only draw down on the loan as and when additional funds are required – which will help with curtailing interest costs.

The Government forecasts that by the end of 2020, Bank Balances will be $188.2 million – which is $431.2 million or 69.6 % lower than budget!

Debt Balances

At 30 June 2020, debt balances stood at the year to date Budget of $266.5 million.

If the $500.0 million loan is approved and a portion of the loan is drawn down, debt balances are forecast to be $273.6 million by the end of 2020 – which is $23.4 million or 9.4 % more than budgeted.

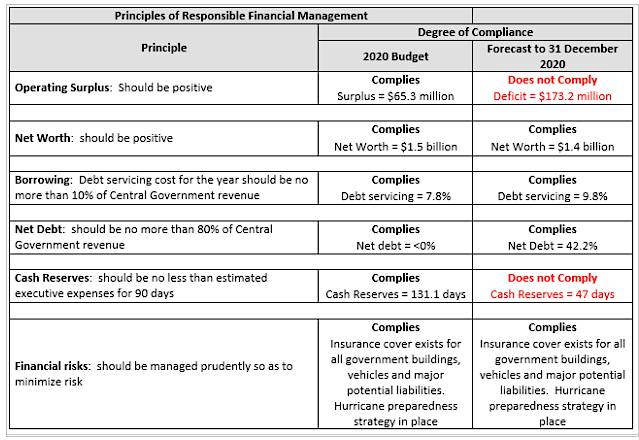

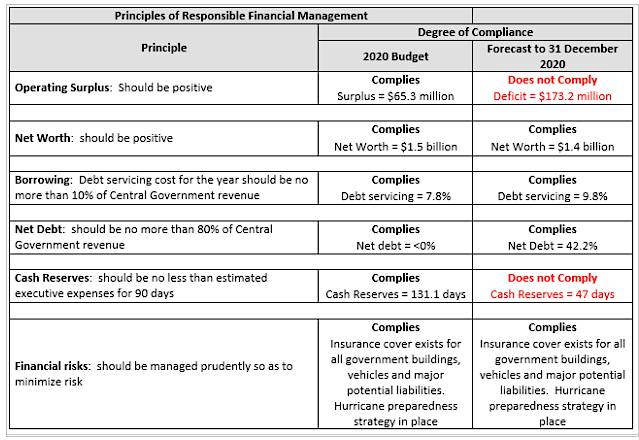

Compliance with Principles of Responsible Financial Management

For the 2020 financial year, the Government will not comply with all of the Principles of Responsible Financial Management (the Principles):

- The Government is forecast to have an Operating Deficit of $173.2 million – the Government is required to maintain an Operating Surplus; and

- the Government will only have 47 days of Cash Reserves to cover Operating Expenditures ‒ which is less than the minimum 90-day legal threshold. The Government believes that, although it will have access to several hundred million dollars of loan funds, it does not make fiscal sense to draw down on the loan and incur interest costs, just to satisfy this Principle.

The Government will be in full compliance with the:

- Net Worth ratio – as net worth is forecast to be positive at $1.4 billion;

- The Government’s Debt Servicing Cost – which includes both interest and principal payments – is forecast to be 9.8 % – which is within the 10% threshold; and

- Net Debt – the ratio between Government’s bank balances and total debt – will be 42.2 % – which is less than the maximum 80% threshold.

As a result of breaching compliance with the Principles, as required by the Public Management and Finance Law, the Government is now required to get written approval from the Foreign and Commonwealth Office before:

- the Strategic Policy Statement is finalised;

- any public borrowing or any refinancing of public borrowing is undertaken;

- proceeding with any project with a lifetime value of more than $10 million;

- using public assets as collateral as part of any arrangement with a party external to the Government;

- the hypothecation of any revenue stream; or

- the divestment of public assets.

My Ministry has had preliminary discussions with the FCO and no specific issues have been raised as a result of this non-compliance.

The maximum amount of time that the Government has to become fully compliant with the Principles is three (3) years. The Ministry of Finance is commencing the exercise of developing a plan for the Government to become fully compliant.

Conclusion

In 2004, we weathered through the vast destruction and devastation of hurricane Ivan. In 2008, we were pummelled by hurricane Paloma and somewhere in the midst of recovery we were again hit by the 2009 global recession and the aftermath which that brought.

Just as we survived those life changing occurrences, we will survive COVID-19.

The early decisions and actions that the Government took to mitigate the potentially deadly impact of the pandemic on the lives, health and well-being of its citizens and residents, were priceless.

Today we can celebrate, with some caution, that the Cayman Islands are COVID-19 free!

Colleagues, amidst the hardest times the strongest bonds are formed, and this crisis has been no different. The resilience and cooperation of businesses and citizens over the past few months has been astounding, our ability to come together and effectively rid these Islands of the COVID 19 virus while others struggle is something to be proud of. I am extremely proud to be a servant of the amazing people of these Islands.

But alas, our efforts must continue lest we undermine the hard work and sacrifice of our past. I am immensely proud of the fiscal strategies implemented and adhered to by this and the previous Administrations that I have had the pleasure to be a part of.

The wisdom of our three pronged fiscal strategy of:

- no new taxes;

- paying down debt; and,

- budgeting for significant surpluses each year, has allowed us to build significant reserves and prepare the country for the inevitable economic downturn that would come. I am the first to acknowledge that we could not anticipate that it would manifest itself in such a violent way! Were it not for this wisdom and foresight, we would be experiencing a world of hurt right now. We stayed the course and kept our promises. With the significant reserves in the treasury, we are, and continue to be, well placed and well prepared to face the fiscal challenges that were wrought upon us by Covid19. Today, I pledge to you that we remain committed to exercising prudent and responsible financial management to improve both the physical and institutional infrastructure necessary to manage the Covid19 crisis and facilitate economic recovery in a sustainable and appropriate manner.

However, despite our efforts and commitment, we cannot rebuild a better Cayman without the collaboration and leadership of the Private Sector. The private sector has always been the catalyst of our economic performance, and overcoming the current crisis will rely heavily on the private sector. I underscored at the last meeting that the collaboration between our Government and the private sector was at the heart of our recent success. In the same breath, I firmly believe that our continued partnership is critical to navigate the current climate and rebuild a better Cayman. I look forward to working even more closely with President Foster, the Chamber Council and the wider business community, as we partner to achieve a better Cayman.

Thank you and maybe next year we will be enjoying ourselves down at the Kimpton again.