Cayman: Consolidated Water Reports Q2 2020 Results- “In Q2, our core water production and distribution and manufacturing operations remained stable and profitable..” – CEO

Revenue up 4% to $19.1 Million, First Half 2020 Revenue up 13% to $39.8 Million

NEWS PROVIDED BYConsolidated Water Co. Ltd.

Aug 14, 2020, 17:30 ET

GEORGE TOWN, Cayman Islands, Aug. 14, 2020 /PRNewswire/ — Consolidated Water Co. Ltd. (Nasdaq Global Select Market: CWCO), a leading developer and operator of advanced water supply and treatment plants, reported results for the three and six months ended June 30, 2020. Quarterly and first-half comparisons are to the year-ago period unless otherwise noted.

Financial Highlights

- Revenue in the second quarter increased 4% to $19.1 million, first half up 13% to $39.8 million.

- Gross profit in the first half increased 8% to $15.7 million.

- Net loss attributable to Consolidated Water stockholders for the second quarter of 2020 was $1.1 million or $(0.07)per basic and fully diluted share, as compared to net income of $2.5 million or $0.16 per basic and fully diluted share in the year-ago quarter. For the first half of 2020, net income attributable to Consolidated Water stockholders was $1.8 million or $0.12 per fully diluted share, down from $8.7 million or $0.57 per fully diluted share in the same year-ago period.

- Cash and cash equivalents totaled $35.0 million as of June 30, 2020.

- Paid $1.3 million in dividends in Q2 2020.

Management Commentary

“In Q2, our core water production and distribution and manufacturing operations remained stable and profitable, although at reduced production levels due to the impact of the COVID-19 pandemic,” commented Consolidated Water CEO, Rick McTaggart. “This allowed our financial condition and liquidity to remain strong, with cash balances totaling$35.0 million at quarter end.

“Our services segment revenue was up by more than $3.3 million due to the contribution from PERC Water, our new majority-owned subsidiary that we acquired in the fourth quarter of last year. PERC has been performing better than we anticipated given the current market conditions created by the pandemic. During the quarter, PERC was awarded two new contracts and secured four contract renewals for operating and maintaining advanced water treatment plants inCalifornia. We expect PERC’s two new O&M contracts to add incremental revenue of $1.7 million in the second half of this year.

“We continue to see attractive opportunities for PERC in a very active market. Its strong growth potential is largely due to its excellent product and service offerings, and strong presence in the Southwestern United States where water supplies are increasingly under stress.

“PERC has been highly complementary to our existing business and overall mission, supporting our pursuit of water reuse projects and other emerging opportunities with a comprehensive suite of solutions for improving water infrastructure. PERC also provides us a solid platform upon which to expand to North America our core business of designing, constructing and operating desalination plants. Given these compelling growth factors, earlier this week we acquired an additional 10% of PERC from another shareholder for $900,000, thereby raising our ownership interest from 51% to 61%.

“Overall, Consolidated Water continues to be well positioned to successfully navigate these uncertain and turbulent times, thanks to a strong balance sheet and well-established growth strategy that brought us PERC and, we anticipate, other successful future acquisitions.

“Although COVID-19 has impacted each of our operating segments to varying degrees, our products and services remain public health and economic imperatives for the communities we serve. Customers still need turn-key and affordable sources of drinking water from our desalination plants, and wastewater still must be treated to the highest standards for environmentally responsible disposal or reuse. We expect the growth drivers inherent in our markets to persist over the long term, which bodes well for Consolidated Water and our efforts to enhance shareholder value over the years to come.”

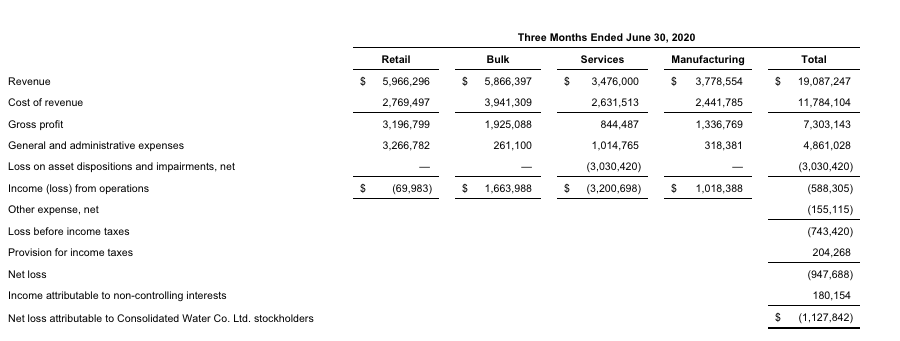

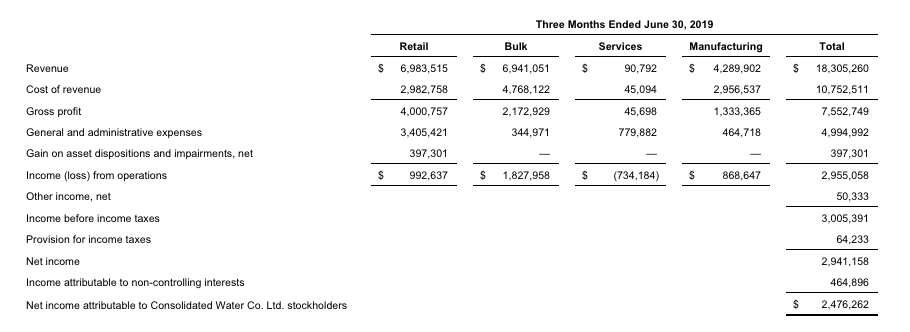

Q2 2020 Financial Summary

Revenue increased 4% to $19.1 million from $18.3 million in the second quarter of 2019, which was driven by an increase of $3.4 million in the services segment. The increase was partially offset by decreases of $1.0 million in the retail segment, $1.1 million in the bulk segment, and $511,000 in the manufacturing segment.

The increase in services revenue was due to the addition of $3.4 million in revenue from PERC as a result of acquiring 51% of this company in late October 2019.

The decrease in retail revenue was due to a 16% decrease in the volume of water sold due to the temporary cessation of tourism on Grand Cayman resulting from the closing of all Cayman Islands airports and seaports in March 2020 in response to the COVID-19 pandemic.

The decrease in bulk water revenue was primarily due to lower energy costs in the Bahamas, which correspondingly decreased the energy pass-through component of the company’s rates. The decrease was also due to a lower rate that came into effect in July 2019 for the North Side Water Works plant under the new contract with the Water-Authority Cayman.

The decrease in manufacturing revenue was due to a decrease in the number of active projects.

Gross profit for the second quarter of 2020 was $7.3 million or 38.3% of total revenue, down 3% from $7.6 million or 41.3% of total revenue in the same year-ago quarter.

Net loss attributable to Consolidated Water stockholders for the second quarter of 2020 was $1.1 million or $(0.07) per basic and fully diluted share, as compared to net income of $2.5 million or $0.16 per basic and fully diluted share in the second quarter of 2019. The decrease was due to a $3.0 million loss on asset dispositions and impairments.

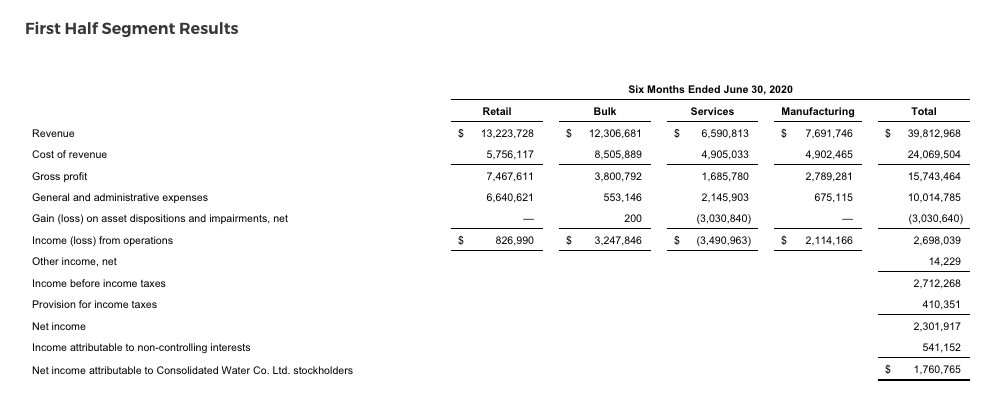

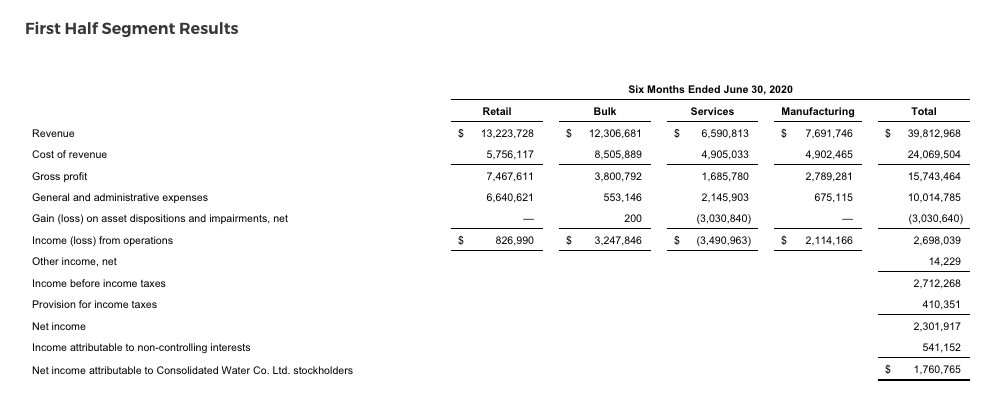

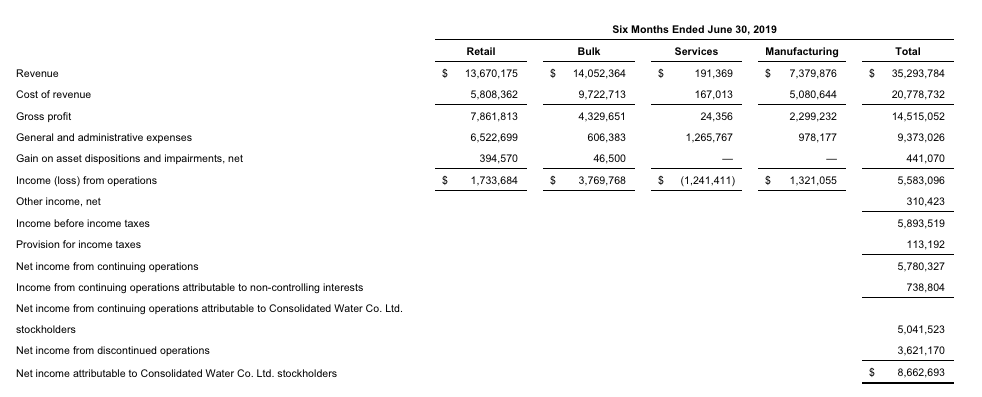

First Half 2020 Financial Summary

Total revenue for the first half of 2020 was $39.8 million, up 13% compared to $35.3 million in the same year-ago period. The increase was primarily driven by an increase of $6.4 million in the services segment, and an increase of $312,000 in the manufacturing segment. The increase in total revenue was partially offset by decreases of $1.7 million in the bulk segment and $446,000 in the retail segment.

The increase in services revenue was due to the addition of $6.4 million in revenue from PERC as a result of acquiring 51% of this company in late October 2019.

Retail revenue decreased due to the volume of water sold, which decreased by 3%. This sales volume decrease is due to the temporary cessation of tourism on Grand Cayman resulting from the closing of Cayman Islands airports and seaports in March 2020 in response to the COVID-19 pandemic.

The decrease in bulk revenue was due to the lower rates that came into effect in February of this year under the new contract with the Water-Authority Cayman for water supplied by the Red Gate and North Sound plants. The decrease was also due to the lower rate that came into effect in July 2019 under the new contract with the Water-Authority Cayman for water supplied by the North Side Water Works plant, as well as due to decreased energy prices that decreased the energy pass-through component of the company’s bulk revenue by $448,000.

The increase in manufacturing revenue was due to an increase in project production activity.

Gross profit for the first half of 2020 was $15.7 million or 39.5% of total revenue, up 8% from $14.5 million or 41.1% of total revenue in the same year-ago period.

Net income attributable to Consolidated Water stockholders for the half of 2020 was $1.8 million or $0.12 per fully diluted share, down from $8.7 million or $0.57 per fully diluted share in the same year-ago period.

Second Quarter Segment Results

Annual General Meeting of Shareholders

The company has rescheduled its 2020 annual meeting of shareholders for November 18, 2020 to be held at a time and location yet to be determined. Shareholders of record as of September 15, 2020 will be entitled to vote at the meeting.

Conference Call

Consolidated Water management will host a conference call to discuss these results, followed by a question and answer period.

Date: Monday, August 17, 2020

Time: 11:00 a.m. Eastern time (8:00 a.m. Pacific time)

Toll-free dial-in number: 1-844-875-6913

International dial-in number: 1-412-317-6709

Conference ID: 10147145

Please call the conference telephone number five minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact CMA at 1-949-432-7566.

A replay of the call will be available after 1:00 p.m. Eastern time on the same day through August 24, 2020, as well as available for replay via the Investors section of the Consolidated Water website at www.cwco.com.

Toll-free replay number: 1-877-344-7529

International replay number: 1-412-317-0088

Replay ID: 10147145

About Consolidated Water Co. Ltd.

Consolidated Water Co. Ltd. develops and operates advanced water supply and treatment plants and water distribution systems. The company operates water production facilities in the Cayman Islands, The Bahamas and the British Virgin Islands and operates water treatment facilities in the United States. The company also manufactures and services a wide range of products and provides design, engineering, management, operating and other services applicable to commercial and municipal water production, supply and treatment, and industrial water and wastewater treatment. For more information, visit www.cwco.com.

Cautionary Note Regarding Forward-Looking Statements

This press release includes statements that may constitute “forward-looking” statements, usually containing the words “believe”, “estimate”, “project”, “intend”, “expect”, “should”, “will” or similar expressions. These statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements inherently involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. Factors that would cause or contribute to such differences include, but are not limited to (i) continued acceptance of the company’s products and services in the marketplace; (ii) changes in its relationships with the governments of the jurisdictions in which it operates; (iii) the outcome of its negotiations with the Cayman government regarding a new retail license agreement; (iv) the future financial performance of its subsidiary that manufactures water treatment-related systems and products and provides design, engineering, management, operating and other services applicable to commercial, municipal and industrial water production; (v) the collection of its delinquent accounts receivable in the Bahamas; (vi) its ability to integrate and profitably operate recently acquired subsidiary PERC Water Corporation; (vii) the possible adverse impact of the COVID-19 virus on the company’s business; and (viii) various other risks, as detailed in the company’s periodic report filings with the Securities and Exchange Commission (“SEC”). For more information about risks and uncertainties associated with the company’s business, please refer to the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” sections of the company’s SEC filings, including, but not limited to, its annual report on Form 10-K and quarterly reports on Form 10-Q, copies of which may be obtained by contacting the company’s Secretary at the company’s executive offices or at the “Investors – SEC Filings” page of the company’s website at http://ir.cwco.com/docs/. Except as otherwise required by law, the company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Company Contact:

David W. Sasnett

Executive Vice President and CFO

Tel (954) 509-8200

[email protected]

Investor Relations Contact:

Ron Both or Grant Stude

CMA Investor Relations

Tel (949) 432-7566

[email protected]

To view CONSOLIDATED WATER CO. LTD. CONDENSED CONSOLIDATED BALANCE SHEETS Go to PRNEWSWIRE