Butterfield Reports First Quarter 2022 Results

Financial highlights for the first quarter of 2022:

- Net income of $44.4 million, or $0.89 per share, and core net income1 of $44.7 million, or $0.90 per share

- Return on average common equity of 19.7% and core return on average tangible common equity1 of 21.9%

- Net interest margin of 2.03%, cost of deposits of 0.12%

- Board declares dividend for the quarter ended March 31, 2022 of $0.44 per share

Hamilton, Bermuda – May 2, 2022: The Bank of N.T. Butterfield & Son Limited (“Butterfield” or the “Bank”) (BSX: NTB.BH; NYSE: NTB) today announced financial results for the first quarter ended March 31, 2022.

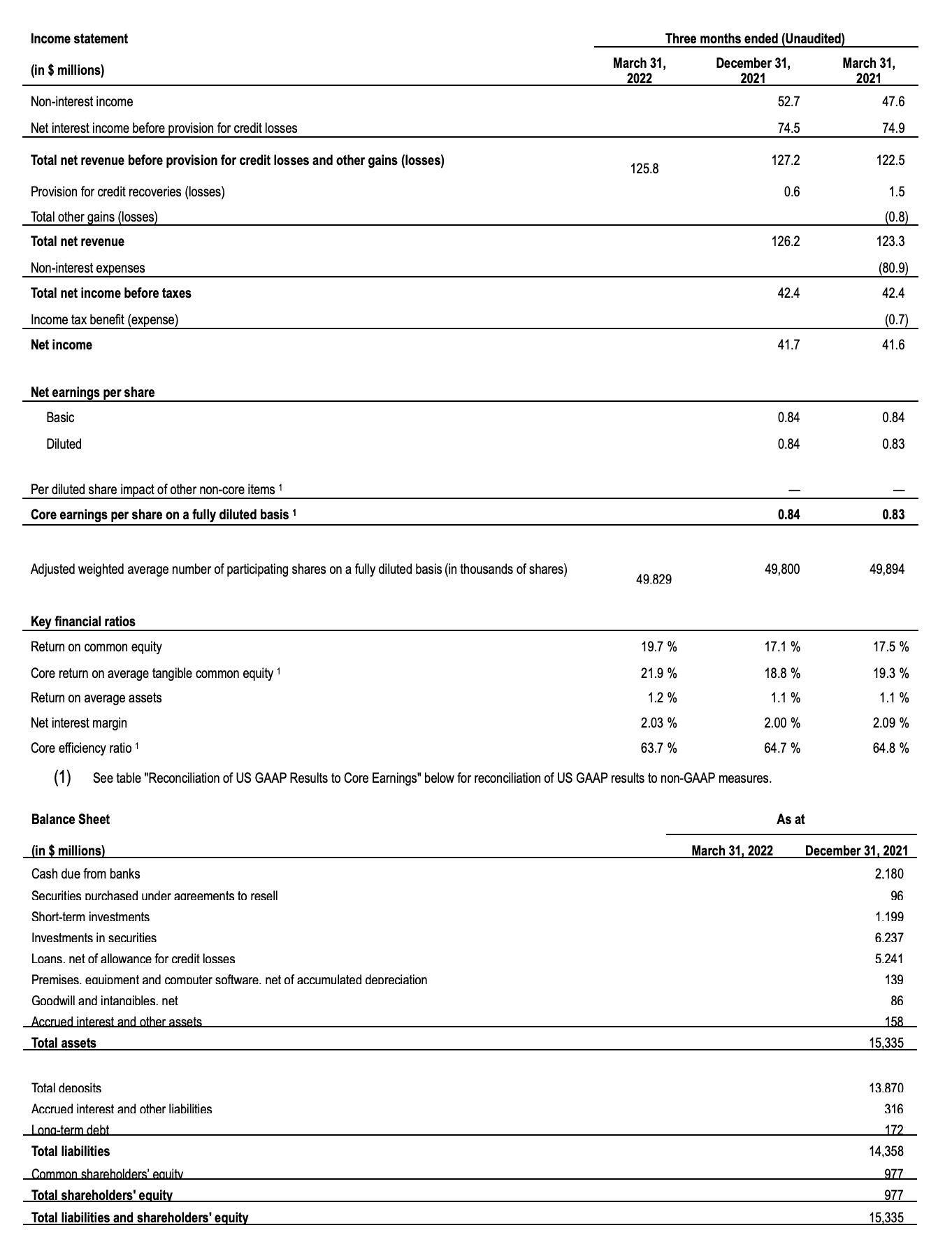

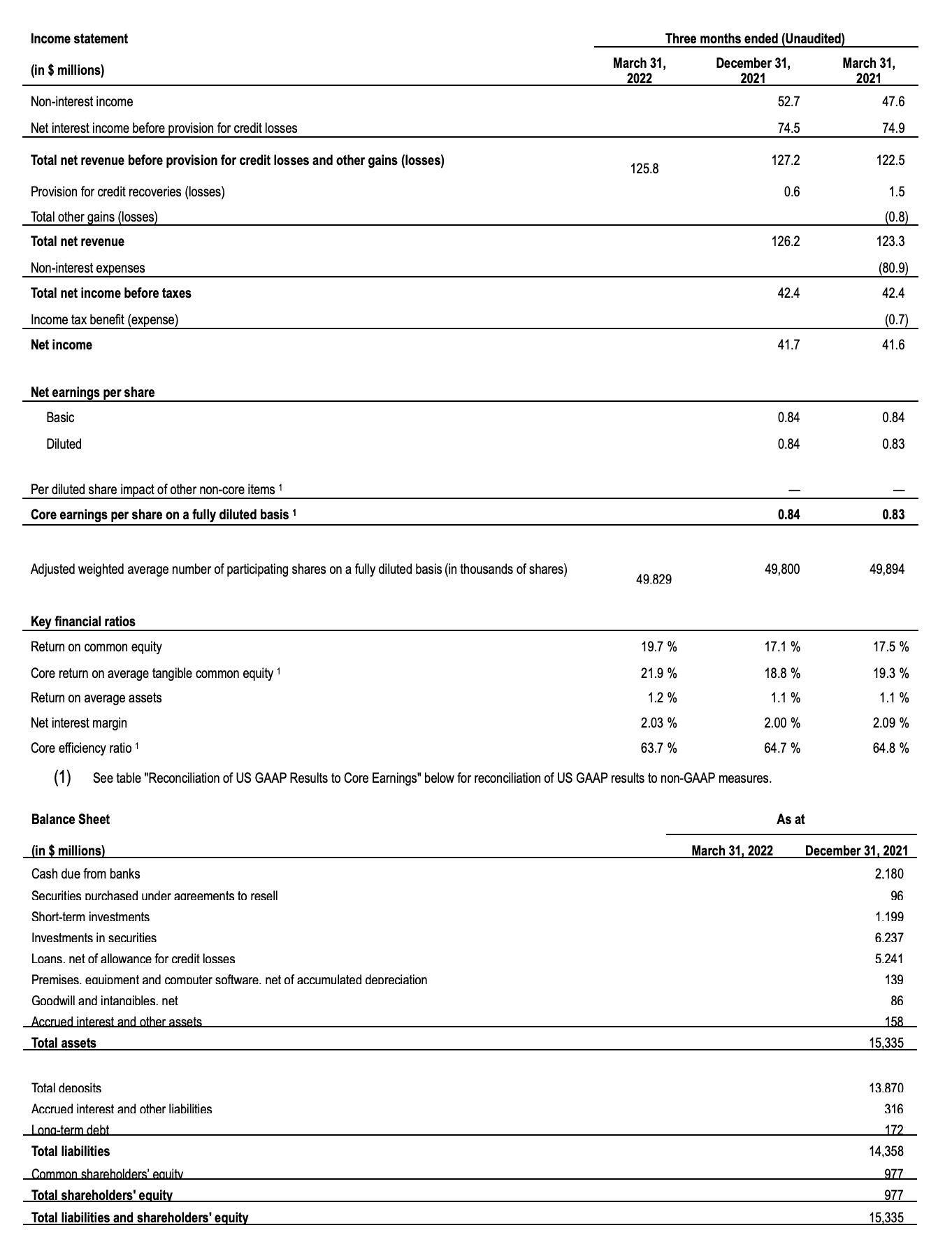

Net income for the first quarter of 2022 was $44.4 million or $0.89 per diluted common share compared to net income of $41.7 million, or $0.84 per diluted common share, for the previous quarter and $41.6 million, or $0.83 per diluted common share, for the first quarter of 2021. Core net income1 for the first quarter of 2022 was $44.7 million, or $0.90 per diluted common share, compared to $41.7 million, or $0.84 per diluted common share, for the previous quarter and $41.6 million, or $0.83 per diluted common share, for the first quarter of 2021.

The core return on average tangible common equity1 for the first quarter of 2022 was 21.9%, compared to 18.8% for the previous quarter and 19.3% for the first quarter of 2021. The core efficiency ratio1 for the first quarter of 2022 was 63.7% compared with 64.7% in the previous quarter and 64.8% for the first quarter of 2021.

Michael Collins, Butterfield’s Chairman and Chief Executive Officer, commented, “The first quarter of 2022 was an excellent start to the year. Our asset sensitive balance sheet has already benefited from the initial increases in interest rates, with improved net interest income and NIM. We expect market interest rates to continue to provide upward momentum to earnings during 2022. Additionally, we are seeing signs of improving economic activity across our operating jurisdictions, including growing visitor numbers, the return of cruise ships and increasing airlift to Bermuda and Cayman. While not yet back to pre-pandemic levels, we are very pleased to see progress for the tourism industry. Capital management continues to be an important focus for Butterfield, including a sustainable quarterly dividend, support for organic growth and potential acquisitions and the flexibility to repurchase shares when appropriate. Butterfield remains well positioned to benefit from the anticipated rising interest rate environment, whilst generating significant non-interest income and managing expenses.”

Net interest income (“NII”) for the first quarter of 2022 was $75.9 million, an increase of $1.4 million, compared with NII of $74.5 million in the previous quarter and up $1.0 million from $74.9 million in the first quarter of 2021. NII was higher during the first quarter of 2022 compared to the prior quarter primarily due to lower prepayment rates in the investment portfolio, which decreased the periodic amortization charge on US agency mortgage securities. In addition, rates improved on short term cash and treasury assets. Compared to the first quarter of 2021, NII was higher due to the increased deployment of cash into the investment portfolio, offsetting lower book yields.

Net interest margin (“NIM”) for the first quarter of 2022 was 2.03%, an increase of 3 basis points from 2.00% in the previous quarter and down 6 basis points from 2.09% in the first quarter of 2021. NIM in the first quarter of 2022 was higher than the prior quarter primarily due to increased rates on shorter-term assets. Compared to the first quarter of 2021, NIM was down due to lower overall asset yields, while deposit costs remained flat.

Non-interest income for the first quarter of 2022 of $49.9 million was $2.8 million lower than the $52.7 million earned in the previous quarter and $2.3 million higher than $47.6 million in the first quarter of 2021. Non-interest income during the first quarter of 2022 decreased compared to the prior quarter primarily due to lower banking and trust fees, partially offset by increased foreign exchange revenue. The fourth quarter of 2021 benefited from seasonally higher fees due to increased debit and credit card activity and higher activity-based fees and new business in the trust business. Non-interest income was up in the first quarter of 2022 compared to the first quarter of 2021 due to increased banking and foreign exchange revenues.

There was a net credit reserve release of $0.7 million for the first quarter of 2022, compared to a net credit release in the previous quarter of $0.6 million and $1.5 million during the first quarter of 2021. The credit releases were driven by a decrease in non-accrual loans, paydowns in the portfolio and general improvement in economic assumptions.

Non-interest expenses were $82.0 million in the first quarter of 2022, compared to $83.8 million in the previous quarter and $80.9 million in the first quarter of 2021. Core non-interest expenses1 decreased to $81.6 million in the first quarter of 2022, compared to $83.7 million the previous quarter and higher than the $80.9 million incurred in the first quarter of 2021. Non-interest expenses were lower in the first quarter of 2022 versus the fourth quarter of 2021 primarily due to the completion of the 10-year amortization period for Butterfield’s legacy banking system in the fourth quarter of 2021 resulting in lower technology costs. Compared to the first quarter of 2021, non-interest expense was higher due to other small movements.

Period end deposit balances remained constant at $13.9 billion compared to December 31, 2021. Deposits continued to remain elevated across all jurisdictions.

The Bank maintained its balanced capital return policy. The Board again declared a quarterly dividend of $0.44 per common share to be paid on May 31, 2022 to shareholders of record on May 16, 2022. During the first quarter of 2022, Butterfield repurchased 0.1 million common shares under the Bank’s share repurchase plan authorizations.

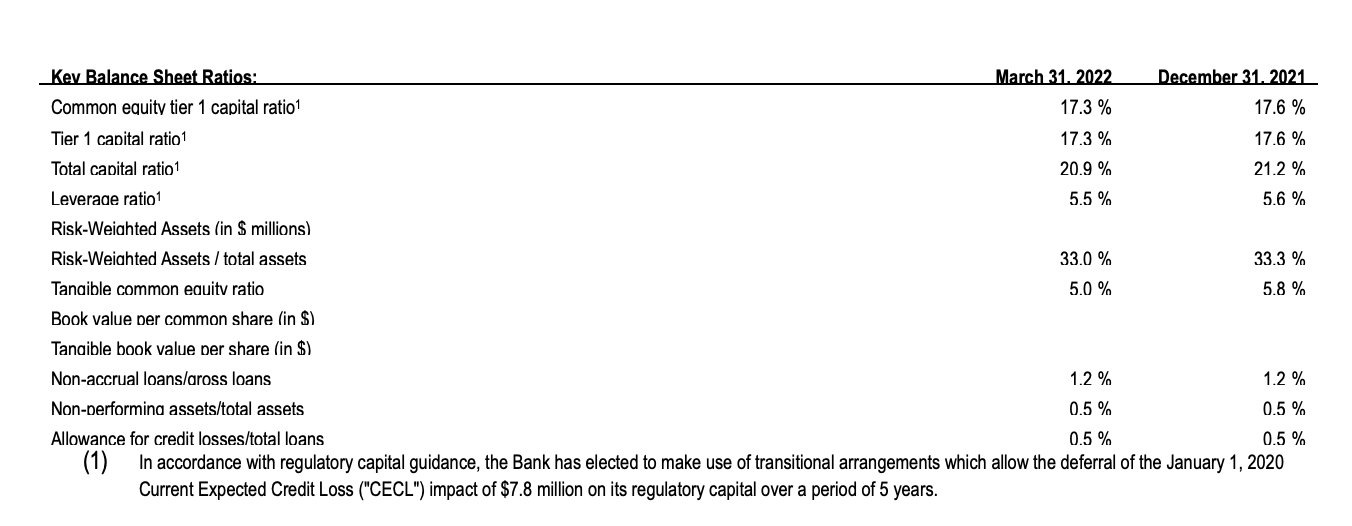

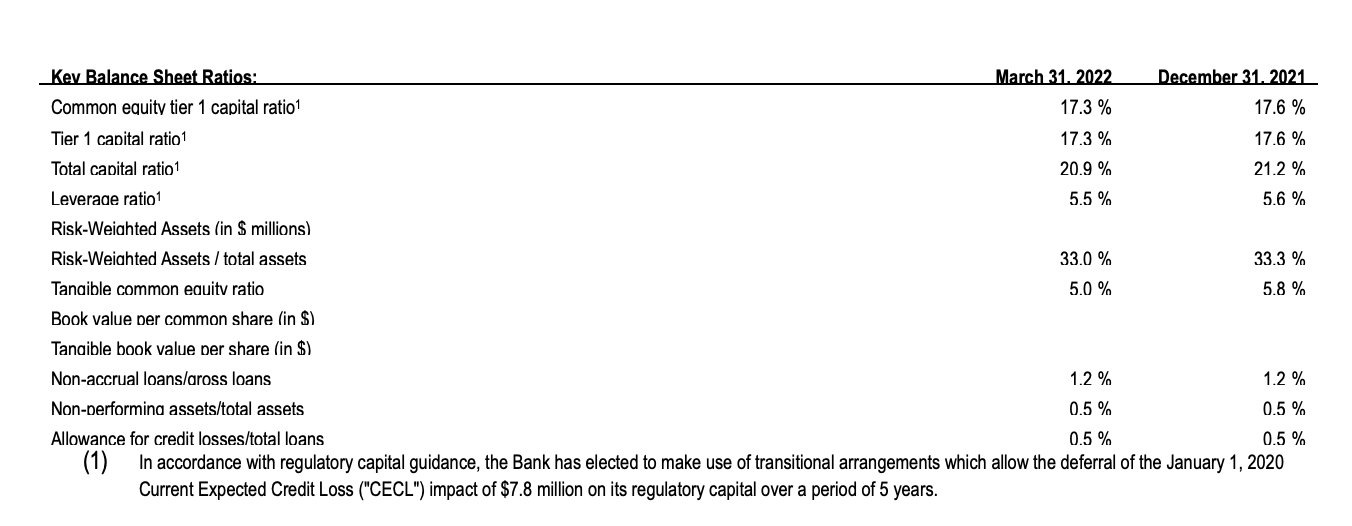

The current total regulatory capital ratio as at March 31, 2022 was 20.9% as calculated under Basel III, compared to 21.2% as at December 31, 2021. Both of these ratios remain significantly above the minimum Basel III regulatory requirements applicable to the Bank.

(1) See table “Reconciliation of US GAAP Results to Core Earnings” below for reconciliation of US GAAP results to non-GAAP measures.

ANALYSIS AND DISCUSSION OF FIRST QUARTER RESULTS

QUARTER ENDED MARCH 31, 2022 COMPARED WITH THE QUARTER ENDED DECEMBER 31, 2021

Net Income

Net income for the quarter ended March 31, 2022 was $44.4 million, up $2.7 million from $41.7 million in the prior quarter.

The $2.7 million increase in net income in the quarter ended March 31, 2022 compared to the previous quarter was due principally to the following:

- $2.8 million decrease in non-interest income due to lower banking fees driven by last quarter’s seasonally higher consumer spending supporting interchange revenue and higher trust income driven by both new business and higher activity-based fees. This was partially offset by higher foreign exchange revenue driven by increased volumes;

- $1.4 million increase in net interest income before provision for credit losses, driven by higher income from investments due to an increase in market interest rates and slower prepayment speeds;

- $2.4 million increase in total other gains due to losses related to defined benefit settlement accounting in the Channel Islands and UK segment recorded in the previous quarter that did not re-occur; and

- $1.6 million decrease in technology and communications cost due to the depreciation charges on the existing core banking system in the prior quarter continuing to outpace costs associated with the new technology projects.

Non-Core Items1

Non-core items resulted in a net expense of $0.3 million in the first quarter of 2022. Non-core items for the period relate to residual professional fees incurred in relation to the resolved US Department of Justice inquiry and the settlement of a non-US corporate income tax inquiry in connection with the commercial affairs of a legacy custody client.

Management does not believe that comparative period expenses, gains or losses identified as non-core are indicative of the results of operations of the Bank in the ordinary course of business.

- See table “Reconciliation of US GAAP Results to Core Earnings” below for reconciliation of US GAAP results to non-GAAP measures.

BALANCE SHEET COMMENTARY AT MARCH 31, 2022 COMPARED WITH DECEMBER 31, 2021

Total Assets

Total assets of the Bank were $15.3 billion at March 31, 2022, which was comparatively flat against December 31, 2021 balances. The Bank maintained a highly liquid position at March 31, 2022, with its $9.8 billion of cash and demand deposits with banks, reverse repurchase agreements and liquid investments representing 64.3% of total assets, compared with 63.3% at December 31, 2021.

Loans Receivable

The loan portfolio totaled $5.1 billion at March 31, 2022, which was $172.8 million lower than December 31, 2021 balances. The decrease was driven by the Channel Islands and UK segment as a result of facility repayments and a decrease in the GBP/USD FX rate.

Allowance for credit losses at March 31, 2022 totaled $26.6 million, a decrease of $1.4 million from $28.1 million at December 31, 2021. The movement was driven by a decrease in non-accrual loans, net paydowns in the portfolio and the positive economic environment.

The loan portfolio represented 33.2% of total assets at March 31, 2022 (December 31, 2021: 34.2%), while loans as a percentage of total deposits decreased to 36.4% at March 31, 2022 from 37.8% at December 31, 2021. The decrease in both ratios were attributable principally to a decrease in loan balances at March 31, 2022 as noted above.

As of March 31, 2022, the Bank had gross non-accrual loans of $58.7 million, representing 1.2% of total gross loans, a decrease of $2.3 million from $61.0 million, or 1.2% of total loans, at December 31, 2021. The decrease in non-accrual loans was driven by a number of Bermuda residential mortgages improving to current status.

Other real estate owned (“OREO”) decreased by $0.4 million from December 31, 2021 to $0.3 million due to the sale of a residential property in Bermuda during the quarter.

Investment in Securities

The investment portfolio was $6.1 billion at March 31, 2022, down $0.1 billion from $6.2 billion at December 31, 2021. The movement was driven by the increase in total net unrealized losses on the available-for-sale portfolio that is carried at fair value.

The investment portfolio is made up of high quality assets with 100% invested in A-or-better-rated securities. The investment book yield increased to 1.79% during the quarter ended March 31, 2022 from 1.65% during the previous quarter. Total net unrealized losses on the available-for-sale portfolio increased to $133.5 million, compared with total net unrealized losses of $21.8 million at December 31, 2021, as a result of rising long-term US dollar interest rates. No credit losses have been noted as at March 31, 2022.

Deposits

Average deposits were $14.1 billion for the quarter ended March 31, 2022, an increase of $0.4 billion compared to the previous quarter.