Real-Time Video Identification – Practical approach to combat payment fraud

Real-Time Video Identification – Practical Approach

to Combat Payment Fraud

Since the advent of digitization, customer behavior patterns are permanently changed. They are demanding more convenience and touchless financial services. While payment service providers are making effort to meet client requirements, they are unwillingly attracting more criminal threats. Fraudsters see digital transactions as their ticket to conceal illicit funds and steer clear of legal scrutiny.

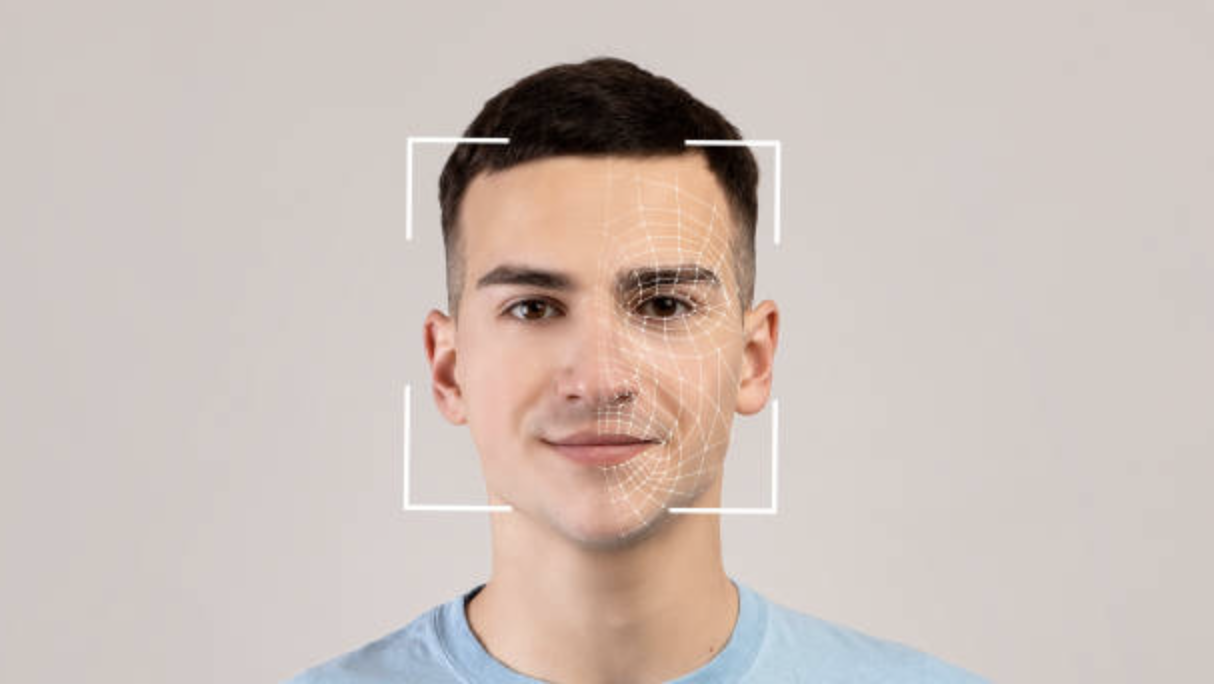

Keeping in view the increase in emerging fraud trends, the payment industry is investing more in integrating automated identity verification solutions in their customer onboarding process. With real-time video identification, financial service providers can validate the presence of customers while making a transaction. These AI-powered IDV solutions are a replacement for manual customer verification methods. This article outlines reasons why the payment industry needs video KYC services.

The Need for Implementing Video Verification Services

The payment industry is shifting to the online realm to facilitate customers with digital financial services. 86% of the customers are willing to pay additional charges for a better and improved experience. Therefore, payment service providers should also invest more in incorporating real-time video identification solutions. These IDV tools are cost-effective, consume less time, and provide touchless financial operations.

Digital payment service providers are implementing automated customer verification solutions to streamline digital onboarding while staying put with legal KYC standards. Financial institutions are supported by AI-powered real-time video identification services to enhance user experience. While fraudsters are equipped with advanced forgery tools such as Photoshop, preparing synthetic identities has become an easy task. By using tampered documents, they easily steer clear of simple customer verification procedures.

In order to restrict criminals from maliciously using digital financial services, payment providers require more efficient video identification solutions. While documents are easy to forge, fraudsters can not create fake facial features, voices, iris/retina structures, vein patterns, and surroundings. AI-powered real-time video identification tools use biometrics to analyze biological as well as behavioral traits which further enhances accuracy.

Customer Privacy and Data Security is the Prime Concern

Account takeover fraud is taking manifolds as criminals deploy various strategies including identity theft, phishing, and others. As of 2021, it resulted in a loss of 90% totaling to be $11.4 billion. Among other threats, payment service providers are experiencing an increase in customer privacy breaches. Criminals perform data breaches, phishing, spoofing, and deepfake attempts to hack financial accounts. Later on, they use the profiles to perform illicit activities. Money laundering, terrorist funding, corruption, and stealing money are to name a few.

Customers develop a sense of loyalty and trust after ensuring the company is risk-free. Security measures such as real-time video identification accelerate confidence between clients and payment service providers. Furthermore, keeping privacy and cybersecurity intact is the topmost priority for financial institutions. Otherwise, they will not only face legal proceedings but also fall prey to criminals’ intentions. AI-powered video verification of identity however restricts fraudsters without payment service providers having to compromise their integrity.

Benefits of Video Identity Verification Services

The ease of shopping from their favorite e-commerce platform, reducing the hassle of transferring funds across different banks, and accessing touchless financial services are reshaping the customer experience. Simultaneously, safeguarding customers from external breaches has become a foremost responsibility. Hence, payment service providers require more efficient video identification solutions.

Real-time video identification is an improved form of digital KYC which enables payment service providers to ensure secure customer onboarding. Furthermore, the use of AI-powered IDV tools and biometrics leaves less room for criminals. Further benefits of real-time video identification include the following:

Fast Expansion of Remote Financial Services

The reign of remote financial services is leading to the extinction of geographical barriers in terms of fund transfers. For customers, accessing payment service providers from any corner of the world without having to leave their homes is driving more convenience. Hence, by incorporating real-time video identification, financial institutions are accelerating the expansion of their services to global customers.

Storing and Safeguarding Updated Records

Video verification services are eliminating the need for using PINs, documents, and passwords. Customers can simply use their facial features to authenticate transactions. Furhtmeroe, by using AI-powered real-time video identification tools, payment service providers can restrict unauthorized and prevent account takeover fraud. Similarly, they can also store and safeguard digital financial records. With ongoing automated monitoring, payment service providers can keep their databases updated.

Operational Cost Reduction

For payment service providers, saving additional operational costs is a plus point. They can utilize the resources somewhere more productively. Furhtmeroe, video identity verification accelerates secure customer onboarding reducing the time taken for customer identification. AI-powered IDV procedures do not involve the use of a workforce as the technologically advanced tools handle client authentication themselves.

Conclusion

Real-time video identification is emerging as a substitute for long-existing KYC methods. Payment service providers can automate their customer onboarding by providing them with self-service and user-friendly options. Furthermore, real-time video identification solutions are easy to integrate, cost-effective, reliable, and provide accurate results. Hence, payment service providers can detect and deter criminal threats before they cause any harm.