Measures to ensure good governance for Cayman Island Funds

NEW YORK, NY / ACCESSWIRE / April 15, 2019 / The Cayman Islands has established itself as the domicile of choice for offshore hedge funds. Around 85% of the world’s hedge funds are domiciled in the Cayman Islands, enabling the jurisdiction to outrank competing offshore centers (BVI, Bermuda and Jersey among them) as the top spot for hedge funds.

Generally, all open-ended funds established in Cayman will need to be registered with the Cayman Islands Monetary Authority (CIMA). A fund will be deemed open-ended if it issues ‘equity interests’ (shares, partnership interests or units) that participate in the fund’s profits and gains, and which are redeemable (or otherwise capable of being repurchased) at the investor’s option.

Directors of CIMA registered fund companies are required to be CIMA registered or licensed, depending on the status of the director in each case. CIMA has released a Statement of Guidance which establishes key principles of good governance which must be observed by each Cayman Islands regulated mutual fund. Such principles require, inter alia, the board of directors to properly oversee the activities of the fund’s service-providers, suitably identify, disclose and manage all conflicts of interest and meet at least twice a year.

The Proceeds of Crime Law (Revised) requires that CIMA registered funds have a “nominated officer” in place for the purpose of receiving reports relating to criminal conduct, with the Regulations creating the roles of the Money Laundering Reporting Officer (MLRO), Deputy Money Laundering Officer (DMLRO) and AML Compliance Officer (AMLCO).

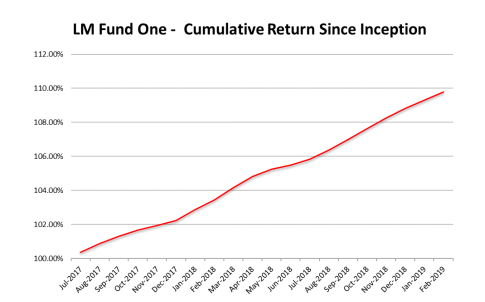

Despite the requirements described above, there are still ample opportunities for malfeasance by fund managers. As such, most Cayman Islands funds including LM Fund One Ltd. retain an independent administrator to conduct fund administration duties such as the periodic calculation of net asset value and providing a second signatory for all cash transfers.

In addition, LM Fund One Ltd. has also purchased crime insurance. Crime policy written for a hedge fund is usually written on a Financial Institution Bond policy form. This type of policy covers the loss of money, securities and other property due to employee dishonesty and certain dishonest acts committed by third parties.

In conclusion, good fund governance requires a system of checks and balances. There has been research which suggests that more hedge fund failures occur due to operational risk failings rather than bad investment decisions. A good fund should have independent and reputable service providers servicing the fund.

SOURCE: CIMA