Cayman: Credit Union Deepens Commitment to Youth Financial Literacy

Credit Union Deepens Commitment to Youth Financial Literacy

As part of its growing efforts to empower the next generation, the CICSA Co-operative Credit Union (the Credit Union) has expanded its focus on youth financial literacy. Aligned with two of the Seven International Principles that guide credit unions globally — Financial Literacy and Concern for Community — these initiatives aim to build money confidence and support smart financial decision-making from an early age.

The Credit Union recently re-launched their website, which now includes a comprehensive online resource centre aimed at guiding young people through each stage of their financial journey. From budgeting basics, to writing a business plan or preparing for homeownership, the platform provides age-specific guidance that’s both accessible and practical.

A soon-to-be-released children’s book, From Humble Beginnings, will further the mission by introducing young readers to the inspiring origin story of the Credit Union’s seven founding members. Rooted in values of cooperation and community, the story underscores early lessons in shared success and Cayman’s history.

Additionally, the Credit Union is actively working to bring its financial literacy tools into primary school classrooms across the Cayman Islands. A pilot of the programme was launched in May with Year 6 students at East End Primary, supporting teachers and families with age-appropriate resources designed to build foundational money skills from an early age.

“At the Credit Union, we believe financial literacy is about more than numbers — it’s about creating opportunity, building confidence, and preparing young people to make empowered choices,” said Patricia Estwick, CEO. “By starting early and supporting learning at every stage, we’re investing in a stronger future for our members and for Cayman.”

Youth Workshop Empowers Nearly 100 Teensancial Literacy

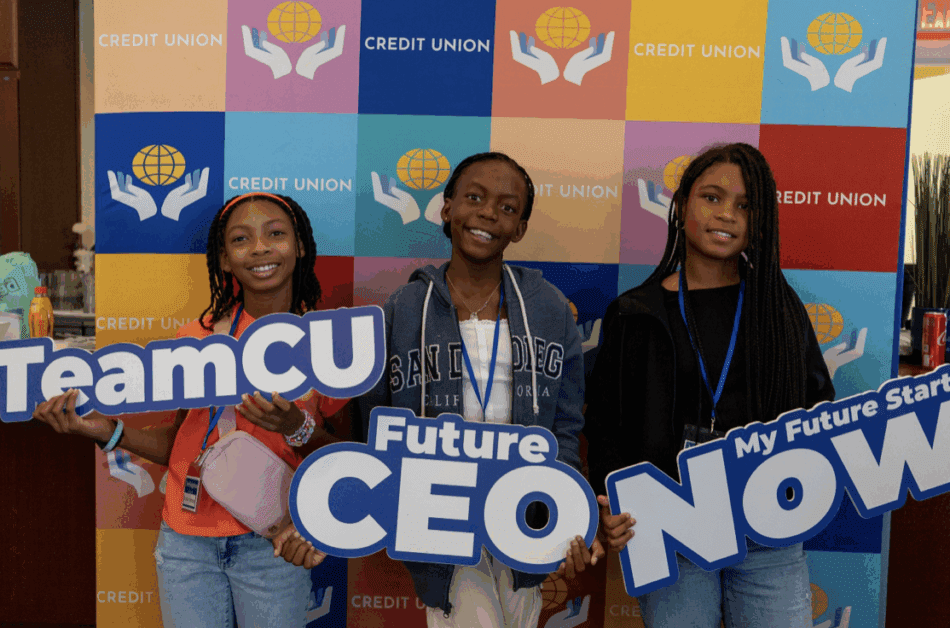

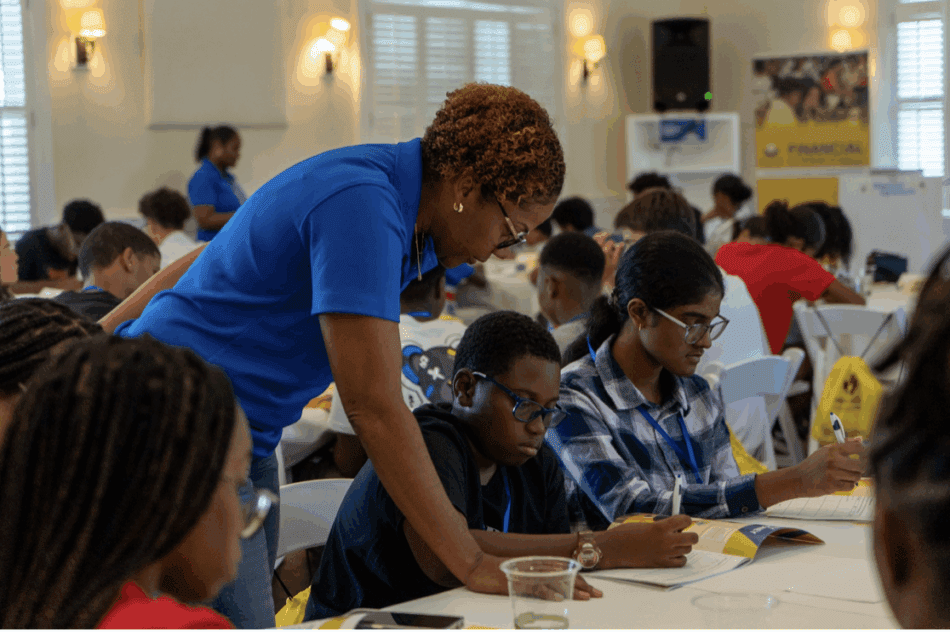

One highlight of the Credit Union’s youth outreaches this summer was its second annual Youth Financial Literacy Workshop, held on 9–10 July 2025 at the George Town Yacht Club.

Nearly 100 students between the ages of 11 and 19 took part in two dynamic days of hands-on learning, real-world scenarios, and open discussion. The programme featured content tailored to two age groups — with younger students (11–15) focusing on foundational topics like saving, budgeting, and interest, while older students (16–19) explored more advanced concepts such as credit, debt, and financial independence.

Sessions were facilitated by Credit Union staff along with guest speakers from the Cayman Islands Monetary Authority (CIMA), CFA Society Cayman, and Radix Financial Cayman, who brought valuable insights from their respective industries. Students wrapped up each day with team presentations, sharing key takeaways and strategies they would pass on to their peers.

A Collective Effort Toward a Resilient Future

As the Credit Union journeys on its Road to 50 years of service, these youth-focused efforts reflect a deepened commitment to financial education and community development.

The Credit Union extends heartfelt thanks to this year’s workshop sponsors — Water Authority Cayman, CFA Society Cayman Islands, Caribbean Utilities Company (CUC), and Cayman Airways — for their generous support in making the event a success.