Fresh Del Monte Produce Inc. Reports Fourth Quarter and Full Fiscal Year 2025 Financial Results

02/18/2026 07:00

Fresh Del Monte Produce Inc. (NYSE: FDP) (“Fresh Del Monte” or the “Company”) today reported financial results for the fourth quarter and full fiscal year ended December 26, 2025. For the fourth quarter of 2025, the Company reported earnings per diluted share of $0.67 or on an Adjusted basis, earnings per diluted share(1) of $0.70. For the full fiscal year 2025, the Company reported earnings per diluted share of $1.88, or on an Adjusted basis, earnings per diluted share(1) of $3.68.

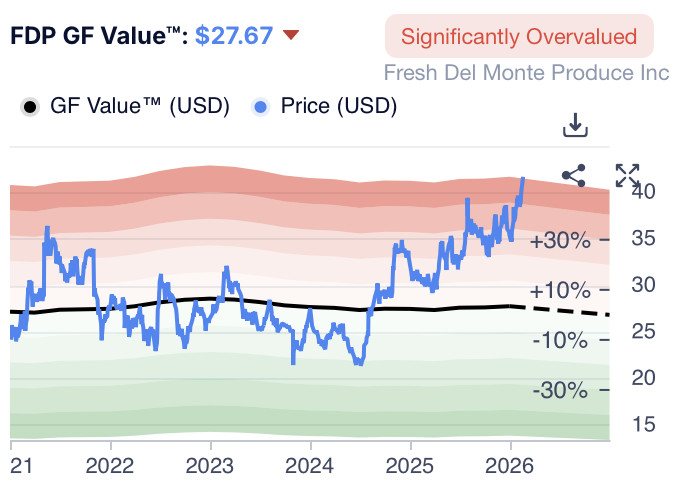

FDP GF Value™: $27.67

Significantly Overvalued

Fresh Del Monte Produce Inc

“Fiscal 2025 reflected solid execution across the business, supported by pricing discipline, continued demand for our core categories, and a strong focus on cash flow,” said Mohammad Abu-Ghazaleh, Fresh Del Monte’s Chairman and Chief Executive Officer. “We closed the year with improved financial flexibility, reduced debt, and continued investment in our operations to support long-term performance. As we move into 2026, we remain focused on disciplined decision-making and thoughtful capital allocation as we evaluate opportunities ahead.”

Financial highlights for the fourth quarter of 2025:

The Company announced its intent to divest its Mann Packing Inc. business operations (“Mann Packing”) in the third quarter of 2025 and completed the transaction during the fourth quarter of 2025. Accordingly, the following financial highlights also include adjusted basis results to reflect the impact of the divestiture.

Net sales for the fourth quarter of 2025 were $1,019.5 million. The increase was primarily driven by higher net sales in the Company’s other products and services and banana business segments, reflecting increased activity in third-party ocean freight services and higher per-unit banana selling prices. Contributing factors included the effects of tariff-related price adjustments in North America and the favorable impact of fluctuations in exchange rates, primarily related to the Euro. The increase was partially offset by lower net sales in the Company’s fresh and value-added products business segment, largely due to reduced sales volume in the fresh-cut vegetable product line following strategic operational actions taken in 2024, including the sale of certain assets of Fresh Leaf Farms. On an Adjusted basis, net sales(1) for the fourth quarter of 2025 were $968.2 million.

Gross profit for the fourth quarter of 2025 was $106.0 million. The increase was driven by higher gross profit in all of the Company’s business segments, primarily reflecting higher per-unit selling prices, partially offset by higher overall per-unit distribution costs and increased production and procurement costs in the Company’s banana business segment. Gross margin increased to 10.4%. Adjusted gross profit(1) for the fourth quarter of 2025 was $109.2 million. Adjusted gross margin increased to 11.3%.

Operating income for the fourth quarter of 2025 was $46.0 million. The increase was primarily driven by higher gross profit, partially offset by a lower gain on the sale of property, plant and equipment, net, reflecting the prior-year sale of the Company’s Toronto distribution center. Adjusted operating income(1) for the fourth quarter of 2025 was $47.6 million.

FDP net income(2) for the fourth quarter of 2025 was $31.9 million. Adjusted FDP net income(1) was $33.2 million.

Financial highlights for the full fiscal year 2025:

For full fiscal year 2025, net sales were $4,322.3 million. The increase was driven by higher net sales across all of the Company’s business segments, primarily due to higher per-unit selling prices in the fresh and value-added products and banana business segments, including the effects of tariff-related price adjustments in North America and the favorable impact of fluctuations in exchange rates, primarily related to the Euro and British pound. The increase was partially offset by lower sales volume in the fresh-cut vegetable product line following strategic operational actions taken in 2024, including the sale of certain assets of Fresh Leaf Farms. On an Adjusted basis, net sales(1) for the full fiscal year 2025 were $4,097.5 million.

For full fiscal year 2025, gross profit was $399.1 million. The increase was driven by higher net sales in the Company’s fresh and value-added products business segment. The increase was partially offset by higher per-unit production and procurement costs in the Company’s banana business segment and increased distribution costs. Gross margin increased to 9.2%. Adjusted gross profit(1) for the full fiscal year 2025 was $426.8 million. Adjusted gross margin increased to 10.4%.

For the full fiscal year 2025, operating income was $137.4 million. The decrease was primarily due to higher asset impairment charges, net, related to low-productivity banana farms in the Philippines, as well as charges associated with the divestiture of Mann Packing, and a lower gain on disposal of property, plant and equipment, net. The decrease was partially offset by higher gross profit. Adjusted operating income(1) for the full fiscal year 2025 was $221.9 million.

For the full fiscal year 2025, FDP net income was $90.7 million. Adjusted FDP net incomewas $177.7 million.

Fourth Quarter and Full Fiscal Year 2025 Business Segment Performance and Selected Financial Data

(As reported in business segment data)

| Fresh Del Monte Produce Inc. and Subsidiaries | |||||||||||||||||||||||||||||

| Business Segment Data | |||||||||||||||||||||||||||||

| (U.S. dollars in millions, except for Gross Margin) – (Unaudited) | |||||||||||||||||||||||||||||

| Quarters ended | |||||||||||||||||||||||||||||

| Segment Data: | December 26, 2025 | December 27, 2024 | |||||||||||||||||||||||||||

| Net Sales | Gross Profit | Gross Margin | Net Sales | Gross Profit | Gross Margin | ||||||||||||||||||||||||

| Fresh and value-added products | $ | 605.6 | 60 | % | $ | 77.0 | 73 | % | 12.7 | % | $ | 612.3 | 61 | % | $ | 46.1 | 67 | % | 7.5 | % | |||||||||

| Banana | 358.7 | 35 | % | 19.5 | 18 | % | 5.4 | % | 356.8 | 35 | % | 14.0 | 20 | % | 3.9 | % | |||||||||||||

| Other products and services | 55.2 | 5 | % | 9.5 | 9 | % | 17.2 | % | 44.1 | 4 | % | 8.6 | 13 | % | 19.5 | % | |||||||||||||

| $ | 1,019.5 | 100 | % | $ | 106.0 | 100 | % | 10.4 | % | $ | 1,013.2 | 100 | % | $ | 68.7 | 100 | % | 6.8 | % | ||||||||||

| Years ended | |||||||||||||||||||||||||||||

| December 26, 2025 | December 27, 2024 | ||||||||||||||||||||||||||||

| Net Sales | Gross Profit | Gross Margin | Net Sales | Gross Profit | Gross Margin | ||||||||||||||||||||||||

| Fresh and value-added products | $ | 2,621.9 | 61 | % | $ | 299.4 | 75 | % | 11.4 | % | $ | 2,606.9 | 61 | % | $ | 243.3 | 68 | % | 9.3 | % | |||||||||

| Banana | 1,490.4 | 34 | % | 71.0 | 18 | % | 4.8 | % | 1,475.9 | 34 | % | 86.8 | 24 | % | 5.9 | % | |||||||||||||

| Other products and services | 210.0 | 5 | % | 28.7 | 7 | % | 13.7 | % | 197.4 | 5 | % | 27.8 | 8 | % | 14.1 | % | |||||||||||||

| $ | 4,322.3 | 100 | % | $ | 399.1 | 100 | % | 9.2 | % | $ | 4,280.2 | 100 | % | $ | 357.9 | 100 | % | 8.4 | % | ||||||||||

| (1) Non-GAAP financial measure. Reconciliations and other information required by Regulation G can be found below under “Non-GAAP Measures.” | |||||||||||||||||||||||||||||

| (2) “FDP net income/loss” as referenced throughout this release is defined as Net income/loss attributable to Fresh Del Monte Produce Inc. | |||||||||||||||||||||||||||||

Fourth Quarter 2025 Business Segment Performance

Fresh and Value-Added Products

Net sales for the fourth quarter of 2025 were $605.6 million. The decrease was primarily a result of lower per-unit selling prices in the avocado product line, reflecting increased industry supply, as well as lower net sales in the fresh-cut vegetable product line due to strategic operational reductions implemented during the fourth quarter of 2024. The decrease was partially offset by higher per-unit selling prices in the pineapple product line and the effects of tariff-related price adjustments in North America. On an Adjusted basis, net sales(1) for the fourth quarter of 2025, excluding the impact of the divestiture of Mann Packing, were $554.3 million.

Gross profit for the fourth quarter of 2025 was $77.0 million. The increase was primarily driven by higher per-unit selling prices in the pineapple and prepared food product lines, partially offset by lower net sales in certain product lines. Gross margin increased to 12.7%. Adjusted gross profit(1) for the fourth quarter of 2025 was $82.0 million. Adjusted gross margin increased to 14.8%.

Banana

Net salesfor the fourth quarter of 2025 were $358.7 million. The increase was primarily driven by higher per-unit selling prices across all of the Company’s regions, including the effects of tariff-related price adjustments in North America and the favorable impact of fluctuations in exchange rates, primarily related to the Euro. The increase was partially offset by lower sales volume in Asia, North America, and Europe.

Gross profit for the fourth quarter of 2025 was $19.5 million. The increase was primarily driven by higher net sales and lower per-unit ocean freight costs, partially offset by higher per-unit production and procurement costs, an allowance recorded on a receivable from an independent grower in Asia, and the negative impact of fluctuations in exchange rates, primarily related to the Costa Rican colon. Gross margin increased to 5.4%. Adjusted gross profit(1) for the fourth quarter of 2025 was $17.7 million. Adjusted gross margin increased to 4.9%

For more go to: https://www.gurufocus.com/news/8626421/fresh-del-monte-produce-inc-reports-fourth-quarter-and-full-fiscal-year-2025-financial-results