Ukraine war slows down German machinery exports

- Exports in mechanical and plant engineering only with slight growth of 0.4 per cent in the first quarter

- Exports down 6.2 per cent in March

- Deliveries to Russia fall by 73 per cent in March

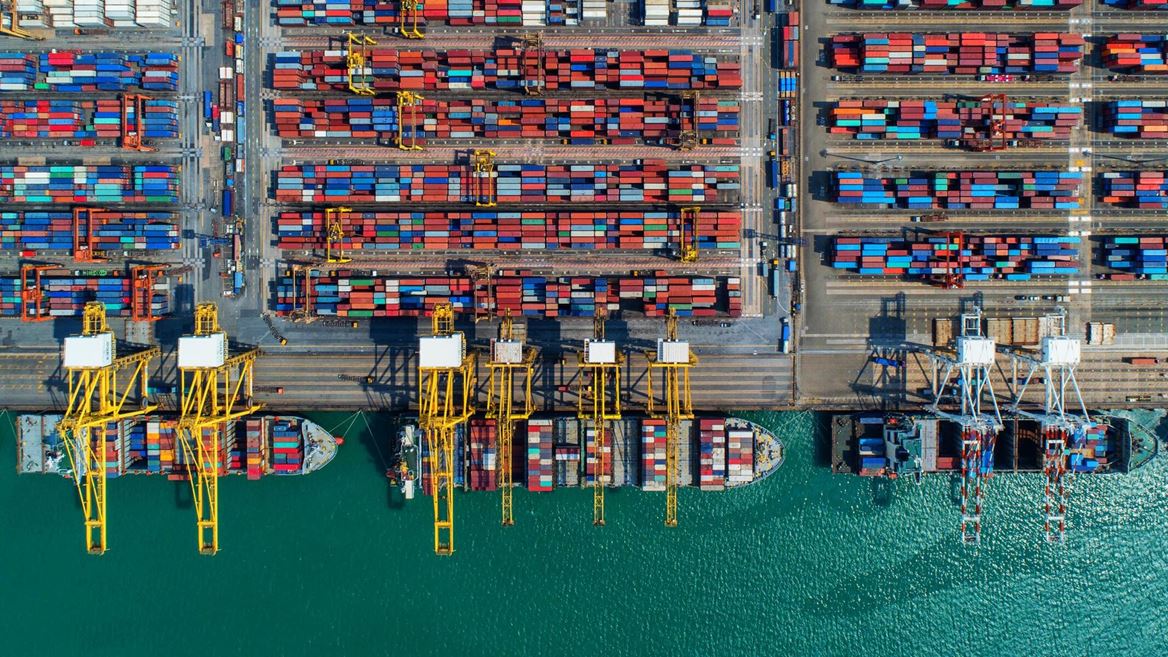

Machinery and plant manufacturers from Germany are increasingly feeling the consequences of the Ukraine war as well as supply chain problems. Since the start of the war, exports have declined noticeably. The decline in business with Russia is particularly drastic.

Frankfurt, 16/05/2022 – The war in Ukraine has put a noticeable damper on the export-oriented German mechanical and plant engineering sector and is causing additional pressure in the supply chains. In the first two months of the current year, machinery exports from Germany still achieved year-on-year growth of 4.8 percent. In March, however, they fell by 6.2 per cent. In the entire first quarter, the export value of machinery and equipment thus amounted to 43.6 billion euros – only 0.4 percent above the previous year’s level, as reported by the Federal Statistical Office on the basis of preliminary figures. Adjusted for prices, machinery exports even fell by 4.7 per cent in the first three months. Machinery imports, on the other hand, developed much more positively with growth of 6.4 per cent (price-adjusted minus 0.1 per cent).

“Companies in the mechanical engineering sector started the new year with confidence, relying on good global demand. However, business expectations have clouded over considerably as a result of the Ukraine war,” says VDMA chief economist Dr Ralph Wiechers. “In addition, this and the lockdown in China have exacerbated the problems in the supply chains, whether through delivery bottlenecks or extended delivery times.

Exports to China already declining before Shanghai lockdown

Machinery exports to China fell by 6.9 per cent to 4.5 billion euros in the first quarter – and thus even before the lockdown in Shanghai. And hopes for an imminent revival of the Chinese market have been significantly dampened against the backdrop of far-reaching Corona restrictions since April. “In our recent VDMA business survey among managing directors of Chinese subsidiaries of German machinery and plant manufacturers, they significantly downgraded their sales expectations. All in all, our local members expect zero growth in real terms for 2022,” Wiechers explains.Companies in the mechanical engineering sector started the new year with confidence, relying on good global demand. However, business expectations have clouded over considerably as a result of the Ukraine war.Dr. Ralph Wiechers, VDMA Chief Ecoomist

Exports to the USA continue to grow

In contrast, machinery exports to the United States continue to develop very positively. The export value increased by 13.9 per cent to 5.4 billion euros in the first quarter. Machinery and components worth 18.9 billion euros were exported to the EU-27 in the first three months – a decline of 2.9 per cent. With the exception of Italy, export business with the five most important EU customer countries declined: France (minus 6.2 per cent), Italy (plus 7.6 per cent), the Netherlands (minus 4.4 per cent), Austria (minus 5.8 per cent) and Poland (plus 5.1 per cent). The strongest growth within the top 20 sales markets for machinery exporters was shown by India with a plus of 37.1 per cent.

Machinery exports to Russia fall more than total exports

As a direct result of the Ukraine war, machinery exports to Russia fell particularly sharply in March by 72.6 per cent. By comparison, total German exports of goods to Russia fell by 58.7 per cent in the same month. Machinery exports to Ukraine fell by 89.4 per cent and to Belarus by 62.9 per cent. With an export volume of 6.9 billion euros, these three countries still accounted for 3.8 per cent of total machinery exports from Germany in 2021 as a whole. In March, the figure was only 1.2 per cent. Beyond sanctions, lack of transport options and restrictions directly related to the war, many mechanical engineering companies have significantly reduced or completely abandoned their business with Russia out of their own conviction. As a result, machinery exports recorded a particularly high minus.

The VDMA is Europe’s most important mechanical engineering industry associaton and represents more than 3,400 German and European companies. The industry stands for innovation, export orientation and medium-sized businesses. The companies employ around four million people in Europe, more than one million of them in Germany alone. Mechanical and plant engineering represents a European turnover volume of around 800 billion euros. In the entire manufacturing sector, it contributes the highest share to the European gross domestic product with a value added of around 270 billion euros.