Negative interest rates are costing European banks a ton of money

How much will the ECB’s new negative interest rate policy cost the euro area banks? That’s the question Bank of America Merrill Lynch’s European Banks Strategy research team set out to answer in a note issued to clients last week.

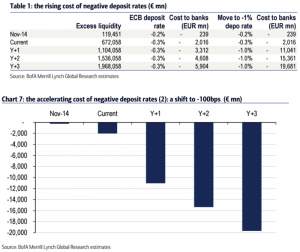

And while the report was published a week before the ECB’s decision, (published 02 March 2016) it still raises some interesting points. For example, when negative rates were first introduced back in late 2014, the annual cost to banks was around €0.2 billion, but this run rate has risen tenfold to €2 billion today.

Moreover, Bank of America’s analysts estimates that a negative 100 bps deposit rate (The ECB cut its deposit rate on Thursday by 10 bps to minus 0.4%) would cost banks €20 billion per annum by 2018.

Banks will see rising costs from negative rates

As well as costing Europe’s banks billions, Bank of America believes that the ECB’s qualitative easing policy is creating deposits in the banking system — exactly the opposite of what it was designed to do.

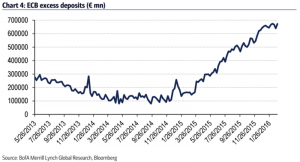

As the chart below shows, when negative interest rates were first introduced there was only €100 billion of assets (compared to the overall balance sheet of Europe’s bank system which is around €30 trillion) that met the excess reserve threshold on which the negative deposit was applied.

However, since the introduction of a negative interest rate policy, excess deposits have surged and now stand just under €700 billion.

ECBValueWalk

Bank of America blames a QE supply-demand mismatch for this explosion assets:

“We believe that QE is at the heart of this increase. QE creates deposits in the banking system. If it stimulates significant additional demand for loans or risky assets in the economy, these may then run down again over time as such investments are made. However, to the degree QE runs ahead of increased demand, the deposits sit on bank balance sheets.”

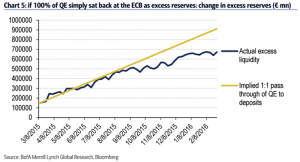

Bank of America’s analysis goes on to show that with the amount of QE the ECB has been undertaking, at €60 billion a month, assuming all other things remaining equal 60% of the deposits created by QE so far sit as excess deposits at banks, placed back with the ECB. There’s also the LTRO and TLTRO positions to consider. As these liquidity initiatives mature, or banks choose to unwind early, the banks would reduce their cash position and get their securities back.

negative ratesValueWalk

There should not be a correlation between QE and excess reserves. Bank of America presents figures showing that the opposite is indeed true. In fact, the bank goes so far as to say that there is a strong directional correlation between the two, and it’s highly likely that more QE will create more excess reserves.

To this end, Bank of America summarizes that QE and negative rates are already creating an income problem for banks and any further move into negative territory, or increase in QE (just as the ECB has now done) will accelerate the challenge faced by banks.

A negative rate of -30 bps was costing Europe’s banking industry €2 billion euros a year in lost income on excess reserves of €672 billion. Assuming excess reserves continue to grow their rate Bank of America predicted the without any further plunge into negative territory, and negative rate of -30 bps would cost Europe’s banking industry just under €6 billion per annum by 2019. However, a move to a negative rate of 100 bps would cost the industry nearly €20 billion per annum in lost income by 2019.

negative ratesValueWalk

Rupert may hold positions in one or more of the companies mentioned in this article. You can find a full list of Rupert’s positions on his blog. This should not be interpreted as investment advice, or a recommendation to buy or sell securities. You should make your own decisions and seek independent professional advice before doing so. Past performance is not a guide to future performance.

Read the original article on ValueWalk. Sign up to get our free newsletter and receive our free e-books on famous hedge fund managers and value investors. You can also check out ValueWalk on Facebook, Twitter and Yahoo Finance Contributors. Copyright 2016. Follow ValueWalk on Twitter.

IMAGE: below zero temperatureReuters/Peter Andrews

Tourists leave the Kasprowy Wierch ski station based 1987 meters above the sea level as the temperature on the thermometer shows -9 Celsius (15.8 Fahrenheit), 10 degrees Celsius than 1000 meters below in Zakopane, Poland

For more on this story go to: http://www.businessinsider.com/negative-interest-rates-costing-european-banks-2016-3?utm_source=feedburner&%3Butm_medium=referral&utm_medium=feed&utm_campaign=Feed%3A+businessinsider+%28Business+Insider%29