How Malaysia’s 1MDB Fund scandal reaches around the world

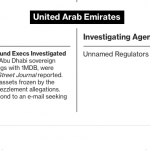

State investment company 1Malaysia Development Bhd., or 1MDB, has been making headlines in Malaysia and around the world in the past year, mainly for the wrong reasons. There are probes reported in at least ten countries related to 1MDB, or on companies and individuals linked to it.

Investigations surrounding 1MDB center on alleged financial irregularities and possible money laundering. Both 1MDB and Prime Minister Najib Razak have consistently denied wrongdoing, and the fund continues to state that no foreign legal authorities have contacted them on any of these investigations. Here’s a snapshot of the various probes – see attachments (click to enlarge).

For more on this story go to: http://www.bloomberg.com/graphics/2016-malaysia-1mdb/

Related stories:

The men who sold 1MDB on a fake Aabar

By Zikri Kamarulzaman From Malaysiakini

1MDB is in quite a pickle after the International Petroleum Investment Co (IPIC) and Aabar Investment PJS denied links to an Aabar company that 1MDB had been making payments to.

The company, Aabar Investment PJS Ltd or Aabar BVI, based in the British Virgin Islands, had received US$3.5 billion from 1MDB.

1MDB said it transferred the funds to Aabar BVI after being told by then IPIC managing director Khadem al Qubaisi and Aabar chairperson Mohamed Al Husseiny that the BVI firm is an IPIC subsidiary.

So who exactly are these two men alleged to have fooled 1MDB?

Khadem al-Qubaisi

Khadem is a well-known Emirati businessman who, according to his now defunct personal website, started working in IPIC as an investment manager in 2000 before becoming its managing director (MD) seven years later.

A reported billionaire, Khadem is said to have a penchant for expensive US properties.

The New York Post said this includes Manhattan’s most expensive penthouse worth US$50.9 million, which he has unsuccessfully tried to sell.

Sarawak Report, meanwhile, has claimed that under him, IPIC’s capital base had shrunk from over US$70 billion to less than US$15 billion.

Khadem’s career in IPIC then came to an abrupt end when he suddenly left the company’s board and was replaced as MD following a reshuffle decreed by the United Arab Emirates President Khalifa Zayed in April 2015.

Khadem then resigned as chairperson of Aabar properties and other IPIC subsidiaries such as Cepsa and Nova Chemicals.

Mohamed al-Husseiny

Said to be Khadem’s left-hand man, Mohamed has a rather low-public profile, attracting less attention than his boss.

He was appointed as CEO of Aabar Investment PJS in 2010, and held the post until August last year when he quit to reportedly helm private equity firm Trustbridge.

Mohamed is also a director at Falcon Private Bank, and was a board member from 2009 to 2013, and was re-appointed in April last year.

According to The Wall Street Journal, Falcon, a subsidiary of IPIC, is being probed after investigators traced a 2013 transfer of nearly US$700 million from an account at Falcon Private Bank in Singapore to accounts allegedly belonging to Prime Minister Najib Abdul Razak.

He is also reported as a principal investor in Red Granite, a Hollywood firm owned by Prime Minister Najib Abdul Razak’s stepson Riza Aziz.

At least US$3.5b from 1MDB

Both Khadem and Mohamed are alleged to have set up Aabar BVI in March 2012, two months before it received US$576.94 million from 1MDB as a security deposit.

In total, the company is said to have received at least US$3.5 billion from the Malaysian sovereign wealth fund.

The Wall Street Journal claims US$155 million of these funds ended up financing Red Granite’s Hollywood film ‘The Wolf of Wall Street’.

Aabar BVI was then liquidated in June last year, as pressure on Najib and 1MDB began picking up steam.

Since then, the UAE has frozen both men’s accounts, and issued travel bans amid an alleged probe into their business dealings.

According to Sarawak Report, Mohamed had also been arrested by Abu Dhabi authorities in late March, and would be extradited to the United States to facilitate in the US’ probe on 1MDB.

For more on this story go to: https://www.malaysiakini.com/news/337742

Likely scenarios for the missing ‘songlapped’ US dollars

From Malaysiakini

I refer to the latest development that even Hans Christian Andersen could not have concocted any better.

I have working knowledge of due diligence for takeovers and joint ventures and would like to add my sense of outrage at the fairy tales being concocted.

It is common in the business world, well proper business world, not the one where retired and failed politician helms companies clueless of business and financial ways, no one pays a different party to that specified in an agreement and if there was a request to pay a third party, this would have started the alarm bell ringing and would not have been done without any letter of indemnity from the parties to the agreement.

This is common and business 101. Unless off course all parties were colluding from the word go.

It is also not difficult to confirm ownership of companies or otherwise as a company search in any jurisdiction will show shareholders and directors of any company, even if the shareholdings were done by a proxy or a trust company.

Please don’t be taken in by the hype of Cayman Islands, British Virgin Islands and similar so-called offshore entities companies. These jurisdictions do not have the same level of due care as even the Companies Commission of Malaysia (SSM) does. As an example, in Malaysia, to appoint new directors, the proposed directors must sign a declaration which must be certified before a commissioner of oaths and a copy of NRIC or passport must be attached.

These offshore jurisdictions are ‘cowboy’ country as I term it, for a payment of a fee anything is possible and it is all about fees and fees and fees, and they are not cheap either. Lawyers especially love to advise clients to set up entities in offshore places for so-called tax minimisation and liability capping but believe me, most of it is hogwash. The inconvenience and lack of diligence sometimes far outweigh the benefits peddled.

In a project I was working on where the parties jumped the gun and set up two Cayman entities, the Cayman company secretaries were able to set up the companies by relying on directors’ names submitted by the promoters without any consent from the directors, and worse still one of the directors named did not even know anything about it ever.

Like I said, cowboy land. This is what attracts so-called business people to set up companies all over these offshore havens. Not for tax minimisation or liability capping but the ability to do anything you want with a payment of a fee.

Likely causes

Coming back to 1MDB’s ‘missing’ US$3.5b ‘songlapped’ by these fraudsters at BVI, in my opinion these are the likely causes:

1. All parties were in cahoots and it was a scheme to defraud Malaysia of this monies for use of whatever purpose and the culprits would not have counted on the Wall Street Journal (WSJ) and Sarawak Report exposes as well as the sacking of two senior personnel from IPIC.

If this was the real reason, then the lack of due care , the ease of payment to a third party not named in the agreement with IPIC as well as no follow-up action when this was first exposed last September when it was mentioned that IPIC accounts does not show these receipts/deposits from 1MDB, makes a whole lot of sense.

2. Same as above but only the personnel/officers involved in the transaction is guilty and 1MDB has no knowledge of this shenanigans.

3. Both the officers of IPIC, since suspended, brilliantly conned Malaysia out of US$3.5 billion by pretending all along that Aabar BVI belongs to IPIC and forged documents to show these which is why 1MDB due diligence failed to pick this up. No personnel or management from 1MDB was aware and if guilty was just guilty of negligence and incompetence of the highest order.

4. This was an elaborate scheme set up by the Zionist Jews working with the racist DAP and the white imperialist supremacist group to bring down a legitimately-elected minority government in Malaysia.

Time will definitely conclude which of the above is true. The one thing about money transfers, whether international or local, is that it would have left a trail. Even if you hide and burn your bank statements and hard delete your hard drive, there is always a copy somewhere else. You can never escape. This is why a clever Malaysian decided to just move the monies in his suitcase.

For more on this story go to: https://www.malaysiakini.com/letters/337806

For all iNews Cayman stories on 1MDB go to: http://www.ieyenews.com/wordpress/?s=1MBD