Cruising around investment cases against the Caribbean islands

(Jones Day) From Kluwer Arbitration Blogs

Cruising around investment cases against the Caribbean islands is not only a recreational journey. It is also an informative one. This article aims at presenting key observations made during this journey.

As mentioned in a previous publication, since 1973, the sovereign islands of the Caribbean Sea, have concluded over 140 international investment agreements. The ICSID Convention is in force in all islands except Antigua & Barbuda, Cuba, Dominica, and the Dominican Republic.

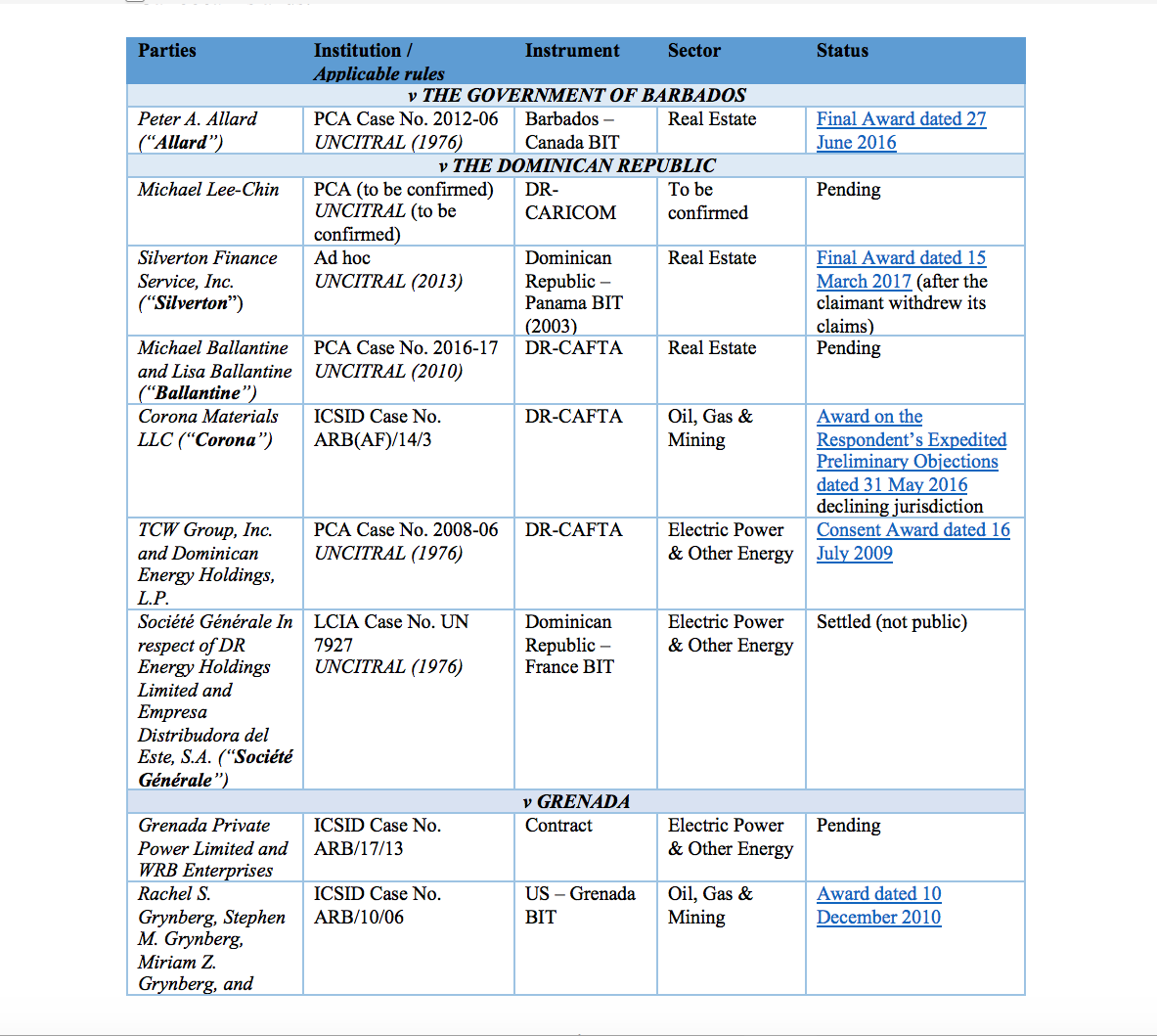

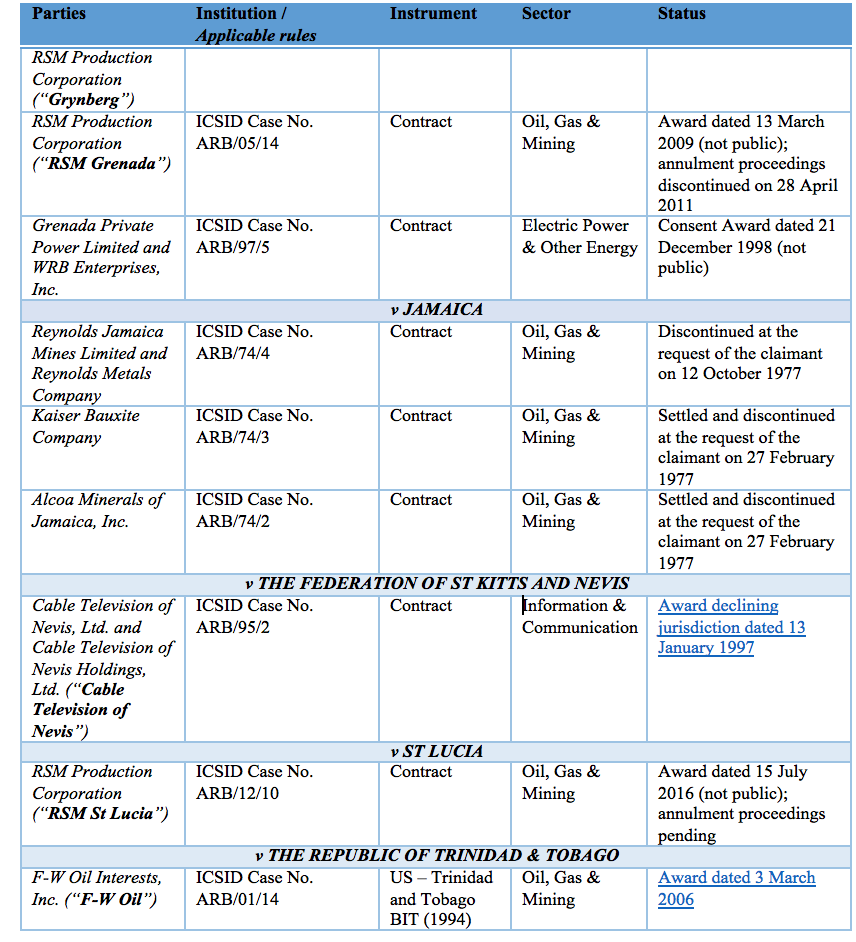

The following table lists the 17 investment arbitrations identified to date against the Caribbean islands:

In these cases, investors based their claims on either contracts or investment treaties. They invoked BITs, the Dominican Republic-Central America Free Trade Agreement (“DR-CAFTA”), or the Free Trade Agreement between the Dominican Republic and the Caribbean Community (“DR-CARICOM”).

Among these 17 cases, 5 settled, 2 were dropped, 2 tribunals declined jurisdiction, and 4 are pending, including at the annulment stage. All 5 awards rendered on the merits were decided in favor of the State.

Disputes tainted by environmental issues

Investment disputes against the Caribbean islands mostly concern the Oil, Gas & Mining, Electricity, Power & Other Energy, and Real Estate sectors.

Three recent cases show the importance of environmental issues:

- In Allard, the claimant alleged that Barbados’ failure to take necessary and reasonable environmental protection measures destroyed the value of his investment in the Graeme Hall Nature Sanctuary, an eco-tourism project on the wetlands on Barbados’ South Coast. However, the tribunal dismissed the claims for lack of evidence of environmental damage during the investment timeframe.

- In Corona, the investor sought to invest close to Sanchez, in the Samaná region in the Dominican Republic, to mine for aggregate materials to be shipped to the US. This project was allegedly hindered by the denial of environmental approvals. The tribunal declined jurisdiction without deciding the relevant environmental issues.

- In Ballantine, investors in an exclusive housing project on the Jamaca de Dios community in the Dominican hills of Jarabacoa claimed that they did not obtain environmental approval to develop the higher portion of their property, where most valuable residences were to be located. Proceedings are pending.

Jurisdictional objections allow DR-CAFTA interpretation

Out of these 17 Caribbean cases, the Corona and the Cable Television of Nevistribunals have declined jurisdiction. The jurisdictional objection in Ballantine is still pending.

The most striking jurisdictional objections are those which require the interpretation of DR-CAFTA:

- In Corona, the tribunal declined jurisdiction under Article 10.18.1, which provides for a 3 years time bar to submit a claim, from the date on which the claimant first acquired, or should have first acquired, knowledge of the breach alleged and knowledge that the claimant or the enterprise incurred loss or damage. This tribunal considered the submission of the US as a non-disputing party dated 11 March 2016, which commented on the interpretation of DR-CAFTA’s statute of limitation rule. A similar time-bar was raised (but dismissed) in Allard, pursuant to Article XIII.3.d of the Barbados – Canada BIT. In Ballantine, the Dominican Republic equally alleged that some of the investors’ claims violate the same rule. TheCorona precedent has since been relied on by the Aaron C. Berkowitz, Brett E. Berkowitz and Trevor B. Berkowitz v Republic of Costa Ricatribunal, in its Interim Award of 30 May 2017, which declined jurisdiction on certain claims.

- In Ballantine, the Dominican Republic alleged that the claimants’ “dominant and effective nationality” was Dominican (not US) at the time of the alleged violations and at the start of the proceedings, in breach of DR-CAFTA Article 10.28. In its Procedural Order No. 2 dated 21 April 2017, the tribunal refused to bifurcate this issue, which remains pending.

Re-litigation of contract claims impossible in new treaty arbitration

Only 5 investment tribunals rendered awards on the merits against Caribbean islands, i.e. in Allard, Grynberg, RSM Grenada, RSM St Lucia and F-W Oil. The 2 RSM awards are not public, and annulment proceedings are pending in RSM St Lucia.

Though it may pertain either to jurisdiction or to the merits, the Grynbergtribunal’s rejection of the claimants’ claims as “manifestly without any legal merits” pursuant to Article 41.5 of the ICSID Arbitration Rules, is interesting. In this treaty-based case, the investor submitted claims that had already been decided in RSM Grenada, a previous contract-based arbitration. The Grynbergtribunal refused to re-litigate conclusions of fact or law concerning the parties’ contractual rights that had already been determined by a prior tribunal. Several ICSID tribunals then referred to this case, in particular NAFTA-based Apotex Holdings Inc. and Apotex Inc. v The US.

Cost decisions penalize non-complying and unsuccessful investors

On 13 August 2014, the majority of the RSM St Lucia tribunal ordered the claimant to post security for costs in the form of an irrevocable guarantee for USD 750,000 to cover St Lucia’s potential legal costs. The RSM St Luciatribunal notably considered similar requests filed and denied in the RSM Grenada and the Grynberg cases, where RSM reportedly failed to reimburse Grenada’s costs. The claimant’s failure to comply with the tribunal’s order resulted in the conclusion of the proceedings. As the first ICSID decision ordering a claimant to pay security for costs, RSM St Lucia has been heavily relied upon. However, since St Lucia, no respondent State has been granted security for costs.

Claimants have also been subject to penalizing cost decisions when “unsuccessful”. For example, in Grynberg, the tribunal awarded all costs to Grenada, as the claimant was attempting to re-litigate claims that had been decided in previous contract-based proceedings. In Silverton, the tribunal awarded all costs to the Dominican Republic after the claimant withdrew its claims, considering the claimant the “unsuccessful party” under Article 42.1 of the UNCITRAL Rules.

This Caribbean journey ends with memorable observations regarding the importance of environmental issues, the interpretation of the 3 years statute of limitations under DR-CAFTA, the articulation between treaty and contract claims, and the tribunal’s power to order security for costs to the claimant. So far, all cases have turned in favor of the States, but time will tell if future disputes leave the Caribbean islands intact.

The views set forth in this post are the personal views of the author and are not intended to reflect those of her employers or clients. The author wishes to thank Mr. Victor Choulika for his assistance in preparing this article.

To make sure you do not miss out on regular updates on the Kluwer Arbitration Blog, please subscribe here.

For more on this story go to: http://arbitrationblog.kluwerarbitration.com/2018/04/28/cruising-around-investment-cases-caribbean-islands/

IMAGE: Phillips Law Firm