Communiqué of the 95th Meeting of the Monetary Council of the Eastern Caribbean Central Bank

Eastern Caribbean Central Bank: an Institution of the OECS

The Ninety-Fifth Meeting of the Monetary Council of the Eastern Caribbean Central Bank (ECCB) was held at the ECCB Headquarters, Basseterre, Saint Christopher (St Kitts) and Nevis, on 14 February 2020, under the chairmanship of The Honourable Allen M. Chastanet, Council Member for Saint Lucia.

1.0 Monetary Stability

Council received the Governor’s Report on Monetary and Credit Conditions in the Eastern Caribbean Currency Union (ECCU), which was based on developments from January to December 2019; and evaluated against outcomes during the comparative period of 2018; and the ECCB Strategic Plan 2017-2021. The Report also included some projections for 2020.

The Council was apprised of the following:

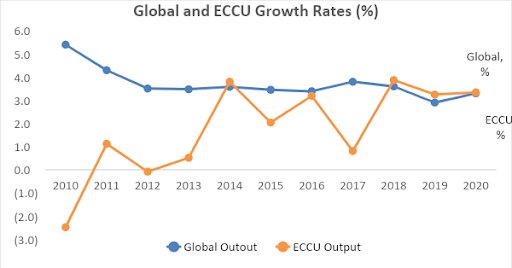

a. The global economy continued its slowdown due, in part, to the USA/China trade war and other geopolitical uncertainties. Global economic growth was projected at 3.0 per cent in 2019 from 3.8 per cent in 2018; however, global output is expected to strengthen to 3.4 per cent in 2020.

b. Monetary and credit conditions were assessed as having improved slightly during 2019. That was against the backdrop of a moderation in the Eastern Caribbean Currency Union’s (ECCU’s) economic growth to 3.3 per cent in 2019 from 3.8 per cent in 2018.

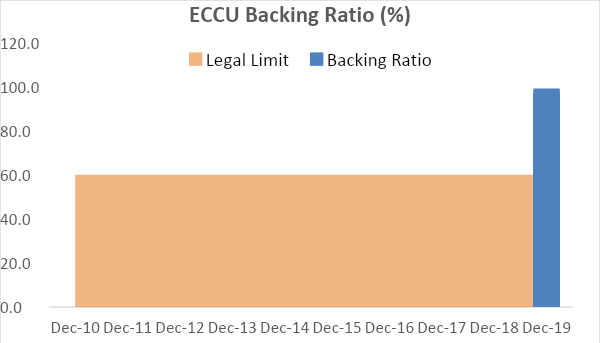

c. The stability of the EC dollar is firmly entrenched with a 99.0 percent backing by foreign reserves. It supports monetary conditions and sustains investor and consumer confidence. Figure 1 below shows ECCU backing ratio from 2010 to 2019.

d. Domestic credit extended by the commercial banking sector was projected to increase by 1.1 per cent at the end of December 2019, relative to the 0.9 per cent growth observed at the end of December 2018.

e. Credit and monetary conditions are projected to remain favourable in the near to medium term. Credit growth is expected to accelerate in 2020, but mostly to households and governments.

Framework for Macroprudential Regulation

The Council was apprised of the ECCB’s work on articulating an optimal framework for the ECCU financial system. Further, the Council directed that the Bank expedite its work on the optimal framework for the ECCU financial system and its recommendations for the Council’s consideration.

Having received the Governor’s Report and recommendations, the Council decided to:

- maintain the minimum savings deposit rate at 2.0 per cent; and

- maintain the Central Bank’s discount rate at 6.5 per cent.

2.0 Financial Stability

The Monetary Council received the Financial Stability Report for the ECCU for the period January to December 2019. The Report revealed that:

- The banking sector was assessed as stable with improvement in some areas.

- The credit union sector continued to grow and is a significant player in the provision of financial services in the ECCU.

- The insurance sector remained stable following large payouts in 2018.

- Risks to the stability of the ECCU financial sector were moderate amid changes in the economic and financial landscape. Possible risks to financial stability were identified as slower economic growth, natural disasters, low investment yields, climate change and cyber resilience.

- The ECCU financial sector is projected to remain stable in 2020 despite its ongoing challenges.

3.0 Fiscal and Debt Sustainability

The Council was apprised that the Debt to GDP Ratio for the ECCU was projected to decrease to 65.4 per cent at the end of December 2019 from 68.3 per cent at the end of December 2018.

4.0 Growth and Competitiveness

The Council noted that:

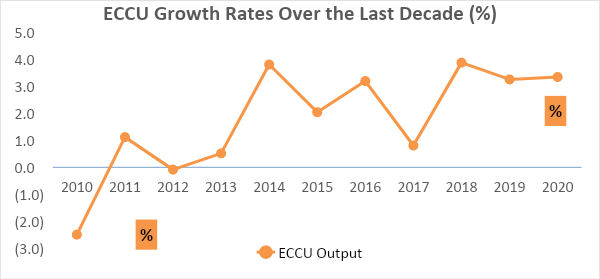

- Economic growth in the ECCU was estimated at 3.3 per cent in 2019 (amid a weaker global economy) compared to growth of 3.8 per cent in 2018. Figure 2below shows the global and ECCU growth rate comparisons from 2010 to 2020.

- Economic growth for the ECCU is projected around 3.2 per cent in 2020 and 2.2per cent in 2021. Figure 2 below shows the ECCU growth rates from 2010 to 2020.

5.0 Report From the Technical Core Committee on Insurance (BAICO and CLICO)

BAICO

The Council was advised that the second payout of EC$30.4 million was paid to British American policyholders as at the end of October 2019, under the Plan of Arrangement. The sum included unpaid amounts from the first distribution.

CLICO

The Council received a report from the Core Committee on Insurance and reconstituted the Ministerial Sub-Committee on Insurance as follows:

- Chair – Antigua and Barbuda

- Deputy Chair – Saint Vincent and the Grenadines

- Member – Commonwealth of Dominica

6.0 Legislative Updates

Proposed Amendments to ECCB Agreement

The Council approved the proposed amendments to the Eastern Caribbean Central Bank Act to facilitate the Bank’s creation and issuance of digital EC currency.

Uniform Insurance and Pension Bill

The Council received a presentation on the Uniform Insurance and Pension Bill. Council agreed to further consider this Bill at its next meeting. The purposes of the Bill are to:

- repeal and replace the individual Insurance Acts within the ECCU countries;

- provide for single space in the ECCU insurance sector with modern and uniform legislation;

- regulate insurance businesses and privately administered pension plans; and

- provide for the enhanced protection of consumers.

Eastern Caribbean Home Mortgage Bank (ECHMB) Bill

The Council approved the revised to the Eastern Caribbean Home Mortgage Bank Agreement and recommended its enactment in member countries. The purposes of the Bill are to:

- Repeal and replace the current ECHMB Act in all member countries; and

- Provide ECHMB with increased authority to raise capital and deliver on its dual mandates of local home ownership and money and capital markets development in the ECCU.

7.0 The Medicinal Cannabis Revolution Report

The Council approved the publication of the Bank’s report styled “Medicinal Cannabis Revolution: Challenges in Banking the Budding Industry in the Eastern Caribbean Currency Union”. The Report:

- Explores the potential opportunities to the development of the medicinal cannabis industry for ECCU member countries; and

- Identifies the challenges to the ECCU financial sector related to the medicinal cannabis industry, particularly as it relates to correspondent banking relations.

8.0 Date and Venue of 96th Meeting of the Monetary Council

The Council agreed that the 96th Meeting of the Monetary Council will convene on Friday, 24 July 2020 in St Kitts and Nevis. The Council further agreed that the meeting will be preceded by the Ceremony to Mark the Change in Chairmanship of the Monetary Council.

9.0 Attendance

Council Members attending the meeting were:

- The Honourable Victor F Banks, Premier and Minister for Finance, Anguilla;

- The Honourable Gaston Browne, Prime Minister and Minister for Finance, Antigua and Barbuda;

- The Honourable Roosevelt Skerrit, Prime Minister and Minister for Finance, the Commonwealth of Dominica;

- The Honourable Joseph Easton Farrell, Premier and Minister for Finance, Montserrat;

- Dr the Honourable Timothy Harris, Prime Minister and Minister for Finance, Saint Christopher (St Kitts) and Nevis;

- The Honourable Allen Chastanet, Prime Minister and Minister for Finance, Saint Lucia;

- The Honourable Camillo Gonsalves, Minister for Finance, Saint Vincent and the Grenadines;

- The Honourable Gregory Bowen, Minister of Infrastructure and Energy, Council Alternate, Grenada.

14 February 2020