Cayman: CIG July 2022 YTD Surplus surpasses projections by $25.2 million

From Cayman Islands Ministry of Finance & Economic Development.

Grand Cayman, 5 September 2022 – Deputy Premier and Minister for Finance and Economic Development, Hon. Chris Saunders, presented the Cayman Islands Government’s July 2022 Year-To-Date (YTD ) to Cabinet on Tuesday, 16 August 2022.

Surplus: Central Government – Better than Budget by $18.9 million

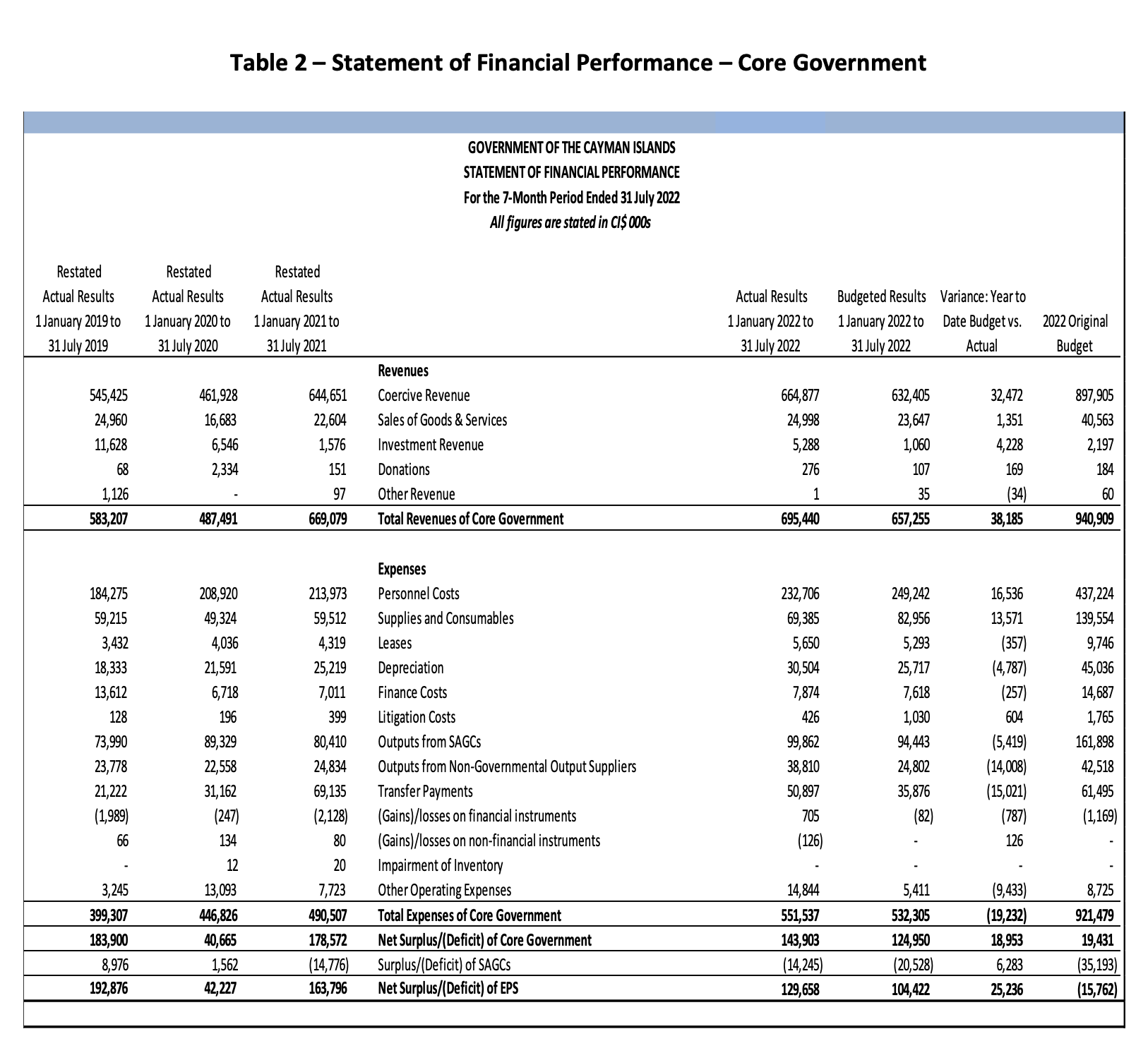

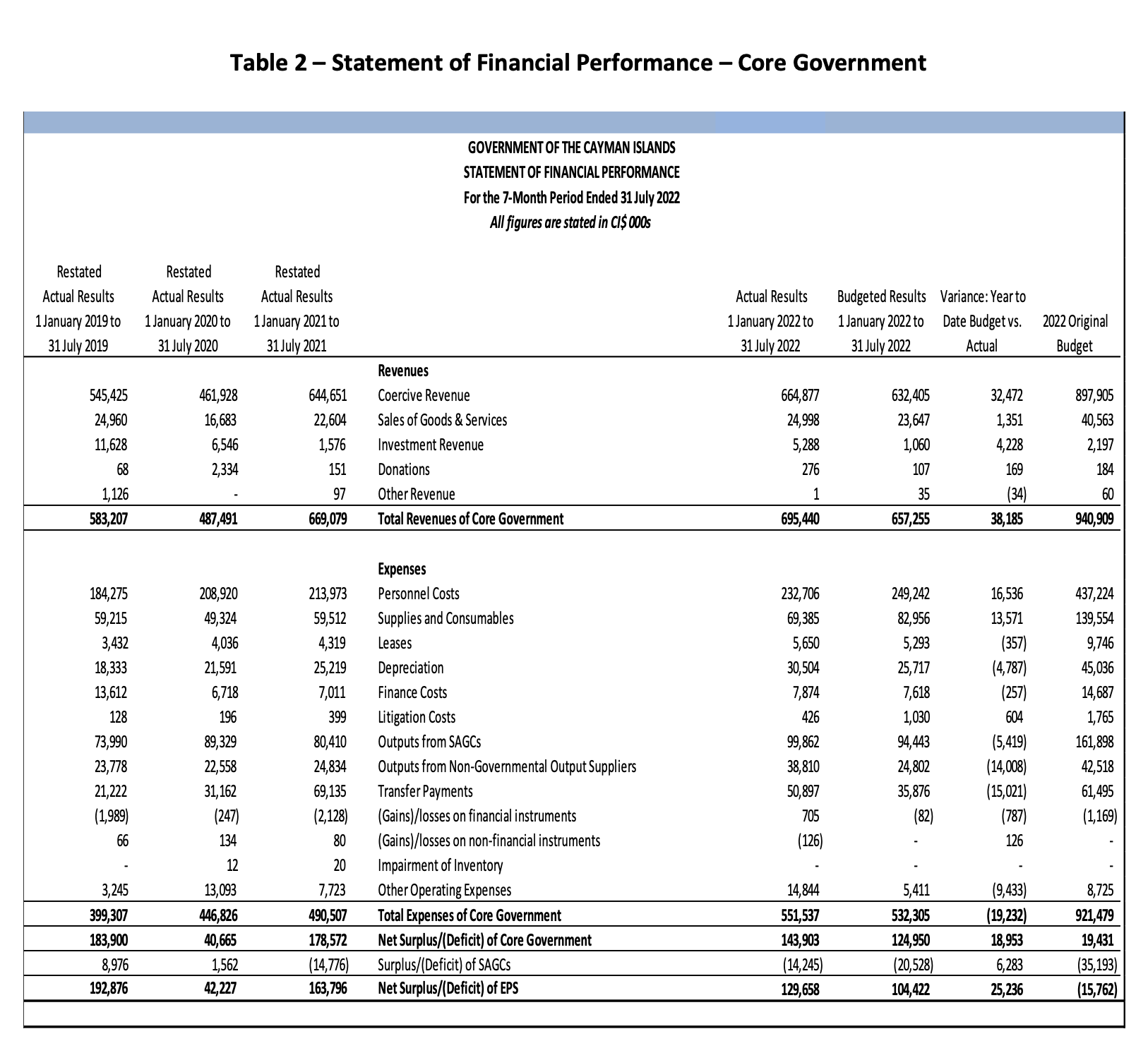

For the 1 January to 31 July 2022 period, Central Government recorded a surplus of $143.9 million, which is $18.9 million more than the projected year-to-date Operating Surplus of $125.0 million.

Surplus: Entire Public Sector – $25.2 million Better than Budget

At the end of the first seven months of 2022, the Entire Public Sector (EPS) had a surplus of $129.6 million, which is $25.2 million more than the projected year-to-date Operating Surplus of $104.4 million.

Revenues: Surpassed Projections by $38.2 million

July 2022 YTD revenues also surpassed budget, amounting to $695.4 million, which was $38.2 million more than the year-to-date projection of $657.2 million. This was mainly due to a favourable variance of $32.5 million in Coercive Revenue.

Coercive Revenue collected in the first seven months of 2022 was $32.5 million higher than the year-to-date projection and $20.2 million more than that collected for the same period in 2021.

Continuing the trend since the start of the year, financial services fees plus work permit and property related revenues contributed most to the higher-than-anticipated revenues collected.

The most significant positive year-to-date variances were recorded for the following categories:

- Financial Services Fees collected by General Registry were $2.8 million higher than anticipated, which was mainly due to a favourable variance in Partnership Fees.

- Financial Services Fees collected by CIMA for Government were $4.4 million higher than expected. These fees include revenues such as Mutual Fund Administrators Licence Fees, Private Fund Fees and Securities Investments Business Licences Fees. While Securities and Investment Business Licences came in $1.7 million less than budget expectations, this was more than offset by the positive variance, with Mutual Fund Administrators Licence Fees of $3.7 million and Private Funds Fees of $3.5 million brought about by a higher-than-expected increase in the volume of registered funds for the seven-month period.

- Work Permit Revenues were $6.6 million higher than projected, representing increasing demand for workers as the economy moved into phase five of the border reopening plan.

- Property Related Revenues were $18.5 million higher than anticipated, as there continues to be a higher-than-expected volume of property transactions coupled with high property values.

Included in the note to Cabinet was a breakdown of coercive revenues collected to the end of July 2022, in several categories with a comparison to prior years, summarised in the following table:

| 2019 | 2020 | 2021 | 2022 | |

| Import Duty Revenues | $111,323,000 | $92,415,000 | $109,895,000 | $128,286,000 |

| General Registry Fees | $147,603,000 | $146,714,000 | $157,930,000 | $167,157,000 |

| Fees collected by CIMA for Government | $92,133,000 | $86,814,000 | $138,989,000 | $149,589,000 |

| Work Permit Revenues | $50,589,000 | $20,921,000 | $46,672,000 | $59,075,000 |

| Property-related Revenues | $43,234,000 | $36,373,000 | $75,217,000 | $63,870,000 |

| Tourism-related Revenues | $31,949,000 | $10,685,000 | $816,000 | $13,014,000 |

Expenses: Over budget due to health & tourism stipend costs, partially offset by personnel, supplies and consumables savings

Expenses for the seven-month period ended 31 July 2022 were $551.5 million; this amount was $19.2 million more than the year-to-date budget of $532.3 million.

The variance between actual and budgeted expenses is largely due to overages of $14.0 million for tertiary health care costs; and $20.6 million more being paid out than the initial 2022 budgeted expenditure for the ex-gratia tourism stipend programme. These overages were somewhat offset by underspending in other areas of expenditure, particularly in the Personnel and Supplies and Consumables Cost categories in which actual costs were, respectively, $16.5 million and $13.6 million less than the YTD Budget.

To ensure sufficient funds are available for the remainder of the budget year, Parliament has approved supplementary funding in these areas.

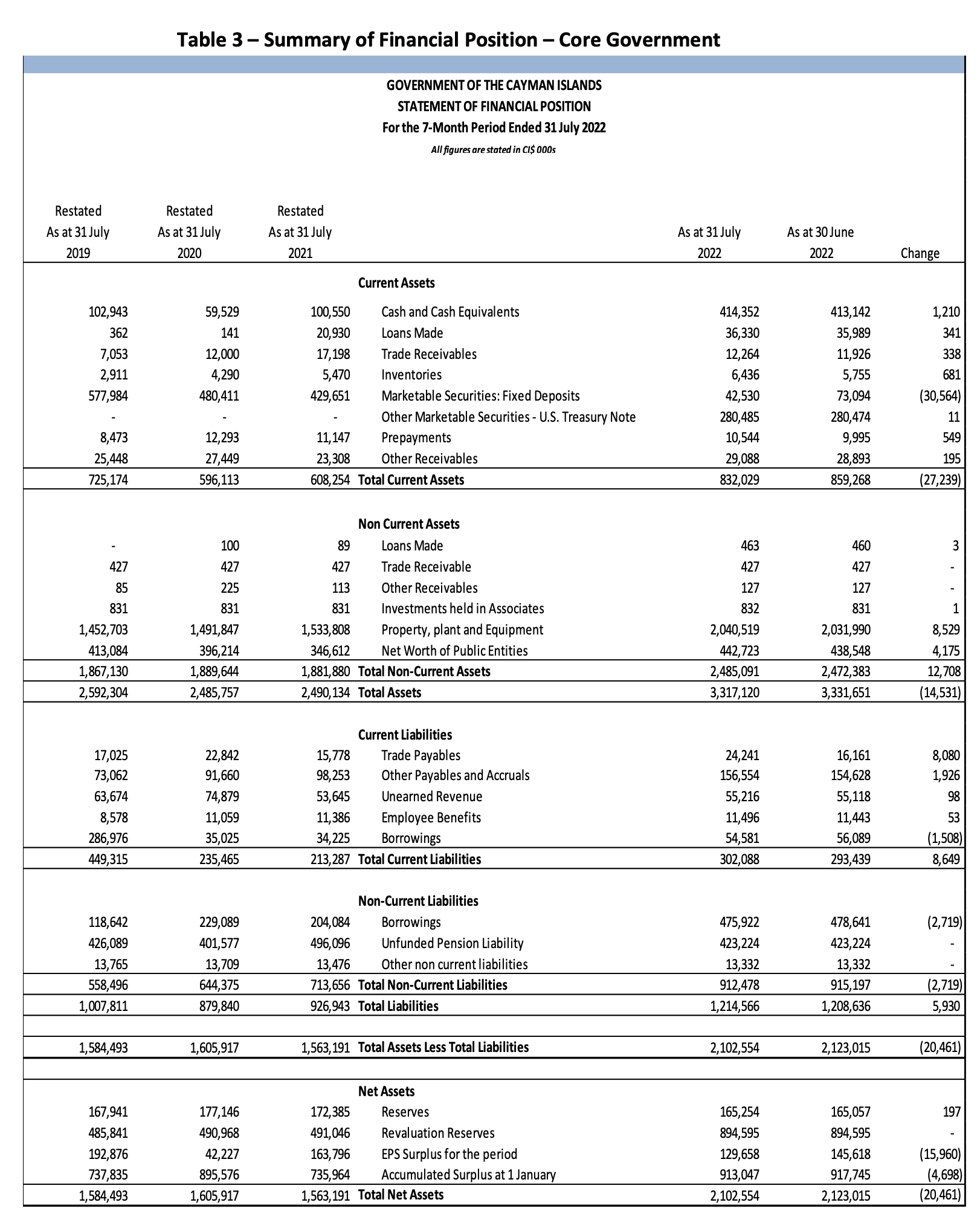

Cash Position

Total cash and fixed deposits as at 31 July 2022, were $456.9 million. This amount is represented as Operating Cash of $291.6 million ($276.6 million of which are held in the form of fixed deposits) and, Reserves and Restricted Cash balances (all held in the form of fixed deposits), of $165.3 million.

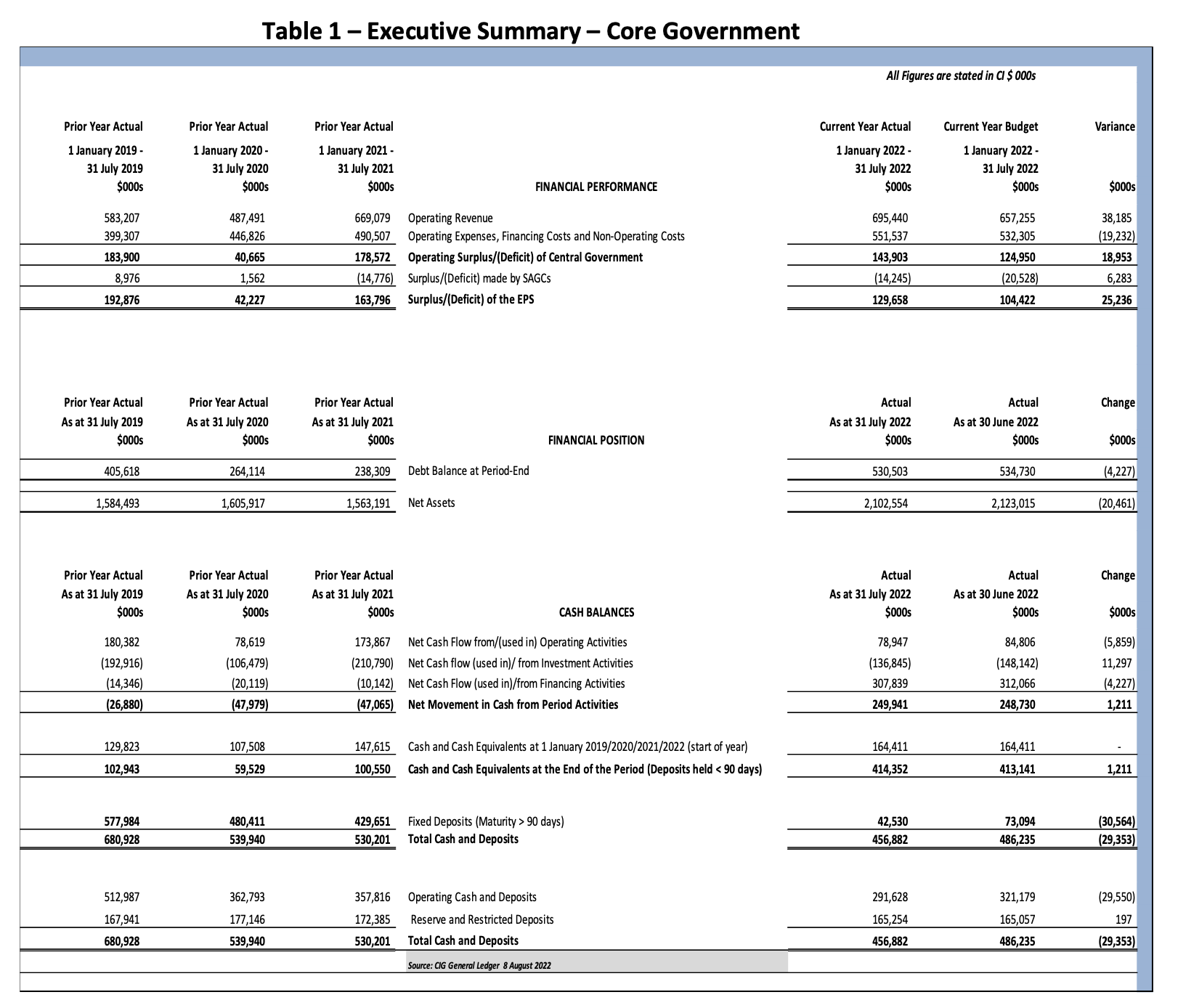

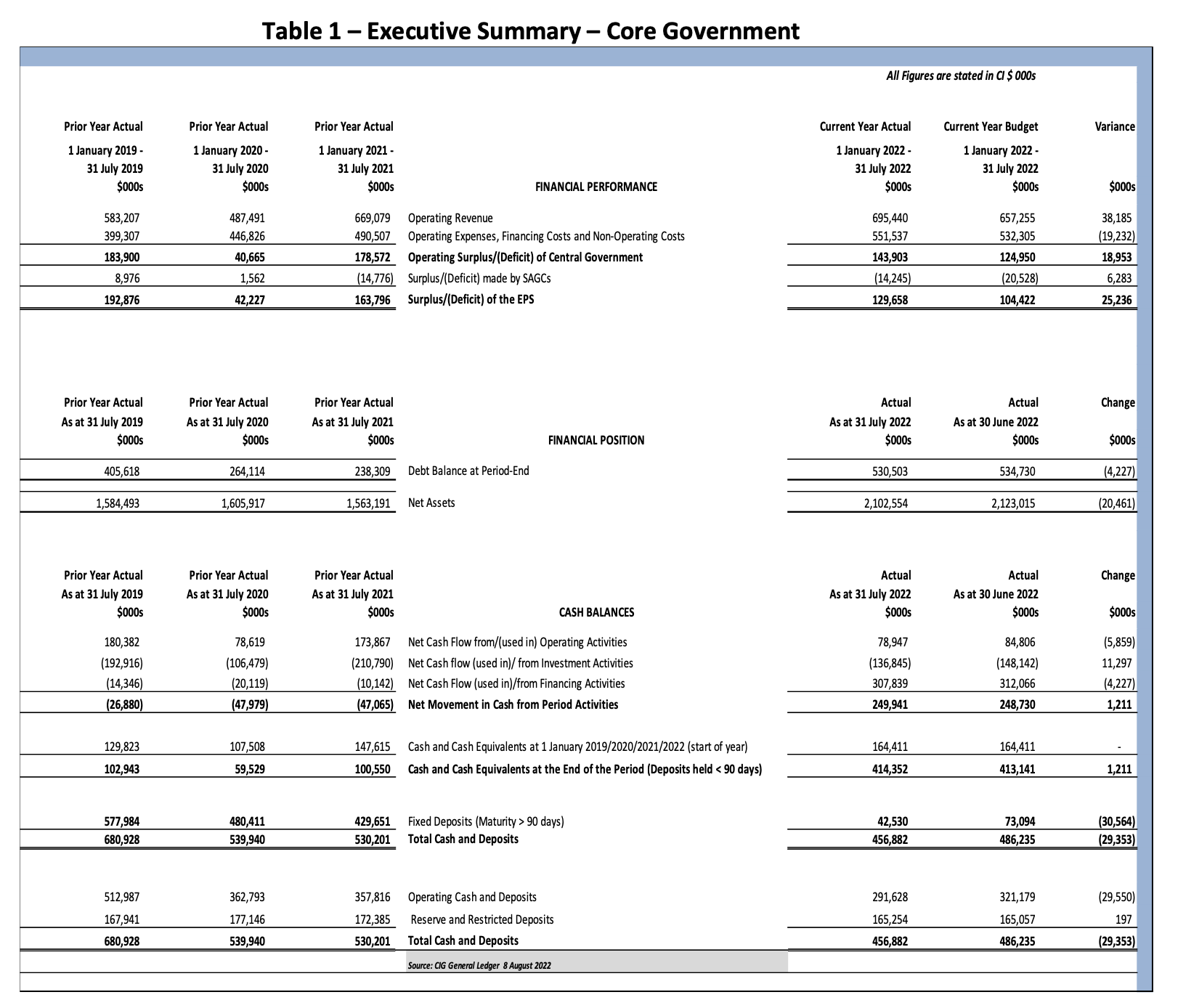

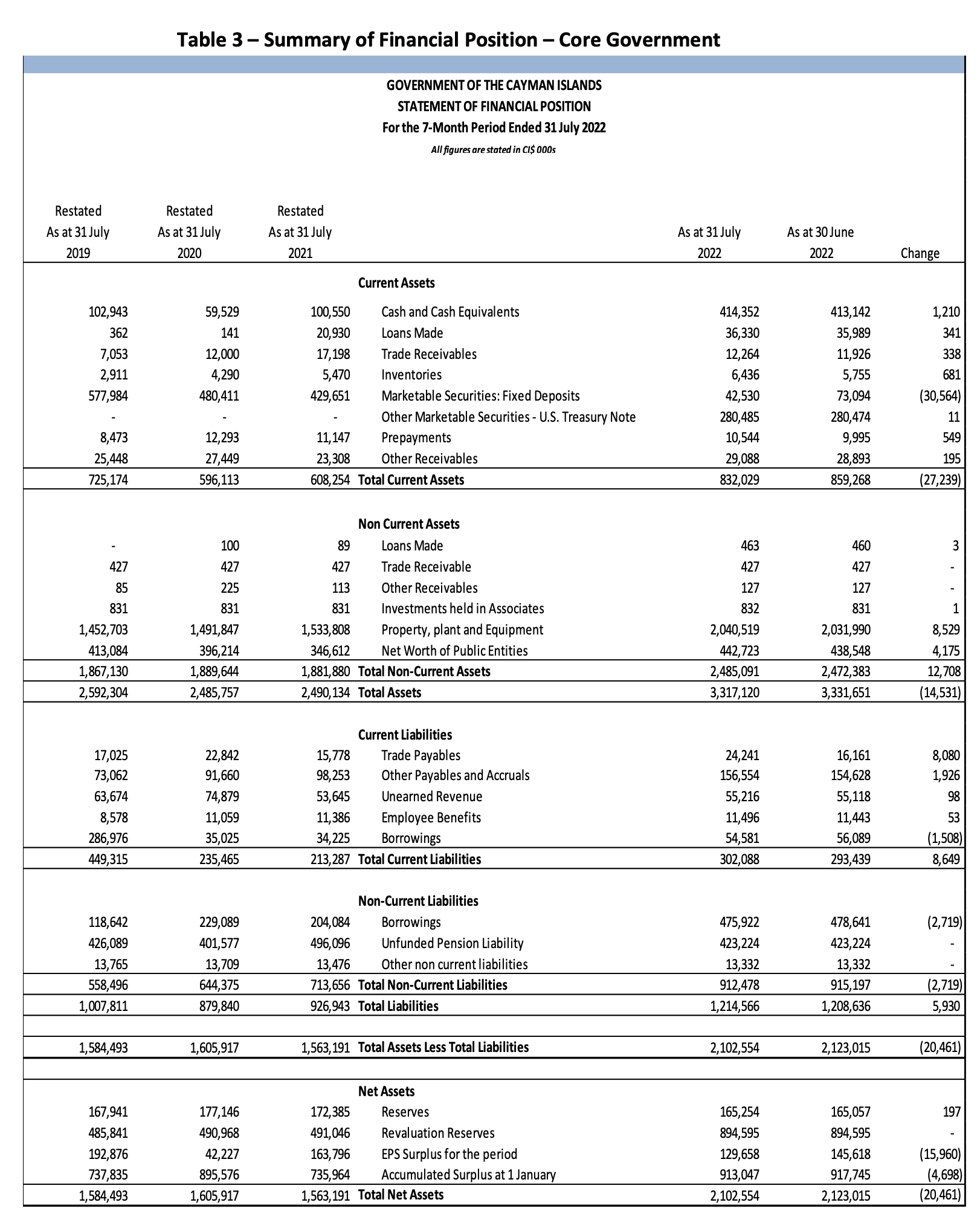

Also included in the note to Cabinet was a comparison of the July YTD financial performance over the previous three years, as summarised in the following table:

| 2019 | 2020 | 2021 | 2022 | |

| Revenues | $583,207,000 | $487,491,000 | $669,079,000 | $695,440,000 |

| Operating Expenses, Financing Costs and Non-Operating Costs | $399,307,000 | $446,826,000 | $490,507,000 | $551,537,000 |

| Operating Surplus of Central Government | $183,900,000 | $40,665,000 | $178,572,000 | $143,903,000 |

| Cumulative Surplus/(Deficit) made by Statutory Authorities and Government Companies | $8,976,000 | $1,562,000 | ($14,776,000) | ($14,245,000) |

| Surplus of the Entire Public Sector | $192,876,000 | $42,227,000 | $163,796,000 | $129,658,000 |

| Total Bank Account balances | $680,928,000 | $539,940,000 | $530,201,000 | $456,882,000 |

Deputy Premier Saunders said, “The July Year-To-Date numbers follow the same trend seen in the first half of the financial year, with the collected fees showing continued confidence in our financial services sector as well as strong and continued growth in the real estate sector. Cayman Islands real estate continues to be a popular investment in tandem with ongoing and new development projects. We have also seen growth in work permit revenue over the prior year, which indicates that local businesses are in recovery mode after the suppressive effects of the pandemic, and are now staffing up to their full complements.”

He continued, “Additionally, we are seeing higher revenues from import duties and tourism related fees and taxes compared to the prior year. This is not surprising given the recent phased reopening of our borders. These two sectors have a symbiotic relationship, with higher tourism arrival numbers resulting in increased consumption and therefore increased imports. With the full reopening of our borders and the removal of COVID-related mandates, we anticipate stronger tourism performance in the upcoming traditional high season of November through April. In general, we have seen that the financial over performance in some areas has thus far more than compensated for underperformance in others and we are still in a strong surplus position.”

Noting that the Entire Public Sector surplus achieved is $25.2 million better than projected, Deputy Premier Saunders observed, “We were cautious in our projections in order to ensure that we would be in a position to provide necessary funding for social programmes such as the school meals programme, the continuation of stamp-duty waivers for first time Caymanian home buyers, meeting the increasing healthcare costs for elderly Caymanians, and the three-month extension of the tourism stipend due to the emergence of the Omicron variant – all in a time when expenses have inevitably gone up due to the after effects of the pandemic. This caution has been rewarded by better than expected revenues, which allow us to provide additional relief to our people due to local cost of living challenges and international inflationary pressures. With continued good stewardship of public funds, we anticipate that the country’s finances will remain in a positive position through the end of this financial year.”

Premier Hon. Wayne Panton said, “I am pleased to see that the July Year-To-Date numbers put the Cayman Islands Government in a good position to weather the traditionally leaner revenue months of the second half of the year. In addition to a healthy surplus, we also have the anticipated tourism high season to add to our revenues from that industry, which is now positioned to rise rapidly to its former levels. While optimistic, we also remain cognizant of global economic pressures and will remain vigilant in our management of Government finances while fostering an environment of continued economic recovery and growth.”

The Premier thanked his Cabinet Ministers and Parliamentary Secretaries for their commitment to keeping Government finances on track. He also expressed his thanks to His Excellency the Governor Martyn Roper; Deputy Governor Hon. Franz Manderson and the Civil Service as a whole for their support.